The decentralized finance (DeFi) sector continues to achieve traction if on-chain information, particularly from decentralized exchanges (DEXes), is something to go by. In keeping with Token Terminal information on December 6, the highest 20 DEXes have collected over $4.4 trillion in buying and selling quantity since launching.

Rise And Rise Of DEXes: Uniswap, Curve Dominate

Contemplating the state of centralized buying and selling within the wake of regulatory pressures in 2023, this growth factors to rising adoption of DEXes, particularly from crypto followers who would possibly treasure and search non-custodial buying and selling choices and publicity of tokens not but listed on mainstream platforms like Binance or Coinbase.

Taking a look at Token Terminal information, Curve, Uniswap, PancakeSwap, and 1inch stand out among the many main DEXes, every catering to a particular area of interest throughout the DeFi panorama. As an example, Curve excels in stablecoin buying and selling, Uniswap facilitates token swaps throughout a number of blockchains, PancakeSwap dominates within the BNB Chain, and 1inch serves as a DEX aggregator throughout Ethereum, Polygon, Avalanche, and different blockchains.

As of December 7, Vertex Protocol, dYdX, and Uniswap v3 emerged as probably the most lively DEXes based mostly on buying and selling quantity information from CoinMarketCap. Particularly, Vertex Protocol and dYdX processed over $1.1 billion in buying and selling quantity previously 24 hours. Then again, Uniswap v3 on Ethereum intently adopted behind with over $780 million.

Just lately, the dYdX chain totally launched on Cosmos following a group vote. The transition means the introduction of superior order-book options and a break up from Ethereum. In the meantime, Uniswap Labs, the group behind Uniswap, plans to enhance and launch Uniswap v4. This model will introduce extra customization with options like hooks that might result in decrease charges and better effectivity.

Binance, Coinbase, And CEXes Nonetheless An Choice For Many

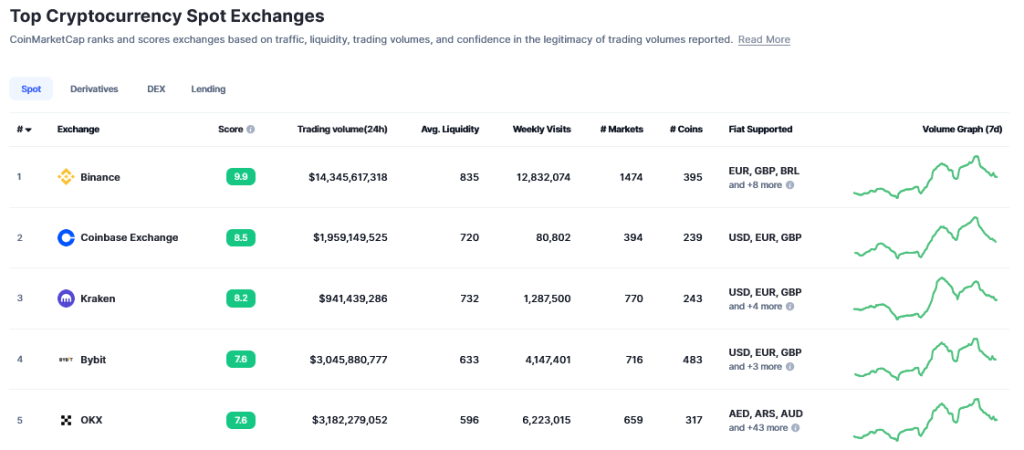

Regardless of the rising recognition of DEXes, centralized exchanges (CEXes) like Binance, Coinbase, and Kraken proceed to dominate the general crypto buying and selling market. As an example, CoinMarketCap information reveals that Binance posted over $14 billion in common spot each day buying and selling volumes, greater than 10X that of Uniswap and dYdX, throughout the similar interval.

Just lately, Binance obtained a $4.2 billion tremendous from the U.S. Securities and Alternate Fee (SEC) in a settlement that noticed Changpeng Zhao, the previous trade’s CEO, step down. International regulators just like the SEC and the Commodity Futures Buying and selling Fee (CFTC) are additionally cracking the whip on centralized exchanges.

After the Division of Justice (DOJ) proposed a settlement with Binance, the SEC charged Kraken, penalizing them $30 million for allegedly working with out registration.

Characteristic picture from Canva, chart from TradingView

_id_c0ada7b0-18f7-48ab-9a54-50f27b579857_size900.jpg)