Sending cash from one nation to a different rapidly and safely is vital for world commerce, remittances, and investing. For many years, SWIFT (Society for Worldwide Interbank Monetary Telecommunication) has been the dominant participant on this discipline.

However now, blockchain expertise has introduced in new gamers like Ripple that desires to alter the sport by making cross-border funds quicker, cheaper, and extra clear.

This text examines the rivalry between SWIFT and Ripple, exploring how each techniques work, evaluating their approaches to dealing with cross-border funds, and assessing their potential to dominate the way forward for world funds.

The Dominance of SWIFT

SWIFT, created and deployed in 1973, is a safe system designed to allow banks to deal with worldwide transactions. Earlier than SWIFT, cross-border transactions have been sluggish and costly, usually managed with telex machines and handbook processes. SWIFT modified that by introducing a dependable community connecting banks worldwide.

SWIFT has grown so much through the years. It began with 239 banks in 15 nations and has expanded to incorporate many extra banks and monetary establishments globally. Now, SWIFT operates one of many world’s largest monetary networks, spanning throughout greater than 200 nations and territories.

The dimensions of SWIFT’s community is spectacular, connecting over 11,000 monetary establishments worldwide. They embrace banks, securities brokers, clearinghouses, asset administration corporations, and company purchasers. With an enormous membership comprising main world establishments, SWIFT manages a major share of worldwide monetary transactions worldwide. It’s basically the usual for worldwide monetary communications

