Main Developments for the Week

Bitcoin set for 400% beneficial properties over gold? Analysts predict report highs

Ethereum soars 16% after Fed minimize, however can the rally final?

As hashrate climbs, will Bitcoin’s worth comply with?

Crypto in election highlight: Harris and Trump compete for trade help

Bitcoin hovers under $65K, however key market-changing elements are in play

Solana reveals its second ‘Web3 cellphone’

Satoshi-era miner strikes Bitcoin for the primary time in 15 years

MicroStrategy provides 7,420 Bitcoin, bringing its whole to 252,220 BTC

Divergence between Bitcoin worth and hashrate hints at a possible rally

Solana braces for a significant transfer after defending $120 help

Altcoins soar previous Bitcoin and Ether following the Fed’s charge minimize

Former President Donald Trump buys burgers with Bitcoin at a New York bar

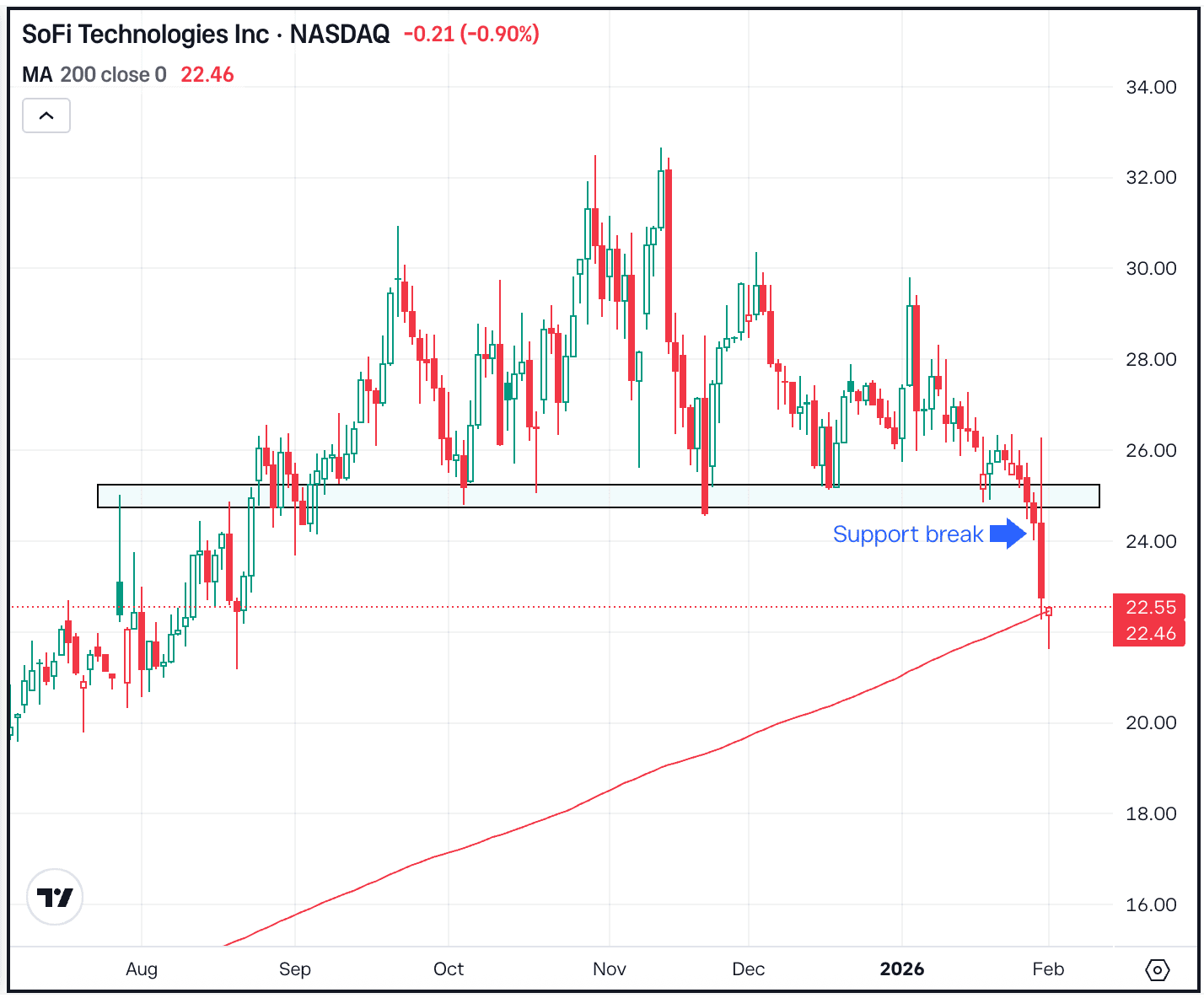

Bitcoin Set for 400% Features Over Gold: Analysts See Document Highs Forward

Bitcoin is on the cusp of a possible breakout, with analysts forecasting a brand new all-time excessive within the close to future. Kevin Svenson means that market indicators, such because the inverse head-and-shoulders sample, level to a pointy worth improve, with October being a key time for a breakout. Svenson emphasizes Bitcoin’s present momentum, constructing towards a big upward transfer because it consolidates round vital worth ranges.

