Crypto lending protocol Aave restarts its bullishness because the market resets. AAVE, the namesake token of the platform, surged to almost 20% previously 24 hours, capturing the momentum of the broader market which remains to be up by over 5% since yesterday.

Associated Studying

Aave’s current developments additionally contributed to this rally. Nonetheless, the broader crypto-finance market is likely to be in disagreement with the platform’s present efficiency.

$200 Million In Market Measurement Unlocked On Aave

Lido Finance, a crypto staking platform, not too long ago onboarded the platform’s Lido V3 market occasion, custom-made for Aave which is tailor-made to Lido’s staked Ethereum (stETH) and wrapped staked Ethereum (wstETH). This may considerably enhance person expertise in lending and borrowing stETH and wstETH as it may be fine-tuned to maximise profitability for Aave customers.

The Lido V3 market on @aave has been stay for 48 hours and simply surpassed $200m in market measurement 👻

Right here’s what you’ll want to know 👇 pic.twitter.com/aNSGxsq2fy

— Lido (@LidoFinance) July 31, 2024

This helped AAVE recuperate in worth. The platform additionally skilled a big bump within the whole worth locked (TVL) with a close to 10% enhance since yesterday. Nonetheless, the broader market appears to be at odds with Aave’s current bullishness.

The 2nd quarter revealed some cracks inside the lending portion of the decentralized finance (DeFi) house. In accordance with CoinGecko’s 2nd Quarter analysis, over $31.87 billion in TVL is devoted to lending, marking a big lower of the pie on DeFi. Nonetheless, the primary features of DeFi similar to staking, lending, and cross-chain bridges noticed an enormous lower in TVL, totaling over $8 billion.

The worth that left these sectors returned within the type of restaking in different platforms or to foundation buying and selling protocols that noticed a whopping 154% enhance in TVL in Q2.

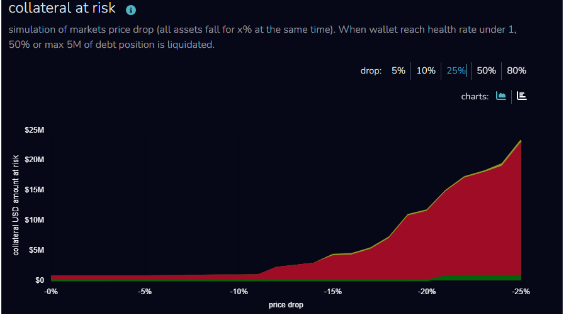

This lower in lending exercise additionally translated to the belongings on the platform. Blockanalitica reveals {that a} majority of the wallets that maintain collateral on Aave are both medium or excessive danger.

If the market drops by 25%, majority of the wallets are within the purple which represents liquidation. This reveals that lending on DeFi stays to be harmful, particularly with the present market volatility skilled this week.

A Brief Squeeze?

AAVE is at present occupying the vary between $93 and $102. This place, though an enormous downgrade from its return from June worth ranges, is a strong assist for a doable breakthrough within the close to future.

Associated Studying

Nonetheless, because it strikes unbiased of the market, this present bullishness would possibly simply be a brief squeeze or a sudden enhance in worth earlier than a pointy fall.

With the present market atmosphere reflecting this volatility, AAVE can have a tough time securing its June worth stage bringing in the potential of additional downturns.

Featured picture from Zerion, chart from TradingView