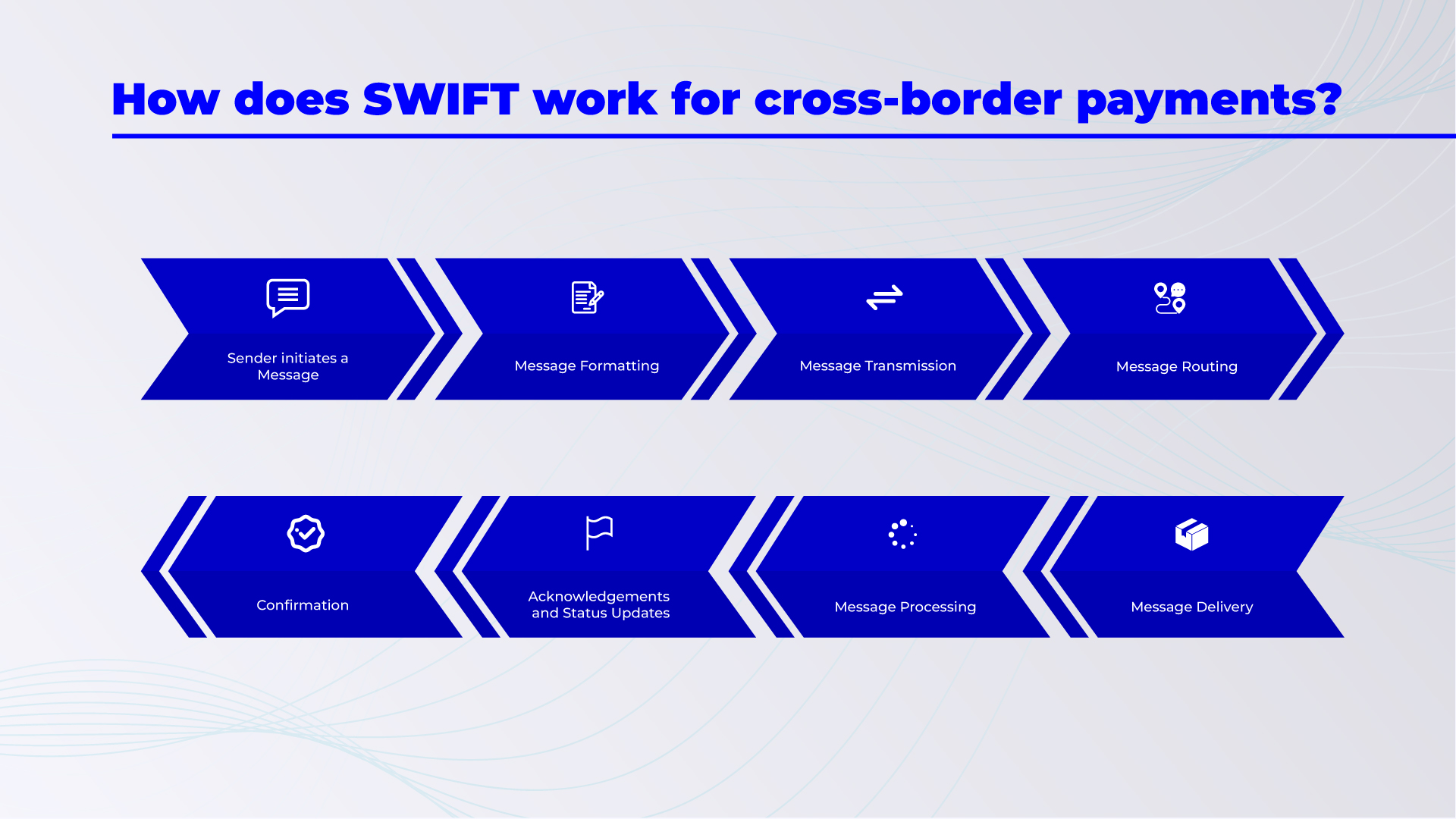

How SWIFT Works

SWIFT operates as an enormous messaging community for monetary establishments worldwide. It doesn’t truly transfer cash; it solely transmits safe messages between banks. The precise motion of funds happens by a community of correspondent banking relationships.

When a buyer initiates a global cash switch, their financial institution creates a SWIFT message with codes that assist banks perceive and deal with transactions rapidly, together with who’s sending cash, how a lot, in what foreign money, and why. This message then travels by the SWIFT community to achieve the recipient’s financial institution.

The journey of a SWIFT switch usually includes a number of middleman banks, particularly when the sending and receiving banks don’t have a direct relationship. Every middleman processes the SWIFT message, deducts its dealing with charges, and forwards the remaining stability to the subsequent financial institution within the chain. This step-by-step course of continues till the funds attain the ultimate vacation spot.

One among SWIFT’s defining traits is its reliance on this community of correspondent banks. Whereas this method ensures broad world protection, it additionally introduces delays and extra prices. All the course of usually takes one to 5 enterprise days, relying on the variety of intermediaries concerned and every financial institution’s processing effectivity.

The Emergence of Ripple

Ripple launched its blockchain-based fee protocol in 2012 with the purpose of revolutionizing world cash transfers. Its imaginative and prescient: to streamline worldwide funds, making them quicker, cheaper, and extra environment friendly in comparison with conventional banks. The protocol addresses points like sluggish and expensive cross-border transactions prevalent in conventional banking techniques.

The corporate appears to be making severe headway with this mission. It has teamed up with main banks and monetary establishments worldwide to broaden its expertise into their fee techniques. For example, Santander in Europe, U.S.’s American Specific, Japanese big, SBI Holdings, and MoneyGram, amongst others are large purchasers and companions of Ripple.

As you possibly can see from the listing above, Ripple’s expertise is utilized in numerous finance sub-sectors, asides worldwide funds. It used to hurry up funds in commerce finance, serving to importers and exporters with faster settlements and fewer charges. Plus, Ripple’s tech is turning into standard in digital funds, giving companies and folks world wide a dependable and environment friendly method to ship and obtain cash.

