EigenLayer, an Ethereum-based restaking protocol, has surged previous Uniswap, the foremost decentralized change (DEX) on the Ethereum community, concerning whole locked worth (TVL).

Knowledge from DeFillama reveals that EigenLayer has emerged because the top-performing decentralized finance (DeFi) protocol over the previous month. Its TVL skyrocketed by 171% within the final seven days alone, reaching $5.67 billion, positioning it because the fifth-largest DeFi protocol.

In distinction, Uniswap noticed a modest 6% enhance in TVL, reaching $4.31 billion throughout the identical interval. Different distinguished DeFi protocols, akin to Lido, Aave, and Maker, additionally skilled comparatively modest progress charges of lower than 10%.

In the meantime, EigenLayer’s fast enhance follows staked ETH progress to an all-time excessive of greater than 29 million tokens regardless of the current selloff by the defunct crypto lender Celsius, in line with Nansen knowledge shared with CryptoSlate.

Why is EigenLayer TVL surging?

EigenLayer’s surge may be attributed to the reopening of its vault for deposits on Feb. 5.

Since then, ETH holdings on the platform have skyrocketed from 941,000 to 2.3 million inside every week, marking a big enhance. This inflow represents roughly 2% of Ethereum’s whole circulating provide now staked by means of this platform.

Blockchain analytics agency SpotOnChain reported that the highest 4 restakers on EigenLayer are Puffer Finance, Tron’s community founder Justin Solar, Eigenpie, and Kelp DAO. Puffer Finance leads the group with 233,600 ETH restaked, adopted by Solar with round 109,300 ETH — Eigenpie and Kelp DAO path intently, having restaked 88,600 ETH and 75,300 ETH, respectively.

What’s EigenLayer?

EigenLayer dominates the restaking market, attracting important consideration from the crypto neighborhood. Since June 2023, this DeFi protocol has progressively elevated its deposit restrict by means of a phased launch technique.

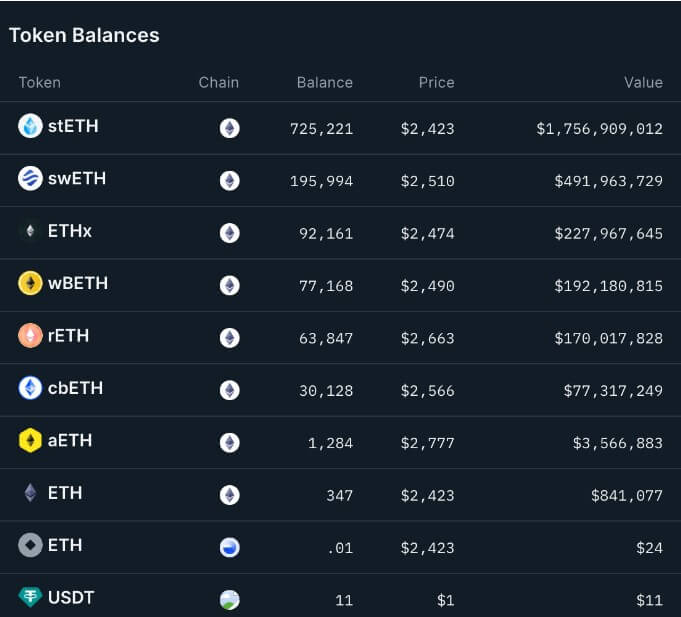

ETH restaking has emerged as one of many main narratives within the crypto market because it permits traders to earn additional rewards on their staked ETH. The protocol helps standard liquid staking tokens akin to lido-staked ETH (stETH) and rocket pool ETH (RETH) restaking by way of its platform.

Murathan, a contributor to DeFi collective, identified the rising reputation of native restaking amongst ETH validators. He mentioned:

“1 in each 4 validators coming into the Ethereum validator queue are setting their withdrawal credentials to an EigenPod.”

Nevertheless, some neighborhood members have warned that the mannequin may create a Ponzi scheme that would come crashing quickly.