Initially printed on Unchained.com.Unchained is the official US Collaborative Custody accomplice of Bitcoin Journal and an integral sponsor of associated content material printed by Bitcoin Journal. For extra data on providers provided, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our web site.

For newcomers, particularly these in and round retirement age, the concept of investing in or proudly owning bitcoin can evoke reactions from skepticism to disbelief. If you happen to look past the favored narratives, nonetheless, you may discover there’s extra to the story than first impressions recommend. Listed here are six causes to think about proudly owning at the very least some bitcoin throughout retirement.

1. Bitcoin helps broaden your asset allocation base

Historically, buyers use a technique known as asset allocation to distribute and defend funds from funding danger over time. A sound asset allocation technique is the antidote to placing your whole eggs in a single basket. There are a number of varieties of asset “lessons” or classes over which to distribute danger. Typically, advisors search to ascertain a dynamic combine between debt devices (i.e., bonds), equities (i.e., shares), actual property, money, and commodities.

The extra classes you use to distribute your belongings and the much less correlated these classes are, the higher your possibilities of balancing your danger, at the very least theoretically. Not too long ago, as a result of unintended penalties attributable to the aggressive growth of societal debt and the cash provide, belongings that had been beforehand much less correlated now are inclined to behave extra in type with each other. When one sector will get hammered right this moment, a number of sectors usually undergo collectively.

No matter these present-day circumstances, asset allocation stays a well-conceived technique for moderating danger. Whereas nonetheless in its relative infancy, bitcoin represents a wholly new asset class. Due to this, proudly owning at the very least some bitcoin, particularly as a result of its distinct properties when in comparison with different “cryptocurrencies,” gives a possibility to broaden your asset base and extra successfully distribute your general danger.

2. Bitcoin affords a hedge towards inflation and forex debasement

As a retiree, defending your self from inflation is essential to preserving your long-term buying energy. Within the asset allocation dialogue above, we referenced the current and aggressive cash provide growth. Everybody who has lived lengthy sufficient to method retirement age is aware of {that a} greenback not buys what it used to. When the federal government points giant quantities of recent cash, it debases the worth of the {dollars} already in circulation. This typically pushes costs greater as newly created {dollars} start to chase the prevailing restricted provide of products and providers.

Our personal Parker Lewis touched on this extensively in his Steadily, Then Immediately sequence:

In abstract, when making an attempt to know bitcoin as cash, begin with gold, the greenback, the Fed, quantitative easing and why bitcoin’s provide is mounted. Cash is just not merely a collective hallucination or a perception system; there’s rhyme and cause. Bitcoin exists as an answer to the cash downside that’s world QE and if you happen to imagine the deterioration of native currencies in Turkey, Argentina or Venezuela might by no means occur to the U.S. greenback or to a developed economic system, we’re merely at a distinct level on the identical curve.

In distinction to fiat currencies, nobody can enhance the availability and arbitrarily cut back bitcoin’s worth. There are not any centralized authorities that govern its financial coverage. Regardless of arguments on the contrary, bitcoin is much like gold—however not precisely, as a result of gold miners proceed to inflate the availability of gold annually at a price of 1-2%.

As bitcoin is slowly launched to the circulating provide (i.e., mined), its inflation price decreases and can finally stop. This truth makes bitcoin uniquely scarce amongst world financial belongings. In the end, this shortage, together with bitcoin’s different financial properties, ought to safeguard its buying energy. As such, proudly owning bitcoin throughout retirement affords you a hedge towards inflation.

3. Bitcoin affords a possibility for uneven returns

Bitcoin’s capability to mitigate lots of the challenges we talk about right here rests on its capability to attain uneven returns. Its provide is mounted (there’ll solely ever be 21,000,000 bitcoin), and demand for the asset is rising steadily. As this restricted provide collides with elevated store-of-value adoption from people, establishments, and governments, bitcoin has the potential to dwarf the returns of almost each competing asset class.

