Victoria d’Este

Revealed: October 25, 2024 at 3:00 pm Up to date: October 25, 2024 at 11:39 am

Edited and fact-checked:

October 25, 2024 at 3:00 pm

In Temporary

Binance’s newest paper explores the impression of spot BTC ETFs on market demand, liquidity, and adoption traits, revealing their vital affect available on the market provide.

Inspecting these dynamics, the most recent Binance paper, “Spot ETFs in Crypto Markets,” describes how spot BTC ETFs have an effect on market demand, liquidity, and adoption traits.

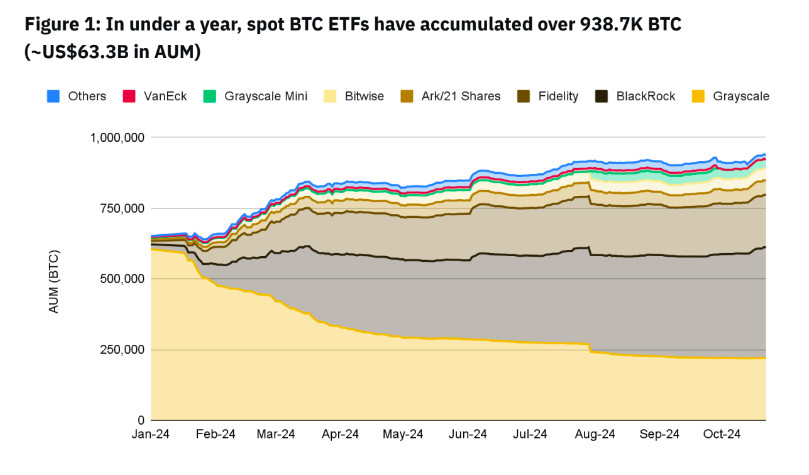

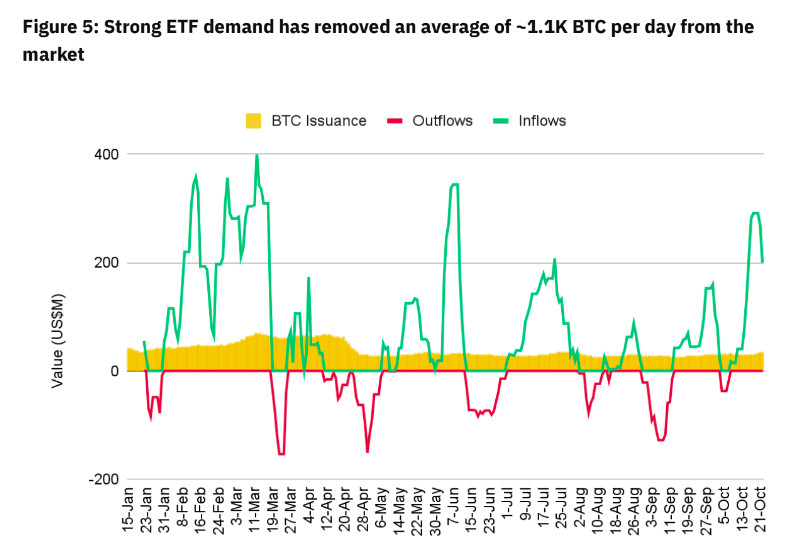

Main capital has rapidly poured into spot bitcoin exchange-traded funds, with holdings already totaling over 938,700 BTC, or over $63.3 billion. This quantity, which quantities to nearly 5.2% of the whole provide of Bitcoin, highlights the extent to which spot BTC ETFs are influencing the market. Giant internet inflows of over 312,500 BTC assist this demand, demonstrating the perform of those ETFs in selling constant demand and decreasing market provide.

As half of a bigger development towards securitizing digital property, spot Bitcoin ETFs have been launched, making them extra accessible to traders who would in any other case favor to work together with cryptocurrency via standard monetary devices.

With ramifications for value dynamics and liquidity, the magnitude of those inflows demonstrates that spot BTC ETFs are extra than simply monetary devices; they’re more and more enjoying a key function within the construction of the Bitcoin market. Though the ETF mechanism just isn’t new to the monetary business, its use within the cryptocurrency discipline has revealed demand ranges that surpass even these of the primary gold ETFs, indicating that Bitcoin ETFs have a definite enchantment.

ETF Divergence and Comparability with Gold ETFs

Gold ETFs, that are seen as extra steady and have set a sample for asset-backed funds prior to now, grew very modestly of their early phases, drawing simply round $1.5 billion over an identical time frame. Nevertheless, in lower than a 12 months, BTC ETFs have amassed nearly $18.9 billion, demonstrating the elevated curiosity in Bitcoin as a hedge in opposition to wider financial volatility in addition to a speculative asset. Remarkably, though simply 95 establishments invested in gold ETFs of their first 12 months, over 1,200 establishments have already invested in bitcoin ETFs.

Nevertheless, Ethereum (ETH) ETFs haven’t been as profitable as Bitcoin ETFs. Ethereum ETFs have had withdrawals of just about 43,700 ETH, or $103.1 million, in accordance with the Binance knowledge, with adverse flows occurring in eight of the primary eleven weeks.

