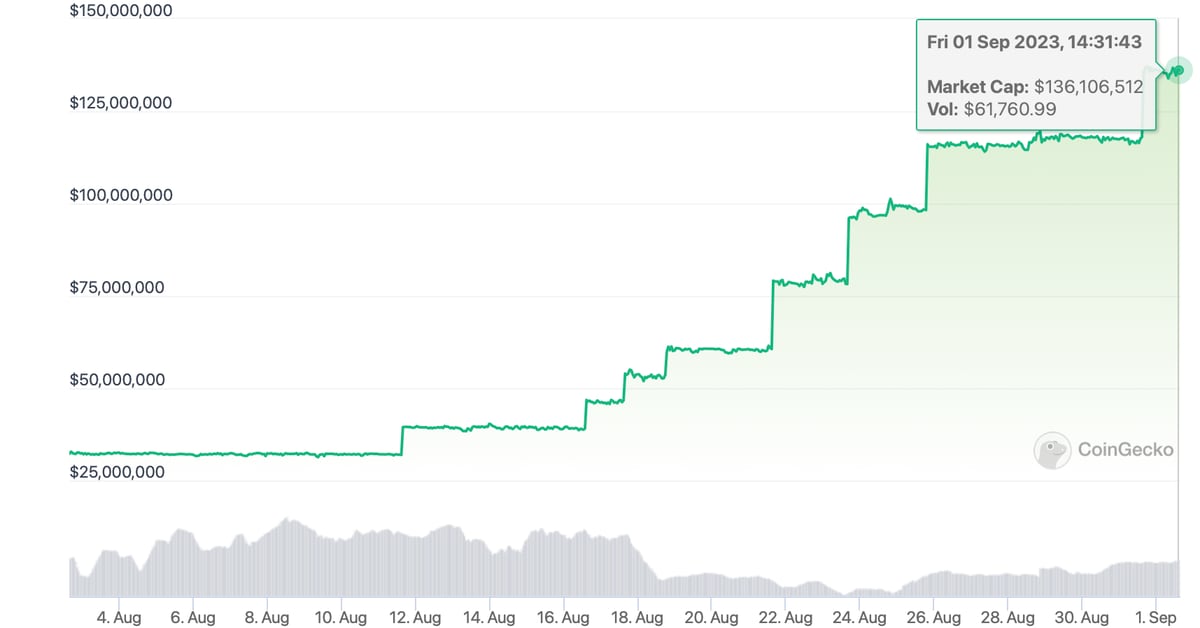

Solana worth has been within the crimson over the previous few weeks, in tandem with the worldwide crypto market amid a buffet of shock headwinds for the crypto business. SOL’s worth is down by almost 18% within the month thus far and 6% decrease for the week. The asset’s whole market cap has crashed by greater than 5% during the last day to $8 billion, rating it ninth within the crypto market, whereas the whole quantity of SOL traded over the identical interval jumped by 35%.

Basic Evaluation

Solana worth has posted vital losses over the previous week as international financial headwinds and a decline in danger urge for food proceed to weigh on the cryptocurrency market. Crypto bigwigs, together with Bitcoin and Ethereum, have every slipped by greater than 4% during the last day to commerce at $25,980 and $1,643, respectively.

The cryptocurrency market rallied briefly on Tuesday as crypto market members reacted to Grayscale’s landmark court docket win in opposition to the US Securities and Change Fee (SEC). The US Court docket of Appeals dealing with the case dominated that the SEC was fallacious to disclaim Grayscale permission to transform its common Bitcoin belief to EFT. The information lifted the cryptocurrency market broadly in addition to crypto equities increased.

Even so, the rally was short-lived, seeing that the court docket ruling was not sufficient to maintain the bullish breakout. Buyers and crypto market members stay looking out after the SEC filed a secret, sealed movement in its case in opposition to Binance, which incorporates greater than 35 displays. The Wall Road regulator’s insistent crackdown on the crypto business stays a significant concern for market members.

Buyers will even be intently watching key financial knowledge, together with the nonfarm payrolls knowledge due later right this moment, trying to find clues on the financial outlook, in addition to the Fed’s financial coverage path. Knowledge printed by the Bureau of Financial Evaluation on Thursday reveals that the Fed’s favourite inflation gauge, the core private consumption expenditures (PCE) index rose 4.2% in July, according to market expectations. The rise in client spending raises the probabilities of the Federal Reserve additional mountaineering its rates of interest this yr.

Solana Worth Technical Evaluation

Solana worth has failed to start out a contemporary bull run above the necessary degree of $22 over the previous few days, pushing its worth almost 18% decrease over the previous 30 days. Even so, the bulls briefly gained management on Tuesday, including greater than 6% in SOL’s worth earlier than backing out. The digital asset has shaped a bearish triangle on the each day chart proven in yellow, indicating a continuation of the bearish trajectory.

SOL stays under the 50-day and 200-day exponential shifting averages, in addition to the 50-day and 100-day easy shifting averages. Its Relative Power Index (RSI) stays under the sign line, indicating a rise in promoting stress, with the Shifting Common Convergence Divergence (MACD) indicator pointing to a promote sign.

Consequently, the Solana worth is prone to proceed falling within the ensuing classes with bears taking full management of the market, thus growing the promoting stress. If this occurs, the following assist ranges to look at might be $19 and $17.70. Nonetheless, we can’t rule out a flip above the most important hurdle at $22, which can invalidate the bearish thesis.

SOL Worth Chart