It’s value noting that folks typically enhance their returns with bitcoin after they maintain it for the long run. Within the trendy period, retirements lasting many years or extra are more and more frequent. Over such time durations, even a restricted allocation to bitcoin affords ample alternative to profit from its upside potential. You simply want time to carry by the short-term volatility, which opposite to fashionable perception, is just not proof of it being a poor retailer of worth.

Sequestering a portion of funds solely for appreciation throughout retirement runs considerably counter to traditional knowledge. Trendy retirement planning typically optimizes for the liquidation of portfolio funds to offer earnings. Nonetheless, setting apart a small quantity of bitcoin—saved steadfastly gated from funds earmarked for earnings—opens the door to profit from the monetization of bitcoin’s restricted provide.

4. Bitcoin affords safety from the chance of long-term bonds

Conventionally, high-grade bonds—held instantly or as fund shares—make up a big a part of most retirement portfolios as a result of their low danger ranges and tendency towards capital preservation. Nonetheless, issues have modified.

Financial growth and will increase in societal debt have pressured bond yields—or the quantity of curiosity paid (i.e., coupon)—to traditionally low ranges. The yields on most bonds right this moment fall effectively beneath the speed of inflation. This “damaging actual yield” signifies that proudly owning a bond can price you cash. However the problem doesn’t finish there.

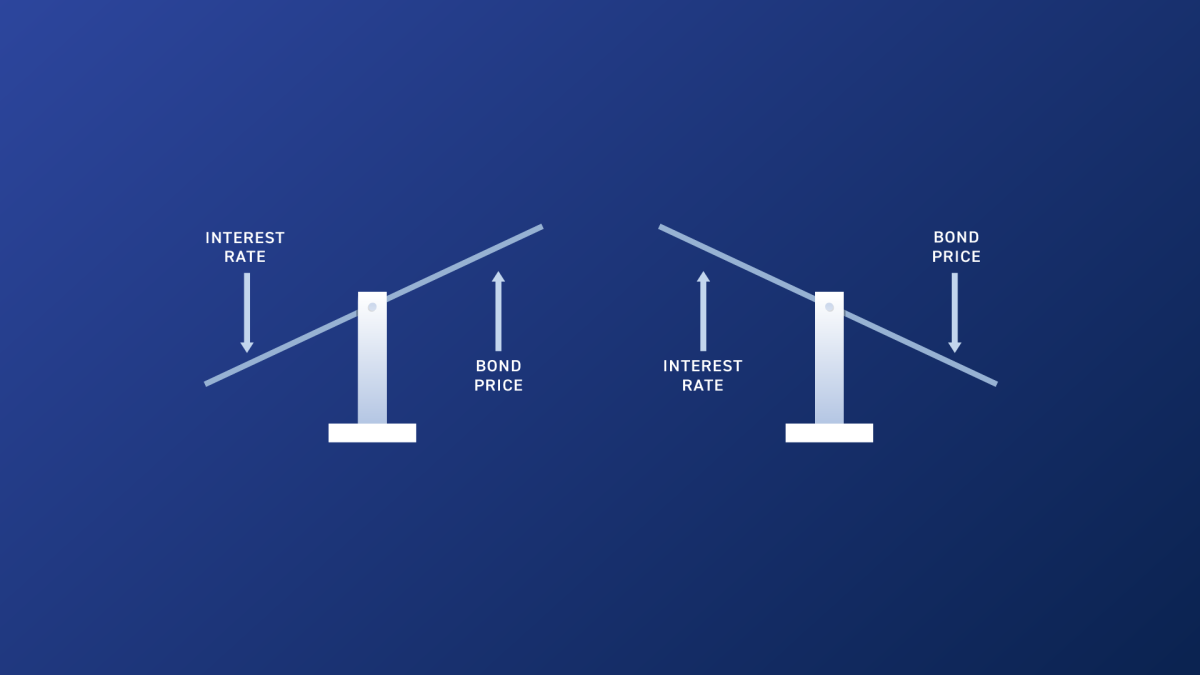

As a result of retirees want funds from their portfolios to pay payments, they typically should promote belongings at present market charges to derive earnings all through retirement. Within the case of bonds, at current, this may be very problematic. Think about the next equations.

