The U.S. Securities and Change Fee has hit exchange-traded fund (ETF) issuer VanEck with a $1.75 million high-quality.

Funding advisor VanEck agreed to pay the high-quality with out admitting or denying the cost that it had didn’t disclose a social media influencer’s position within the launch of its VanEckSocial Sentiment ETF—which trades on the NYSE Arca beneath the BUZZ ticker—again in 2021.

BUZZ is supposed to trace 75 massive cap securities with the “highest diploma of optimistic investor sentiment and bullish notion” primarily based on content material mined from social media, information articles, and weblog posts, based on VanEck. On the time of writing, the BUZZ portfolio consists of Coinbase (COIN), Paypal (PYPL), Tesla (TSLA) and MicroStrategy (MSTR).

The SEC alleged that VanEck used an unnamed social media influencer to advertise the fund—however didn’t disclose this to traders.

“To incentivize the influencer’s advertising and marketing and promotion efforts, the proposed licensing payment construction included a sliding scale linked to the scale of the fund so, because the fund grew, the index supplier would obtain a better share of the administration payment the fund paid to Van Eck Associates,” the SEC assertion mentioned.

“Nevertheless, because the SEC’s order finds, Van Eck Associates didn’t disclose the influencer’s deliberate involvement and the sliding scale payment construction to the ETF’s board in reference to its approval of the fund launch and of the administration payment.”

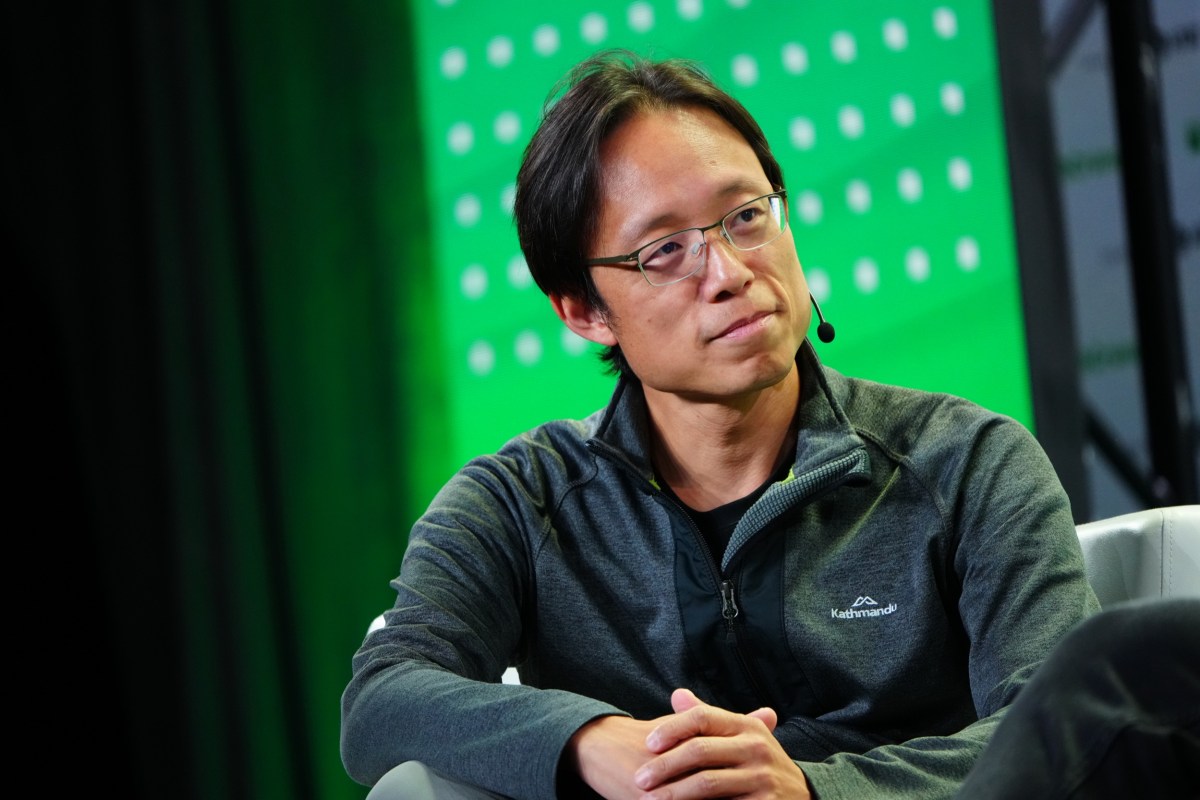

Dave Portnoy, president of sports activities and popular culture weblog Barstool Sports activities, was closely concerned within the fund’s launch however the SEC didn’t identify him within the grievance. Decrypt did not get a direct reply when attempting to achieve him by way of his media firm, Barstool Sports activities.

VanEck is among the many high-profile Bitcoin ETF issuers. The fund supervisor’s Bitcoin Belief launched in January with 9 different funds, giving traders publicity to the most important cryptocurrency by market cap.

The agency has additionally proposed a spot Ethereum ETF to the SEC. The regulator has till Could 23 to approve or deny the proposed product.

Edited by Stacy Elliott.