With Bitcoin changing into a extra standard digital asset for ETF investments, this disparity between BTC and ETH ETFs factors to a shift in investor curiosity and market sentiment. Bitcoin’s standing as the primary cryptocurrency and its repute as a digital retailer of wealth could also be contributing elements to this development because it appeals to extra cautious traders.

Institutional and Non-Institutional Traders’ Contribution to the Progress of Bitcoin ETFs

The involvement of each institutional and non-institutional traders has significantly aided the expansion of spot BTC ETFs. Robust curiosity in these merchandise has been proven by non-institutional traders, who make up round 80% of demand. Retail traders and particular person merchants that favor the benefit of getting Bitcoin publicity via ETFs slightly than personally managing wallets, keys, and exchanges make up this funding base.

There has additionally been a noticeable improve in institutional funding in Bitcoin ETFs. Due largely to monetary advisers, whose Bitcoin holdings surged by 44.2% to succeed in 71,800 BTC, institutional holdings have grown by nearly 30% since Q1. The transfer towards extra regulated and managed entry to digital property is mirrored in institutional traders’ sluggish acceptance of Bitcoin ETFs.

Nevertheless, it’s anticipated {that a} full-scale institutional adoption involving banks, consulting providers, and broker-dealers could be a sluggish course of that takes years to finish. Such a shift might make Bitcoin and different digital property extra broadly accepted by bringing them into the mainstream of worldwide monetary markets.

Bitcoin’s Convergence with Conventional Finance (TradFi)

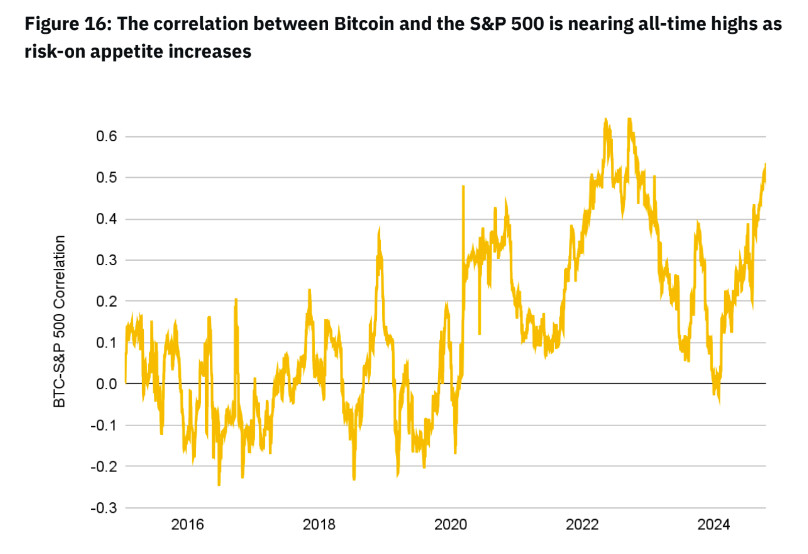

The Binance examine highlights a noteworthy development: the rising hyperlink between Bitcoin and traditional monetary property, particularly the S&P 500 index. This growing hyperlink, which has been stronger for the reason that starting of 2024, factors to a change in how traders see Bitcoin. Bitcoin is now seen as each a risk-on asset and a hedge in opposition to macroeconomic uncertainty, whereas earlier than, it was considered largely uncorrelated. This twin function is a mirrored image of traders’ altering perceptions, as many now view Bitcoin as each a growth-oriented asset and a potential buffer in periods of market volatility.

Each market stability and funding strategies are impacted by Bitcoin’s convergence with conventional finance. Because the cryptocurrency market begins to behave extra like different well-known asset courses, for instance, the stronger reference to shares might point out that the market is maturing. Moreover, the interplay between standard monetary property and digital currencies is anticipated to accentuate as institutional gamers dedicate larger percentages of their portfolios to BTC ETFs, due to this fact reinforcing Bitcoin’s place in standard investing frameworks.

The Impression of Spot BTC ETFs on Market Volatility and Effectivity

Along with creating direct demand for Bitcoin, spot BTC ETFs have had a serious impression on the cryptocurrency market general via second-order impacts. Spot BTC ETFs make up a median of 26.4% of Bitcoin’s spot buying and selling quantity, with occasional peaks of 62.6%, in accordance with the Binance report. As a result of ETF mechanism’s introduction of a extra managed type of demand for Bitcoin, this sizeable proportion has helped to enhance market effectivity and decrease volatility. These ETFs’ reliability can maintain extra constant value patterns, drawing much more merchants to the market.

Enterprise capital is changing into extra excited by spot BTC ETFs because of their liquidity, which permits for a broader market inclusion that goes past Bitcoin to incorporate a variety of blockchain-native property. The market might develop into extra steady and liquid because of this increasing on-chain presence, which is being pushed by ETF demand each immediately and not directly. As an example, the larger legitimacy and liquidity provided by spot BTC ETFs might spur new growth within the tokenized RWA area.

Disclaimer

According to the Belief Undertaking tips, please be aware that the data supplied on this web page just isn’t supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. It is very important solely make investments what you possibly can afford to lose and to hunt impartial monetary recommendation when you have any doubts. For additional data, we recommend referring to the phrases and situations in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Creator

Victoria is a author on a wide range of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on a wide range of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.