Bitcoin skilled a tumultuous day yesterday, with its value briefly touching $53,000 earlier than plummeting to a low of $50,820. Amid this value volatility, an sudden phenomenon caught the attention of market analysts: a dramatic surge in buying and selling volumes for sure Bitcoin ETFs.

Bloomberg’s Eric Balchunas supplied an in depth account of this anomaly on X, notably specializing in the VanEck Bitcoin ETF (HODL) and its astonishing enhance in buying and selling quantity. He remarked, “HODL goes wild at this time with $258m in quantity already, a 14x soar over its every day common, and it’s not one large investor… however reasonably 32,000 particular person trades, which is 60x its avg.”

This stage of exercise was not solely sudden but in addition unprecedented, sparking widespread hypothesis and evaluation inside the monetary group. The weird buying and selling quantity wasn’t remoted to HODL alone. Knowledge Tree’s Bitcoin ETF (BTCW) and BlackRock’s Bitcoin ETF (IBIT) additionally noticed vital upticks in buying and selling exercise, albeit to various levels.

Balchunas identified, “BTCW additionally popping off, $154m trades, 12x its avg and 25x its belongings by way of 23,000 indiv trades.” Nevertheless, he famous that the amount enhance in IBIT, whereas elevated, didn’t attain the “extraordinary ranges” noticed in HODL and BTCW.

What’s Behind The Sudden Spike In Bitcoin ETF Volumes?

Addressing theories that the ETF quantity surge was driving Bitcoin’s value drop, Balchunas supplied a rebuttal, “To the ‘bruh quantity have to be promoting bc btc is dumping’ crowd: a) that is mindless given how little these ETFs had in present aum/shareholders b) plus you by no means see ton of outflows in model new ETF that’s in rally mode c) there are such a lot of different holders of btc apart from ETFs! d) how are you going to name it ‘dumping’ when it’s down 1% after 20% rally in two weeks?”

Nevertheless, the supply of this sudden and explosive enhance in buying and selling quantity stays a thriller, with Balchunas speculating, “Nonetheless haven’t discovered what occurred. Nobody is aware of. Given how sudden and explosive the rise in variety of trades was… I’m questioning if some Reddit or TikTok influencer kind beneficial them to their followers. Feels retail army-ish.”

He additionally thought-about the opportunity of market makers buying and selling amongst one another however discovered it an unlikely rationalization given the liquidity of different Bitcoin ETFs like IBIT and BITO.

The buying and selling day concluded with “The 9” attaining a record-breaking quantity day, due to vital contributions from HODL, BTCW, and BITB, which all shattered their earlier information. Balchunas highlighted the importance of this buying and selling quantity, stating, “For context $2b in buying and selling would put them in Prime 10ish amongst ETFs and Prime 20ish amongst shares. It’s rather a lot.”

Because the mud settles on this unprecedented day of buying and selling, the Bitcoin group continues to grapple with the implications of this quantity surge on Bitcoin ETFs and its potential affect in the marketplace. The precise catalyst behind this phenomenon stays elusive, with analysts and traders alike keenly awaiting additional developments.

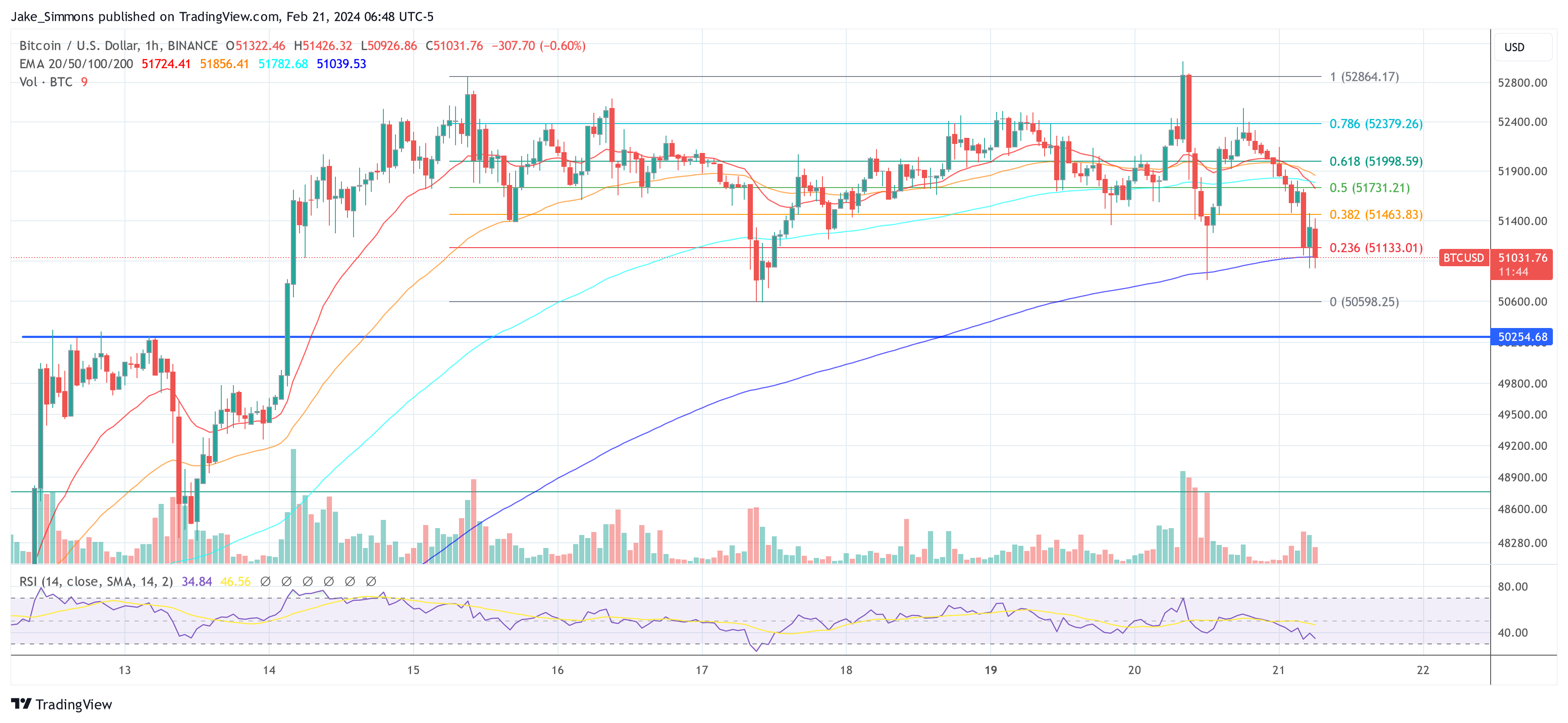

On the time of going to press, BTC fell under the $51,000 mark once more and initially discovered help on the EMA100 on the 1-hour chart.

Featured picture created with DALL·E , chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual danger.