Key Takeaways

Bitfinex analysts anticipate a two-month interval of consolidation for Bitcoin following the current halving occasion;

Bitcoin’s resilience through the consolidation part extends its period and drives elevated curiosity and funding in altcoins;

The current surge in Ether’s market efficiency serves as an indicator of a possible shift from Bitcoin to altcoins.

Bitfinex analysts foresee a interval of worth consolidation for Bitcoin (BTC) following the current halving occasion, doubtlessly spanning two months.

The newest Bitfinex Alpha market report emphasizes Bitcoin’s function as a benchmark for crypto worth motion, significantly within the aftermath of the halving.

Do you know?

Need to get smarter & wealthier with crypto?

Subscribe – We publish new crypto explainer movies each week!

Analysts counsel that its efficiency in Could might set the tone for the whole crypto market, with the potential for worth swings inside a $10,000 vary throughout a 1-2 month consolidation part. The report predicts the constructive impact on Bitcoin’s worth post-halving will come later.

The report underscores the present macroeconomic resilience and low chance of fee cuts, elements that contribute to a extra secure setting. Furthermore, customers and companies are higher geared up with financial insights in comparison with earlier market cycles, doubtlessly prolonging the consolidation interval.

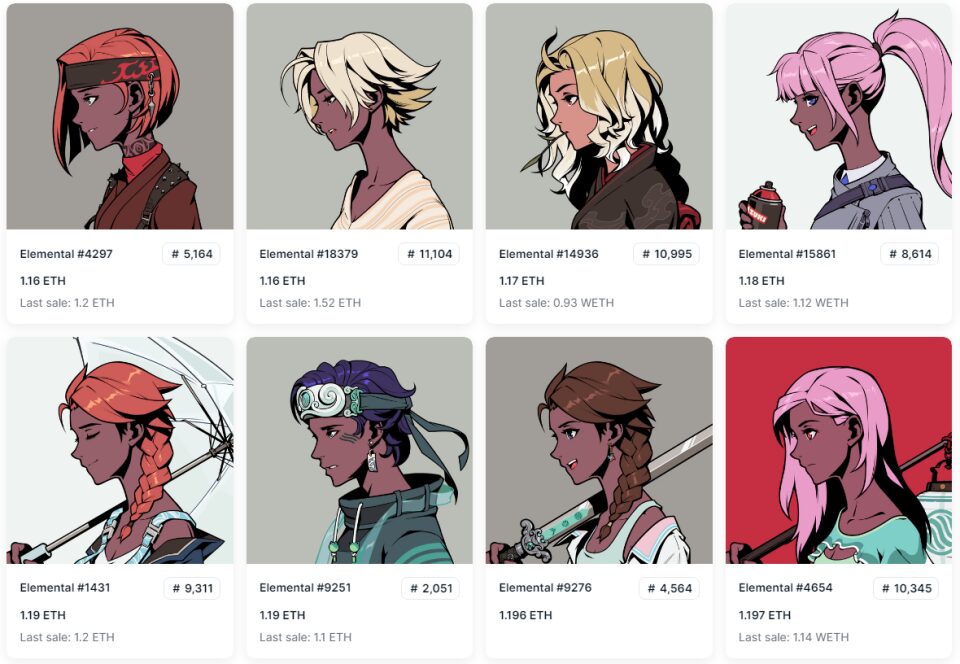

According to Bitfinex’s evaluation, trade merchants suggest that Bitcoin’s dominance might need reached its highest level as merchants begin to transfer their funds from Bitcoin to altcoins.

Ether’s current market efficiency serves as a working example, outperforming Bitcoin in positive aspects for 2 weeks. Bitfinex analysts spotlight Ether as a number one indicator for the altcoin market.

Monitoring Bitcoin’s resilience and altcoin efficiency will supply helpful insights as traders navigate this adjustment interval.

In different information, Michael Saylor has introduced MicroStrategy Orange, a decentralized id resolution on the Bitcoin community.

Having accomplished a Grasp’s diploma in Economics, Politics, and Cultures of the East Asia area, Aaron has written scientific papers analyzing the variations between Western and Collective types of capitalism within the post-World Conflict II period.With near a decade of expertise within the FinTech trade, Aaron understands all the largest points and struggles that crypto lovers face. He’s a passionate analyst who is worried with data-driven and fact-based content material, in addition to that which speaks to each Web3 natives and trade newcomers.Aaron is the go-to individual for the whole lot and something associated to digital currencies. With an enormous ardour for blockchain & Web3 schooling, Aaron strives to remodel the area as we all know it, and make it extra approachable to finish novices.Aaron has been quoted by a number of established retailers, and is a broadcast writer himself. Even throughout his free time, he enjoys researching the market developments, and searching for the following supernova.