This text is featured in Bitcoin Journal’s “The Major Challenge” and is sponsored by HIVE Digital Applied sciences LTD as a part of Bitcoin Journal’s “Purchase The Numbers” content material sequence. Click on right here to get your Annual Bitcoin Journal Subscription.

Click on right here to obtain a PDF of this text.

We’re lower than 30,000 blocks out from the halvening and the stakes couldn’t be larger. For a lot of Bitcoin mining operators, this may make or break the bets made throughout this Bitcoin epoch. Did I develop too quick? Can I deal with a catastrophic drop in hashprice? Will my operations get rekt by my present power contract? Bitcoin itself stays detached. The halvening is inevitable, encoded by Satoshi at Bitcoin’s genesis and enforced by nodes the world over. The blocks will proceed to circulation and there might be blood. The large query many are asking is the way to climate this looming battle. Maybe the higher query is the place to be positioned on the board when the battle occurs. It’s one factor to know the way to construct and function an environment friendly fleet of bitcoin miners, however the important success issue stays power price. It comes all the way down to your place on the map. With a purpose to discover the upper floor, you need to carry out hash recon.

This halvening occasion will problem even essentially the most battle-hardened veterans. They might want to optimize their operations in any respect prices. For inexperienced operators, power price may seem to be a variable you could overlook. They solely give attention to stacking as a lot hashrate as potential and have a tendency to altogether overlook about effectivity — the power consumed per hash produced. In the long term, power price is an important variable. Certain, your {dollars} per terahash are necessary, the bitcoin worth is necessary, and so is community hashrate. It’s all necessary. However power price is the kingmaker. Afterall, the 7-year-old, legendary Antminer S9 continues to be worthwhile at this time with low cost sufficient power.

On the coronary heart of miners’ concerns are two foundational parts: mining income and power bills. These two variables are used to rapidly run the numbers on mining profitability. It’s necessary to notice that this doesn’t take into consideration the extra working prices like labor and different related bills that go into working a mine. It stays a helpful components for protecting the lights on.

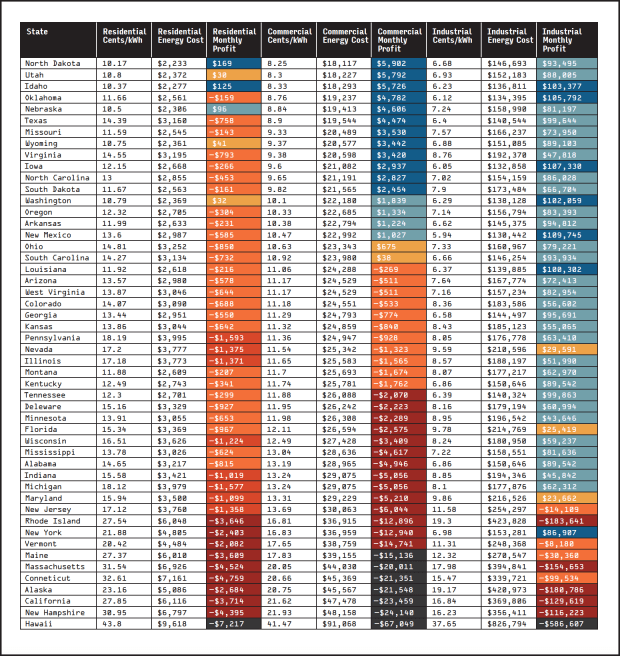

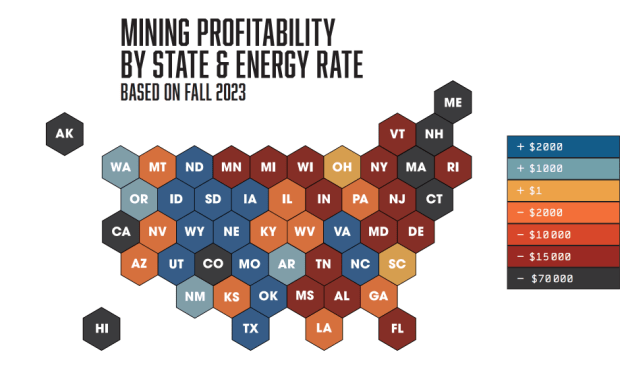

Mining operators are available many alternative sizes, and the best method to distinguish them relies on how a lot energy they’re utilizing. Right here within the U.S., the Power Data Administration (EIA) is accountable for monitoring power tendencies and categorizes consumption and energy prices into Residential, Business, and Industrial buyer energy charges. We are going to give attention to how mining operators would revenue on the relevant charges throughout every of those three classes:

