Latest SEC filings below the Type 13F have disclosed that a number of main Wall Road corporations and US banks have began buying Bitcoin ETFs. These revelations underscore a rising institutional curiosity in Bitcoin, which might have appreciable implications for the cryptocurrency’s acceptance and valuation.

Julian Fahrer, the CEO of the Bitcoin-centric app Apollo Sats, highlighted the significance of those disclosures, stating on social media platform X, “BREAKING: 13F SEC Filings present US Banks are shopping for Bitcoin.”

US Banks And Wall Road Purchase Bitcoin ETFs

Fahrer famous that these filings embrace purchases from a spread of funding managers and household workplaces with property below administration from $200 million to $10 billion, signaling a broadening base of institutional acceptance. Notably, he identified American Nationwide Financial institution’s funding in Ark’s ETF, describing it as “vital for breaking the seal on banks shopping for ETFs.”

The second greatest title within the checklist is Park Avenue Securities LLC with an AUM of $9.9B which purchased 7,328 GBTC shares price $ 457,780. In whole, Wall Road corporations with a mixed $15 billion in AUM purchased publicity to Bitcoin ETFs price roughly $4 million in Q1. The detailed breakdown of those investments is as follows:

LexAurum Advisors, LLC bought 11,973 shares of BlackRock’s IBIT ETF, totaling $484,547.

Founders Capital Administration acquired 261 IBIT shares for $10,563.

Sign Advisors Wealth invested in 20,571 IBIT shares price $832,496.

Park Avenue Securities LLC purchased 7,328 shares of Grayscale’s GBTC, amounting to $457,780.

Marshall & Sullivan Inc bought 4,040 GBTC shares for $255,207.

Johnson & White Wealth Administration, LLC acquired 9,810 GBTC shares totaling $613,125.

BCS Wealth Administration purchased 9,196 GBTC shares valued at $574,750.

Inscription Capital LLC invested in 4,866 GBTC shares price $299,016.

Wedmont Personal Capital purchased 3,471 shares of Constancy’s FBTC ETF for $209,336.

Gunderson Capital Administration invested in 7,671 shares of Bitwise’s BITB ETF for $296,944.

American Nationwide Financial institution acquired 100 shares of Ark Make investments’s ARKB for $7,098.

Matt Hougan, Chief Funding Officer at Bitwise, defined the importance of those disclosures through X, stating, “For everybody questioning ‘who’s shopping for’ bitcoin ETFs, I’d circle Could fifteenth in your calendar.” He elaborated that traders managing over $100 million are mandated to file 13-F types with the SEC, offering a periodic transparency into their public fairness holdings. Though these filings solely provide a snapshot, Hougan urged that “among the names on these filings will shock folks (to the upside).”

MacroScope, a famend crypto analyst, additionally weighed in, indicating that probably the most fascinating names may solely seem in Could filings, as some funds delay their disclosures to take care of strategic secrecy so long as potential. “These filings begin in April and run into Could. (…) In my expertise, probably the most fascinating names might are available Could, since some funds wait so long as potential so as to not present their hand earlier than required to do by the deadline,” MacroScope famous.

This current pattern of serious and numerous establishments steadily rising their stakes in Bitcoin by ETFs underscores a turning level in institutional sentiment. These investments replicate a solidifying belief in its long-term worth as an asset class. The forthcoming filings for Q1, anticipated by Could 15, are anticipated to offer additional perception into this evolving pattern, as Wall Road seems more and more snug with integrating Bitcoin into its portfolio.

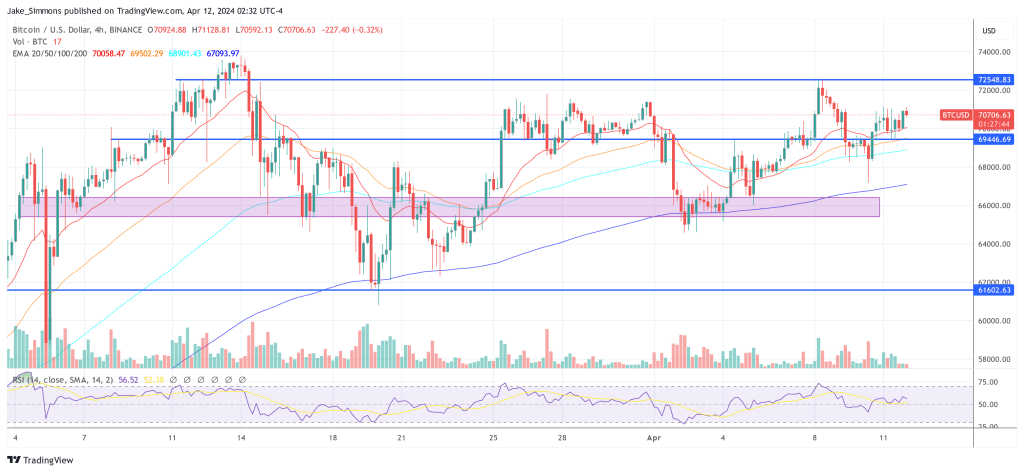

At press time, BTC traded at $70,706.

Featured picture created with DALL·E, chart from TradingView.com