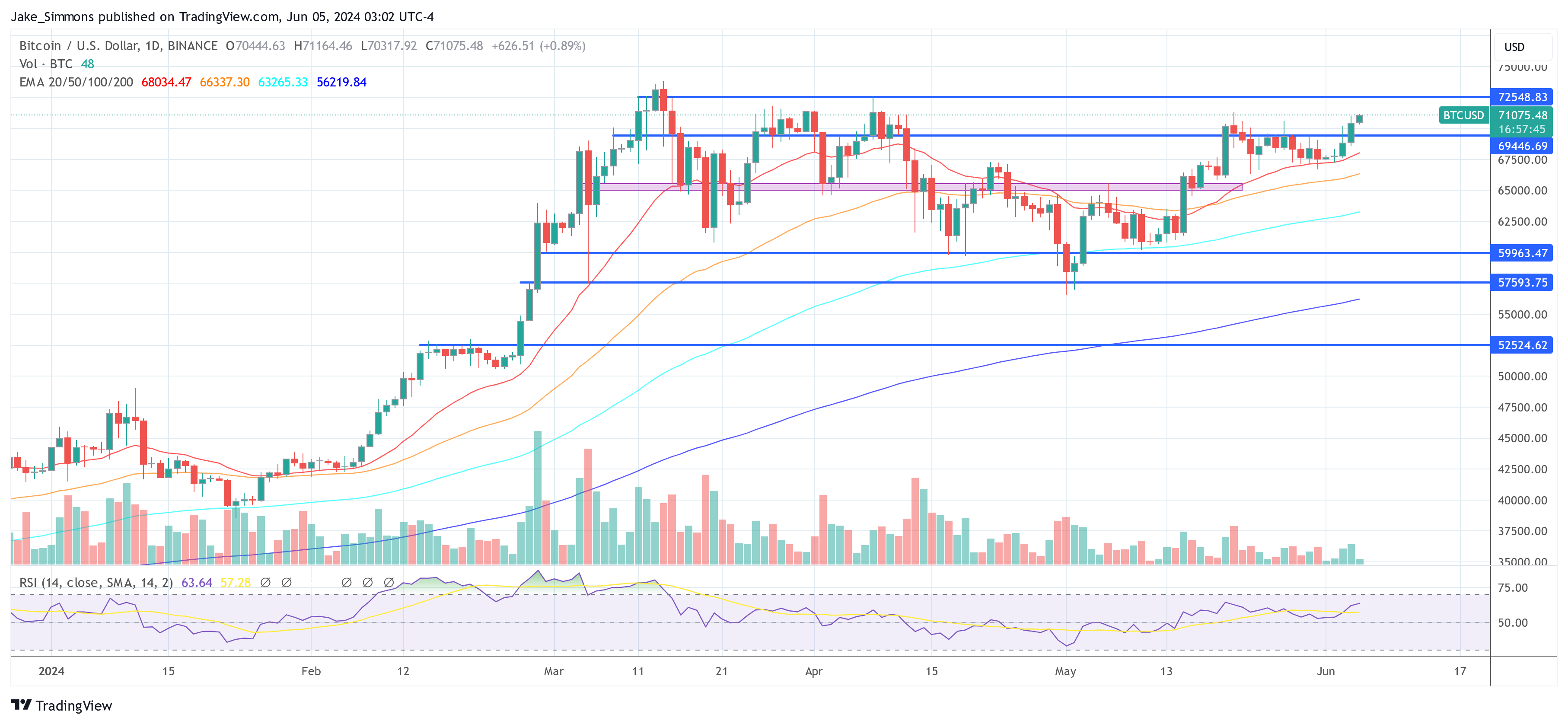

Bitcoin has surged 2.9% within the final 24 hours, reaching a excessive of $71,166 on Binance at present, marking the very best worth since Could 21. This rally seems to be primarily fueled by sturdy inflows into US spot Bitcoin ETFs, with the sector experiencing its sixteenth consecutive day of web inflows.

Why Is The Bitcoin Value Up Right this moment?

Yesterday alone, these ETFs noticed an influx of $886.6 million, with Constancy main at $378.7 million—setting a brand new file for the fund. BlackRock wasn’t far behind, with substantial inflows totaling $274.4 million. Different vital contributions included Ark with $138.7 million, Bitwise at $61 million, and the Grayscale Bitcoin and VanEck Bitcoin Belief recording $28.2 million and $4 million respectively.

Good morning fellow hodlers,

We had an absolute insane day of inflows yesterday with $886.6 million of inflows (that’s ~12 500 BTC)

Constancy did $378.7 million, Blackrock did $274.4 million, Ark did $138.7 million and Bitwise 61 million.

Even $GBTC had inflows price of $28.2… pic.twitter.com/KaDdmTrq9p

— WhalePanda (@WhalePanda) June 5, 2024

The sustained curiosity is additional evidenced as BlackRock’s iShares Bitcoin ETF surpassed $20 billion in belongings, turning into the quickest ETF to achieve this milestone, reflecting vital momentum and investor enthusiasm.

Associated Studying

Eric Balchunas, a Bloomberg ETF analyst, emphasised the size of those inflows, stating, “Constancy not messing round, big-time flows throughout at present for The Ten, almost $1b in complete. Second greatest day ever, since Mid-March. $3.3b in previous 4wks, web YTD at $15b (which was prime finish of our 12mo est). The ‘third wave’ is popping right into a tidal wave.”