Residential: <30 kW — Encompassing residence miners with 1 to 10 bitcoin mining machines. Typical houses can not deal with rather more power than this and would require extra electrical infrastructure being put in. Residential scale has the best power charges throughout the identical state. Business: 30 kW-1 MW — Overlaying small to medium-sized enterprise and bitcoin mining operators with 10 to 300 mining machines. The Business scale vary is characterised by power consumption that’s bigger than Residential however not fairly Industrial scale. This vary is often as much as 1 MW in dimension. Whereas commercial-scale miners have higher charges than residential prospects throughout the identical state, they don’t seem to be sufficiently big to efficiently negotiate with energy corporations.Industrial: >1 MW — Operations with greater than 300 mining machines. Industrial-scale operators are massive sufficient shoppers of energy that they’ll negotiate power prices through energy buy agreements and purchase power on the lowest price throughout the identical state.

Regardless of these variations in scale, all three classes of mining operators are united by a typical want for cost-efficient energy. Whereas some miners could also be restricted by geographical constraints, enterprising miners are actively exploring areas with inexpensive power charges — we’ll name that jurisdictional arbitrage — whereas others are attempting to scale into conditions the place they’re massive sufficient to have a seat on the desk to barter decrease charges.

Conflict Video games

Now that now we have a greater understanding of what completely different scale operations seem like, let’s run the numbers. Since we don’t benefit from a crystal ball, we’ll simulate a struggle recreation utilizing the next knowledge factors:

BTC worth at $30,000.Community hashrate at 400EH/s.Bitmain Antminer S19j Professional 100TH/s at 3kW per unit.Residential scale: 10 Bitcoin Miners.Business scale: 100 Bitcoin Miners.Industrial scale: 1000 Bitcoin Miners.Power charges at 2023 YTD (EIA).

Let’s apply our easy mining profitability components (mining income minus energy price) to see how mining operators would deal with this situation throughout the U.S.

Working the numbers is kind of sobering, as you instantly see simply how unprofitable mining is beneath our outlined situation. Solely 40 states are worthwhile at industrial charges, 18 with business charges, and 6 states at residential charges. In the event you run this identical simulation however implement a halving, slicing your every day mining income in half, it’s all of a sudden a doomsday situation the place no mining operation can be worthwhile. In fact, Bitcoin doesn’t exist inside a vacuum, and this doesn’t account for modifications within the community hashrate and the bitcoin worth.

The struggle recreation seems bleak for operators at residential scale. With outlined situations, profitability at residential power charges seems elusive and mining operations are possible working at a loss nationwide. Whereas some could pursue this path to build up KYC-free sats, for a lot of, this doesn’t justify working at a deficit.

Business charges provide a extra promising outlook for operators, as decrease power prices lengthen profitability into many extra states. Nonetheless, only some states present a worthwhile setting for small and medium-sized enterprise miners, particularly within the doubtlessly difficult 12 months of 2024.

The panorama shifts additional on the industrial scale, the place miners wield extra affect and earn a correct seat on the desk. Power producers take discover when operators’ demand approaches or exceeds 1MW, reflecting a transition from being a rounding error to a significant shopper. Whereas profitability is feasible in 40 states for industrial-scale miners, a number of states stay difficult.

The query is whether or not mining operators will have the ability to survive the battle to battle one other day. Enduring an onslaught of elevated competitors, the halving, and an ever-unpredictable bitcoin worth is not going to be straightforward. Operators might want to discover efficiencies the place they’ll. This elementary precept holds true: Profitability may be achieved with sufficiently low {hardware} and power prices. The large headline on this complete piece is that the geographic location of your operation might be essentially the most important success consider working a mining operation. For a majority of the nation, this implies you shouldn’t plug in bitcoin miners. Nonetheless, there are nonetheless alternatives on the market if you’re formidable sufficient to get within the trenches and do hash recon. That is the place stripes are earned and the excessive floor is claimed.

This text is featured in Bitcoin Journal’s “The Major Challenge” and is sponsored by HIVE Digital Applied sciences LTD as a part of Bitcoin Journal’s “Purchase The Numbers” content material sequence. Click on right here to get your Annual Bitcoin Journal Subscription.

Click on right here to obtain a PDF of this text.