The CEO of analytics agency CryptoQuant has defined how the Bitcoin community fundamentals might help a market cap 3 times the present measurement.

Bitcoin Hashrate/Market Cap Ratio May Reveal Ceiling For Cycle

In a brand new put up on X, CryptoQuant founder and CEO Ki Younger Ju has talked about what the community fundamentals might reveal about how rather more market cap Bitcoin can maintain.

BTC is a cryptocurrency that runs on the proof-of-work (PoW) consensus mechanism, which means that validators referred to as miners compete with one another utilizing computing energy to get the possibility so as to add the subsequent block to the blockchain.

Miners should pay fixed electrical energy prices to run this computing energy. Typically, these chain validators achieve this by promoting their block rewards. These rewards are fastened in BTC worth and given out at a roughly fixed fee, so the principle variable in miner funds is the asset’s USD worth.

Mining-related economics are very a lot associated to the cryptocurrency’s value. A metric central to the miners is the Hashrate, a measure of the computing energy this cohort has related to the Bitcoin blockchain.

Under is a chart that exhibits the development within the 7-day common worth of this BTC indicator over the previous yr.

The worth of the metric appears to have been taking place in current days | Supply: Blockchain.com

Because the graph exhibits, the Bitcoin Hashrate has been using an uptrend throughout this era, largely because of the rally that the asset’s value has loved on this window.

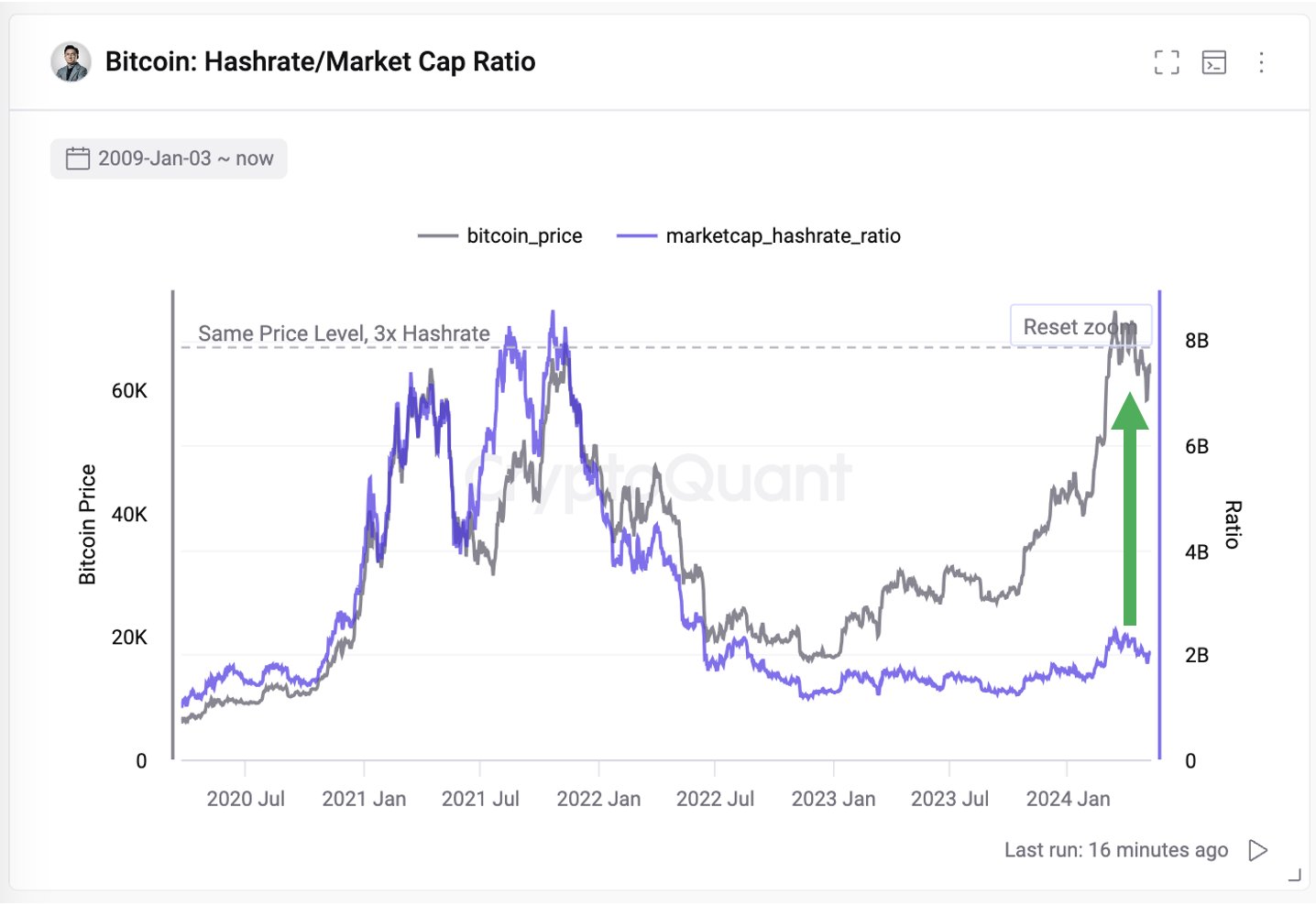

To narrate this elementary metric with the worth of the asset, the CryptoQuant CEO has referred to the “Hashrate/Market Cap Ratio,” which is an indicator that retains monitor of how the market cap (that’s, the full valuation) of the cryptocurrency compares towards its Hashrate.

Right here is the chart shared by Ju that exhibits the development on this metric over the previous couple of years:

Appears to be like like the worth of the metric has been at comparatively low ranges not too long ago | Supply: @ki_young_ju on X

The graph exhibits that the Bitcoin Hashrate/Market Cap Ratio has been at low ranges in comparison with the highs the metric achieved in the course of the 2021 bull run.

That is even if the asset’s value is at present at related ranges to again then. The explanation behind this development is that the community’s Hashrate is now greater than 3 times what it was then.

If the ratio’s excessive from the earlier cycle prime is the place the cycle peak may even be noticed this time round, then it implies that the asset’s market cap might improve over 3 times from its present worth.

Primarily based on this, Ju means that the present community fundamentals might doubtlessly maintain a value of $265,000.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $62,300, up greater than 9% over the previous week.

The worth of the coin seems to have registered a drawdown over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, CryptoQuant.com, Blockchain.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site solely at your individual threat.