The overall worth of property locked (TVL) in liquid staking tasks has continued to climb regardless of the overwhelming bearish sentiments current out there.

DeFillama’s knowledge reveals a formidable surge within the class’s TVL, which has reached virtually $20 billion prior to now 12 months. Notably, this development has outpaced different sectors in decentralized finance, together with lending and decentralized exchanges, throughout the identical timeframe.

Liquid staking protocols, corresponding to Lido (LDO), Frax Ether (FXS), and Rocket Pool (RPL), supply customers the distinctive alternative to earn staking rewards whereas retaining liquidity for different crypto actions. The sector’s development is basically as a result of Ethereum (ETH) Shanghai improve, which allowed stakers to withdraw their staked ETH simply.

This improve reignited enthusiasm throughout the crypto neighborhood for these protocols. For context, Nansen’s Ethereum Shanghai dashboard reveals a development of ETH staking deposits outpacing withdrawals for the reason that course of started. These deposits are focused on liquid staking platforms, with Lido dominating.

Moreover, the current regulatory actions in the USA concentrating on centralized staking service suppliers like Kraken have offered liquid staking protocols with a definite benefit over their centralized counterparts.

Lido stays dominant

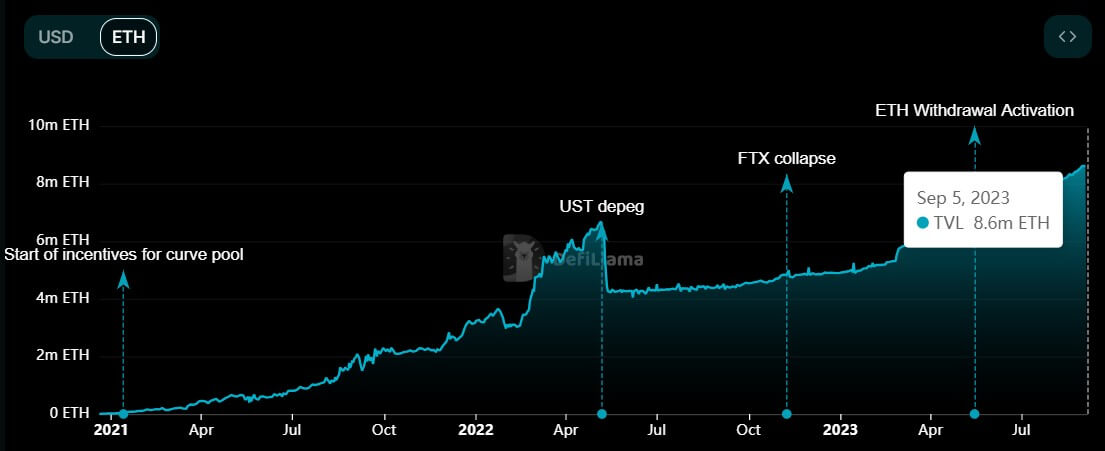

Lido stands out as a chief instance of the dynamic development in liquid staking. In April 2022, the protocol’s TVL peaked at $20.32 billion, in keeping with DeFillama knowledge. Nevertheless, it confronted a setback following Terra’s UST depeg, plummeting to $4.51 billion.

This decline was largely influenced by the sharp drop in ETH costs throughout that interval. Concurrently, Lido’s Ether TVL declined from 6.59 million to 4.27 million.

Subsequently, Lido has skilled a resurgence in its Ether TVL, hovering to an all-time excessive of 8.63 million.

However, this outstanding development in ETH TVL has but to translate into an equal improve in its greenback TVL, primarily as a result of prevailing worth of ETH. Presently, ETH is buying and selling at $1,623, marking an 11% lower over the previous 30 days.

In the meantime, different liquid staking protocols, together with Rocket Pool and Frax Ether, have additionally witnessed substantial expansions of their TVL throughout this era.

The publish Liquid staking outperforms bearish market as Lido development fuels $20B TVL appeared first on CryptoSlate.