How a lot cash does it take for a bond paying a 2% price to yield $20? Reply: $1,000. ($1,000 x 2% = $20)How a lot cash does it take for a bond paying a 4% price to yield $20? Reply: $500. ($500 x 4% = $20)

These two equations reveal that to yield the identical $20 return, the market worth of the underlying bond modifications based mostly on the rate of interest promised.

When rates of interest go up, the market worth of bonds goes down.When rates of interest go down, the market worth of bonds goes up.

The market worth of bonds has an inverse relationship to rates of interest. Think about that rates of interest right this moment hover close to historic lows. Over the subsequent twenty to thirty years, what is going to occur to the market worth of bonds held by retirees if rates of interest enhance considerably? The reply: the market worth of their bonds will collapse.

This modifications the whole danger paradigm for bonds in retirement portfolios and probably makes them far much less secure than sometimes imagined. Bitcoin exists in a separate asset class from bonds; it’s a bearer instrument that’s not uncovered to the identical cash market dangers. As such, proudly owning bitcoin could assist you offset at the very least among the potential danger incurred from proudly owning bonds in retirement.

5. Bitcoin affords a possible resolution for long-term healthcare danger

One other space of concern for retirees is the price of healthcare. Right here, I’m not referring a lot to strange medical payments however quite to the potential to incur long-term care bills in later age. Insurance coverage is obtainable for long-term care, nevertheless it has some distinctive and more and more troublesome challenges to beat.