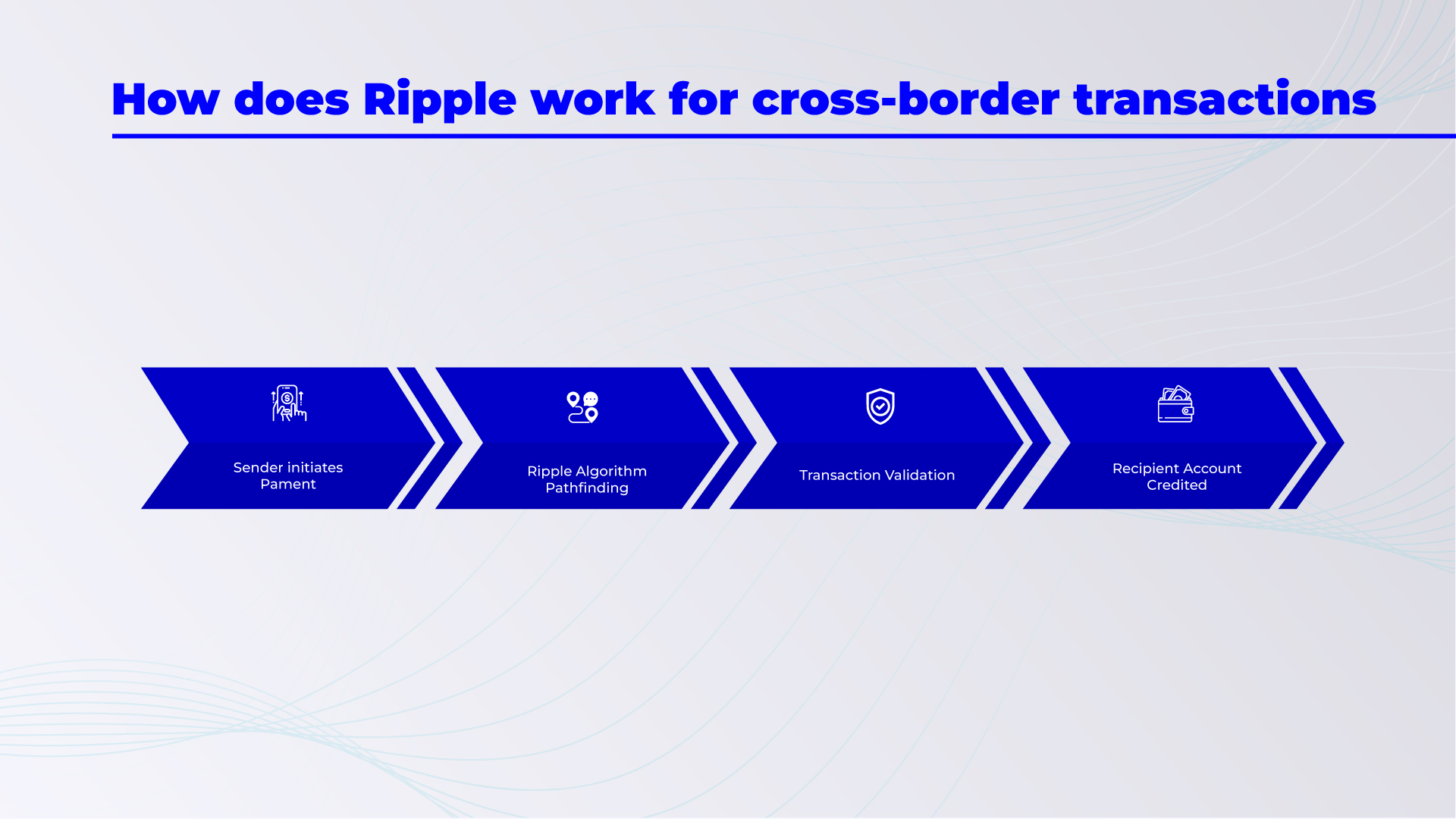

How Ripple Works

In distinction to SWIFT’s messaging-based system, Ripple presents a extra direct strategy to cross-border funds utilizing blockchain expertise. On the coronary heart of Ripple’s system is the XRP Ledger (XRPL), a decentralized blockchain community, and XRP, a digital foreign money that serves as a bridge between totally different fiat currencies.

Ripple operates by a community of validators liable for confirming transactions and sustaining the integrity of the system. Not like conventional blockchain networks, Ripple’s consensus mechanism doesn’t depend on mining, making it extra energy-efficient and quicker.