Regardless of the optimistic influx dynamics, Byzantine Common (@ByzGeneral), a outstanding crypto analyst, noticed that the worth surge might have been extra pronounced. He highlighted the presence of considerable passive provide on spot exchanges, which could have tempered the worth improve.

Associated Studying

He famous yesterday, “Excessive quantity at present, and the perps foundation really went down a bit. I believe that we acquired good ETF flows at present, however… They’re shopping for into a variety of passive provide on spot exchanges.” He additional commented at present, “What did I say, huge ETF inflows. However due to all the passive provide it’s like an unstoppable pressure colliding with an immovable object.”

Furthermore, it’s necessary to notice that the worth improve was not pushed by the liquidation of brief positions within the BTC futures market, which noticed solely $27.58 million in shorts liquidated within the final 24 hours, based on Coinglass knowledge.

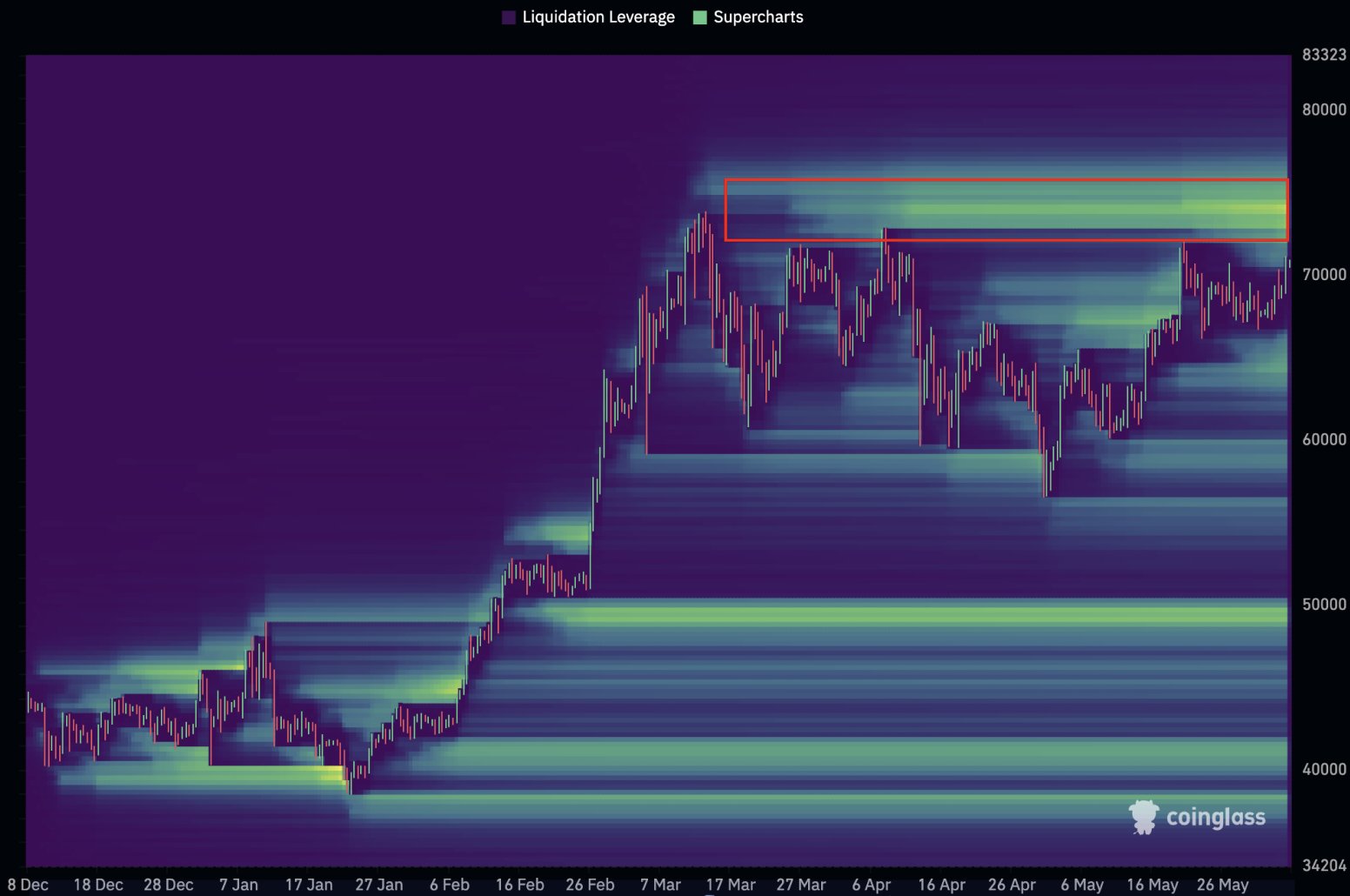

Nonetheless, Willy Woo, a famend on-chain analyst, warned {that a} continued rise might set off a major brief squeeze. Woo stated by way of X, “Tapping 72k is the fuse that’s set to start out a liquidation cascade. $1.5b of brief positions able to be liquidated all the best way as much as $75k and a brand new all time excessive.”

At press time, BTC traded at $71,075.

Featured picture created with DALL·E, chart from TradingView.com