The echoes of 2021’s meme inventory saga reverberated by monetary markets this morning, because the obscure ROAR meme coin and online game retailer GameStop skilled a meteoric rise fueled by social media nostalgia. The catalyst? The return of a well-known face – Keith Gill, higher recognized by his on-line moniker “Roaring Kitty.”

Associated Studying

Kitty Claws Again In

Retail traders have been despatched scrambling after Gill, a celebrity among the many on-line funding neighborhood on Reddit’s WallStreetBets discussion board, posted a cryptic message hinting at a major stake in GameStop.

The publish, that includes a picture of the “Uno Reverse” card, despatched hypothesis into overdrive. Shortly after, Gill confirmed his bullish stance by revealing a large holding of 5 million GameStop shares, valued at roughly $116 million primarily based on Friday’s closing worth.

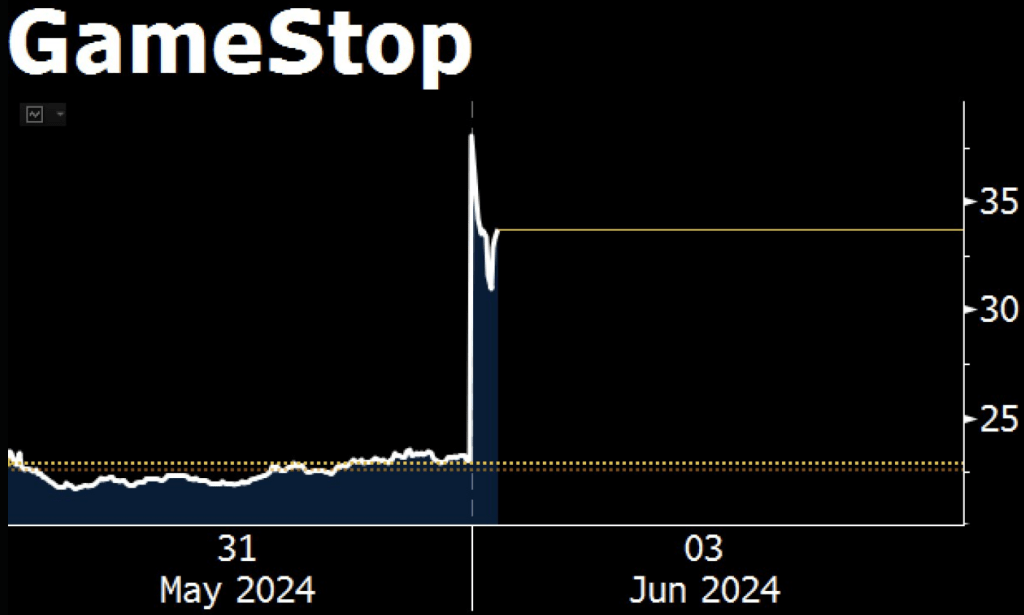

Within the 20 minutes that adopted Gill’s publish, GameStop’s inventory worth on Robinhood’s in a single day markets shot up by 20% to $27.50. This improve adopted the inventory’s Friday closing worth of $23.14. This yr, the shares have elevated by nearly 40%, presumably on account of Gill’s sudden comeback.

This disclosure despatched shockwaves by the market. GameStop’s inventory, notorious for its volatility through the meme inventory frenzy of 2021, surged over 100% at its peak in pre-market buying and selling on Monday.

NOW: GameStop soars after the Reddit account that drove the meme-stock mania of 2021 posted what gave the impression to be a $116 million wager https://t.co/0mnyJF4lIf pic.twitter.com/rpRdA2AIWL

— Bloomberg Markets (@markets) June 3, 2024

Whereas the worth finally settled to a formidable 88% improve, the roar from retail traders was simple. The ROAR meme coin, seemingly named in homage to Gill’s on-line persona, mirrored the GameStop worth surge of over 300%, reaching a excessive of $0.001643.

A Meme Inventory Revival?

The sudden rise of each ROAR and GameStop has reignited the controversy surrounding meme shares. These belongings, usually characterised by excessive volatility and pushed extra by on-line hype than conventional monetary metrics, captured the creativeness of retail traders in 2021. Gill, who performed a pivotal position within the preliminary GameStop saga, seems to be a key participant on this potential revival.

Nonetheless, analysts stay cautious. GameStop itself is in a precarious place, having just lately bought a large chunk of shares to bolster its funds whereas dealing with continued web losses and projected gross sales declines. The corporate’s long-term prospects stay unsure, elevating questions on whether or not it is a real resurgence or just a nostalgic echo of 2021.

Associated Studying

Weighing Hype In opposition to Actuality

The current surge in ROAR and GameStop presents a basic risk-reward situation for traders. Early contributors who purchased in at decrease costs stand to reap vital earnings. Nonetheless, the inherent volatility of meme shares poses a major hazard of considerable losses.

Featured picture from HubPages, chart from TradingView