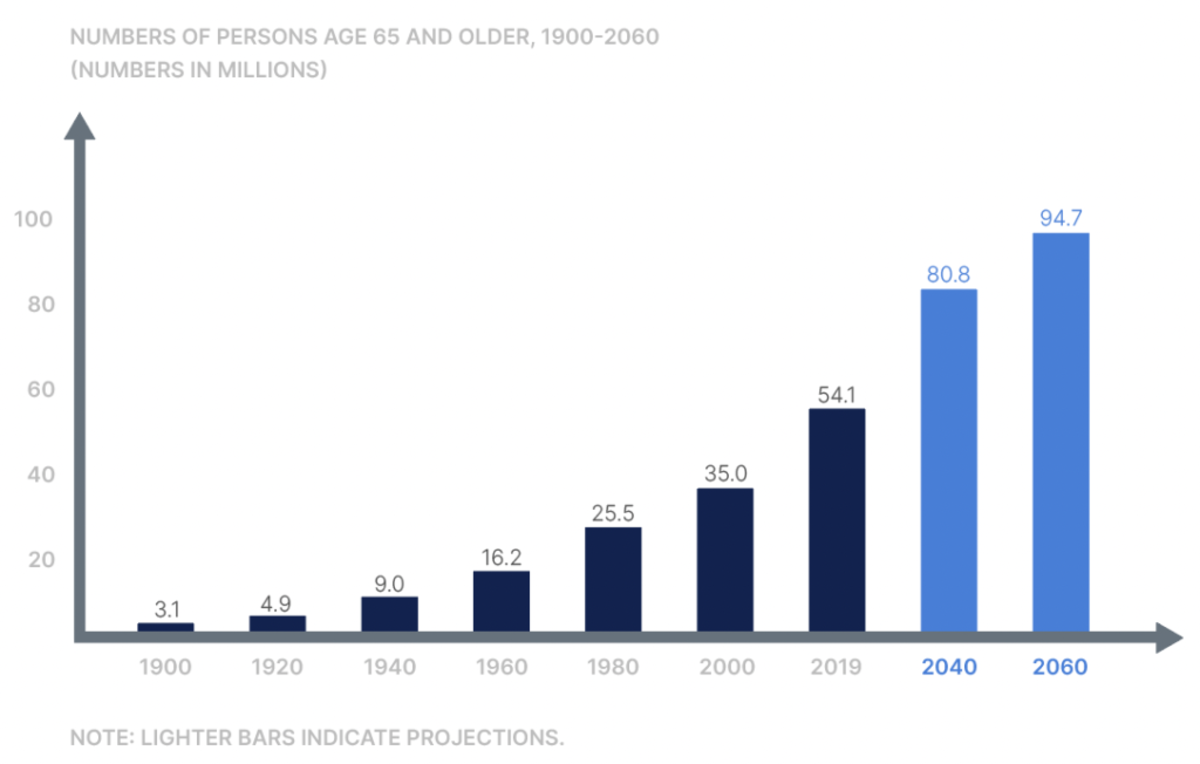

Healthcare, generally, takes a double-hit in the case of worth inflation. Not solely do healthcare prices rise as a result of financial debasement, however healthcare faces further headwinds from demand spurred by progress within the growing old inhabitants.

States regulate insurance coverage for long-term care. To maintain policyowners secure, insurers face scrutiny over the place and the way they make investments coverage premiums. To protect capital required for future claims, insurers typically depend on low-risk, intermediate and long-term bonds. Nonetheless, as our dialogue above on bonds reveals, low yields and the potential for rising charges complicate this apply. One speedy fallout is that premiums for long-term care insurance coverage insurance policies have risen considerably.

We famous earlier bitcoin’s usefulness as an inflation hedge and its potential for long-term worth appreciation. Because it pertains to long-term healthcare, it might make sense to put aside some bitcoin explicitly devoted as a hedge for this quickly rising expense.

6. Bitcoin affords you particular person sovereignty

The ultimate cause we’ll think about for proudly owning bitcoin in retirement is that it affords you elevated particular person sovereignty. Bitcoin gives you a degree of possession that’s not achievable with different belongings. It may possibly simply be carried throughout borders with a {hardware} pockets or seed phrase, for instance, or transferred peer-to-peer wherever on the earth at low price.

If you happen to maintain bitcoin securely in a pockets you management, no central financial institution can steal the worth of your bitcoin by printing it into oblivion. No CEO can dilute its worth by issuing extra of its “shares.” Nor can a financial institution arbitrarily block entry to or confiscate your funds. In contrast to centralized monetary custodians, which could be ordered to freeze or withhold funds on the whims of presidency or different third-party authorities, bitcoin with keys correctly held is resistant to those sorts of overreach.

Particularly for retirement functions, you may also maintain your individual keys for bitcoin in an IRA. Merchandise just like the Unchained IRA are a sturdy instrument for constructing and saving your wealth on a tax-advantaged foundation. And holding your bitcoin keys within the type of a multisig collaborative custody vault permits you to eradicate all single factors of failure when you accomplish that.

Sound monetary ideas and proudly owning bitcoin

Benefitting from bitcoin doesn’t require committing to wild hypothesis or inconsiderate abandonment of sound monetary ideas. In distinction, the extra you have a look at bitcoin by sound monetary ideas and apply them to your considering, the better the alternatives it gives. One steadfast monetary precept that coincides with bitcoin possession is prudence.

Macro-economic funding strategist Lyn Alden usually speaks of creating a “non-zero place” in bitcoin (i.e., proudly owning at the very least some). The chance of shedding just a few portfolio share factors in a worst-case situation is, in my estimation, well worth the potential upside. However to be clear, every individual’s state of affairs is exclusive. You will need to do your individual analysis and make one of the best selections you’ll be able to about what works in your explicit situation.

Initially printed on Unchained.com.Unchained is the official US Collaborative Custody accomplice of Bitcoin Journal and an integral sponsor of associated content material printed by Bitcoin Journal. For extra data on providers provided, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our web site.