Previous efficiency is just not a sign of future outcomes.

Equally, Michaël van de Poppe highlights Bitcoin’s correlation with different macroeconomic elements. He factors to the upcoming Bitcoin ETF approval as a possible catalyst, together with ongoing market liquidity enhancements. He means that if Bitcoin can maintain its place, and stay above the $30,000 mark, it might sign the following leg up, probably reaching new highs inside a matter of weeks. Each analysts agree that October is a vital time for Bitcoin’s trajectory, because it may both consolidate additional or explode right into a worth rally.

Previous efficiency is just not a sign of future outcomes.

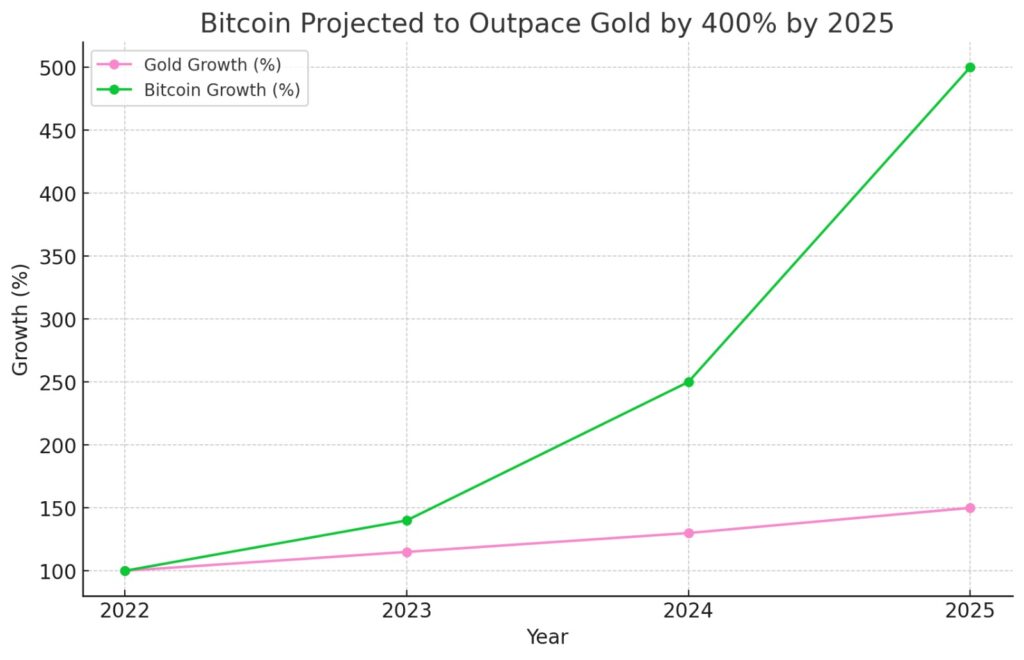

Including to the bullish sentiment, a 3rd perspective considers Bitcoin’s efficiency relative to gold. With institutional curiosity rising and Bitcoin being seen as a retailer of worth, some analysts undertaking that Bitcoin may outpace gold’s development by 400% by 2025. This comparability positions Bitcoin as a hedge towards conventional monetary markets, making it more and more engaging to buyers searching for different belongings in unsure instances.

