Outflows from the Grayscale Bitcoin ETF (GBTC) proceed to be the dominant story of the market. The numbers of outflows proceed to be huge. Yesterday, on Tuesday, $515 million flew out of GBTC, for a complete of $3.96 billion. In the meantime, the “new child 9” noticed $407 million in flows. Thus, day 8 closed with a internet outflow of $106 amongst all 10 spot Bitcoin ETFs.

The detailed breakdown from BitMEX Analysis (after day 8) reveals that Blackrock continues to be main the cost with a constructive influx of $1,849.5 million, adopted carefully by Constancy at $1,599.1 million, and Bitwise at $518.3 million.

The market’s fluctuating dynamics are additional highlighted by the 4 days of internet inflows and 4 days of internet outflows noticed over this era. The overall influx for all 10 ETFs (with Grayscale) stood at 21,362.5 BTC, whereas GBTC alone noticed a large outflow of 98,296 BTC.

Offering a possible glimpse of optimism, BitMEX Analysis added, “Whereas right this moment’s GBTC outflow of $515 million is lower than the $640 million from yesterday, and the low cost to NAV has additionally lowered considerably, these may very well be early indicators of easing promoting strain on GBTC.”

When Will Grayscale’s Bitcoin Outflows Finish?

The excellent news of the previous couple of days was that the market absorbed the promoting of twenty-two million GBTC shares valued near $1 billion by bankrupt crypto trade FTX. Nevertheless, regardless of this large sell-off, GBTC’s outflows continued over the next two days.

Bloomberg analyst Eric Balchunas, in an try to gauge market expectations, performed a ballot which indicated diverse opinions on the longer term scale of GBTC’s outflows. He queried, “GBTC has bled 13% of its shares excellent. How excessive do you assume that quantity will get earlier than the mass exodus stops?”

The ballot, with 9,288 votes (at press time), resulted within the following: 21.5% voted for beneath 20%, 48.7% for 35-50%, 16.4% for 50-80%, and 13.4% for over 80%. Balchunas commented, “FWIW James Seyffart and I are each within the 25% vary, however it is a extremely unsure situation with many unknowns.”

GBTC has bled 13% of its shares excellent. How excessive do you assume that quantity get earlier than the mass exodus stops?

— Eric Balchunas (@EricBalchunas) January 23, 2024

Including to this, Seyffart said, “My quantity is above 20% and under 35% for GBTC’s asset exodus.” Remarkably, solely 42 buying and selling days are left till GBTC reaches 0 BTC if outflows proceed on the identical tempo.

Solely 42 buying and selling days left until $GBTC reaches 0 BTC lol pic.twitter.com/5Kwako4u9A

— NLNico (@btcNLNico) January 24, 2024

Crypto analyst Fabian D. identified a noteworthy pattern, emphasizing, “As we speak’s buying and selling quantity for GBTC was the bottom since its launch, totaling round $760M. This downtrend, if it continues, might sign a lower in outflows, probably pushing the market valuation again above the $40k mark as buyers acknowledge the deceleration within the fee of change.”

Fred Krueger supplied an analytical perspective on the outflows, highlighting their strategic implication: “The capital withdrawing from GBTC primarily consists of short-term, weak holders, together with the FTX property and presumably some from DCG.”

He added that this transition is shifting the market composition in direction of the “new child 9”, characterised by their “ultra-sticky asset allocation,” including “This shift is prone to fortify the market’s basis, paving the way in which for a extra sturdy and secure future.”

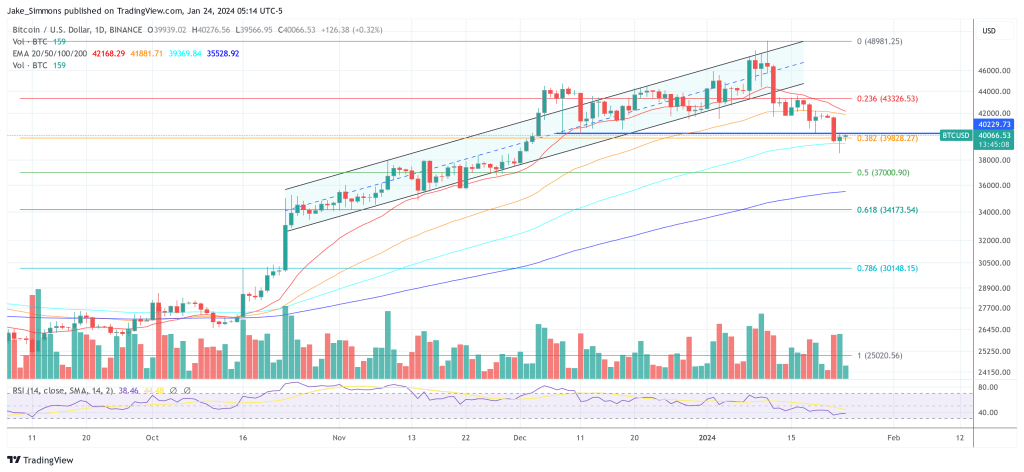

At press time, BTC was buying and selling at $40,066, placing it under the important thing resistance zone at $40,200 to reclaim the earlier buying and selling vary.

Featured picture created with DALL·E, chart from TradingView.com