When a fee is initiated on the Ripple community, the system’s algorithm determines essentially the most environment friendly path for the switch. This path might contain direct switch between Ripple-connected establishments or may embrace foreign money exchanges facilitated by liquidity suppliers. These suppliers, which embrace banks and specialised crypto buying and selling corporations, assist seamlessly convert one foreign money to a different when vital.

A key function of Ripple’s operation is its use of XRP as a bridge foreign money. This permits for fast and environment friendly conversion between totally different fiat currencies, eliminating the necessity for a number of foreign money pairs and lowering the complexity of cross-border transactions.

Ripple vs. SWIFT: The Comparative Evaluation

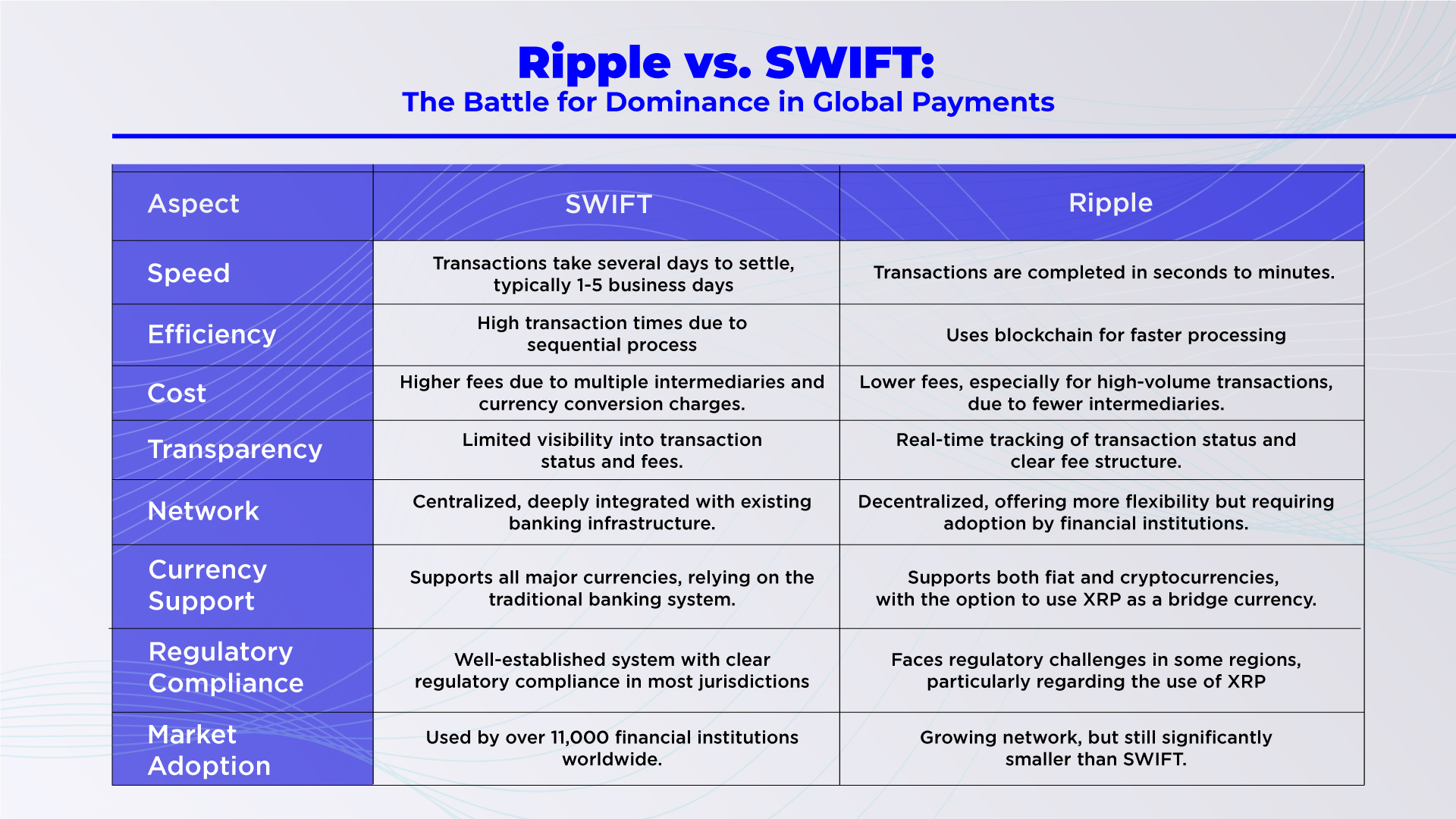

Probably the most notable operational distinction between Ripple and SWIFT lies within the settlement time. Whereas SWIFT transfers can take days because of the involvement of a number of intermediaries, Ripple settles transactions in close to real-time, usually inside seconds. This speedy settlement is especially advantageous for monetary establishments dealing with giant volumes of worldwide transfers.

One other important distinction is the way in which every system handles transaction charges. Within the SWIFT community, every middleman financial institution deducts its charges from the switch quantity, doubtlessly lowering the ultimate sum obtained. Ripple, alternatively, presents extra clear and customarily decrease charges as a consequence of its extra direct switch course of and the elimination of a number of intermediaries.

Whereas SWIFT depends on its intensive community of established monetary establishments, Ripple’s operation opens up prospects for a wider vary of contributors, together with each conventional banks and newer fintech corporations. This inclusivity, mixed with Ripple’s flexibility in dealing with various kinds of currencies (together with cryptocurrencies), represents a bridge between conventional finance and the rising world of digital belongings.

Ripple edges out SWIFT by way of transaction pace, effectivity, and safety. Nevertheless, by way of regulatory compliance, SWIFT is basically the usual. Plus, there’s regulatory and authorized battles somewhere else for Ripple, particularly on the standing of XRP—whether or not it’s a safety or not.