Ethereum Soars 16% After Fed Minimize, However Can the Rally Final?

Ethereum has taken the highlight after the latest U.S. Federal Reserve charge minimize, hovering over 16%, simply outpacing Bitcoin’s modest 6% achieve. This speedy rise displays a wave of bullish sentiment, with buyers betting huge on ether by rising their lengthy positions within the derivatives market. A key indicator, Ethereum’s perpetual futures funding charge, has flipped constructive, signaling robust market demand. Whereas the optimism round Ethereum is constructing, specialists warn that the hype may result in market volatility if sentiment turns into too excessive or exterior circumstances shift.

Ethereum’s surge is a part of a broader rally in altcoins, which have been gaining momentum after months of being undervalued. With open curiosity in Ethereum futures surpassing $11.48 billion, the very best since August, this speedy uptick is a double-edged sword. On one hand, it reveals rising confidence, however on the opposite, it units the stage for attainable market turbulence. As altcoins warmth up, the chance of sharp fluctuations is one thing buyers want to observe carefully.

As hashrate climbs, will Bitcoin’s worth comply with?

Bitcoin’s latest divergence between its worth and hashrate may very well be setting the stage for a possible rally, a sample noticed a number of instances over the previous three years. Traditionally, when Bitcoin’s hashrate rises whereas its worth stays stagnant, it has typically led to cost recoveries because the market catches up. Since July, the hashrate has reached report ranges, hitting 693 exahashes per second (EH/s) by early September, regardless of Bitcoin’s worth till just lately staying across the $54,000 mark. This improve in hashrate, pushed largely by well-capitalized, publicly traded mining corporations, indicators rising miner confidence within the community’s long-term potential.

A major issue behind this rise in hashrate is the rising market share of publicly traded miners, which now account for 23% of Bitcoin’s manufacturing, the very best stage since early 2023. These corporations have been boosting their computing energy, pushing the hashrate again to pre-halving ranges. Because of this, Bitcoin has already gained 15% since reaching an area backside on September 6. If historic patterns maintain, the market could quickly modify to this elevated community power, probably driving a extra important worth rally within the coming months.

eToro’s @BitcoinWorldWide Sensible Portfolio affords buyers publicity to a diversified vary of belongings inside the Bitcoin ecosystem, aligning with the elevated institutional belief and development trajectory of Bitcoin’s market integration.

Crypto within the Highlight: Harris and Trump Vie for Business Assist

U.S. Vice President Kamala Harris has expressed her intention to help the expansion of the crypto trade, alongside AI, whereas making certain client safety. Throughout a fundraising occasion in New York, Harris highlighted her concentrate on fostering innovation, significantly in rising applied sciences, and making a business-friendly atmosphere by streamlining rules. Though she hasn’t supplied detailed plans, her stance marks a shift in the direction of a extra crypto-friendly strategy within the Democratic occasion. This aligns her marketing campaign along with her broader financial targets of selling competitiveness and job creation.

Former President Donald Trump, her Republican opponent, has additionally attracted crypto trade help, although with extra aggressive guarantees, together with rolling again rules and increasing crypto management within the U.S. Each candidates are vying for the help of the rising crypto sector as they define their differing approaches to regulation and financial innovation.

Don’t make investments except you’re ready to lose all the cash you make investments. It is a high-risk funding, and you shouldn’t anticipate to be protected if one thing goes mistaken. Take 2 minutes to study extra.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.