Additionally, the ups and downs of cryptocurrency markets is one other concern. Since Ripple depends on XRP as a bridge foreign money, its success is intently tied to how effectively cryptocurrencies do total. Unbridled modifications in XRP’s worth can influence Ripple’s partnerships and traders’ confidence.

Future Prospects and Improvements

The competitors between SWIFT and Ripple represents a broader shift within the monetary trade in the direction of quicker, extra environment friendly cross-border fee options. Whereas SWIFT advantages from its established place and widespread adoption, Ripple’s progressive strategy presents important benefits by way of pace and value.

SWIFT will not be standing nonetheless, nevertheless. The group is creating new applied sciences like SWIFT gpi (gpi = International Funds Innovation) ,which it introduce in 2017, to enhance transaction pace and transparency. They’re exploring blockchain and distributed ledger applied sciences to reinforce their choices additional.

In the meantime, Ripple continues to broaden its community and refine its expertise. The corporate is specializing in key remittance corridors, notably in rising markets the place conventional banking relationships could also be restricted. Ripple can also be engaged on enhancing its compliance frameworks to deal with regulatory issues in numerous jurisdictions.

Closing Ideas

The way forward for cross-border funds will doubtless contain a mix of conventional and blockchain-based options. Monetary establishments might undertake hybrid approaches, leveraging the strengths of each SWIFT and Ripple-like applied sciences to satisfy numerous buyer wants and regulatory necessities.

Notably, Ripple isn’t alone on this area both. Different blockchain fee techniques like Stellar and IBM’s Blockchain World Wire are additionally making waves. They’re utilizing new tech and partnerships to make cross-border funds smoother too. This places further stress on Ripple to remain forward and preserve arising with new concepts and dealing with key companions available in the market.

Because the panorama evolves, elements comparable to regulatory developments, technological developments, and shifts in market demand will play essential roles in figuring out the stability between conventional and progressive fee techniques.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. At all times conduct due diligence.

If you need to learn extra articles (information reviews, market analyses) like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”