On Monday, spot Bitcoin exchange-traded funds (ETFs) registered their second-largest single-day web outflow since their launch in January. The crypto-based funding merchandise noticed their second consecutive pink day earlier than the US elections, ending a seven-day optimistic streak.

Bitcoin ETFs Document Huge Outflow Day

US-listed spot Bitcoin (BTC) ETFs began the month negatively after recording two days of outflows. The funding merchandise carried out remarkably for many of October, seeing 4 consecutive inexperienced weeks and surpassing the $2 billion mark twice.

Final week, Bitcoin ETF recorded $2.2 billion in inflows, main the crypto funding merchandise’ optimistic efficiency for the fourth week straight. Nevertheless, the funds noticed a major web move lower from October 30 to October 31 as Bitcoin’s worth struggled, going from $893.3 million in inflows to solely $32.3 million.

On Friday, BTC ETFs had their first pink day since October 22, ending their seven-day streak with $54.9 million in outflows. The unfavourable sentiment continued in the beginning of this week, as Bitcoin-based funding merchandise registered the second-largest single-day web outflow since their launch in January.

The funds noticed their largest red-performing day on Might 2nd, with $563 million in outflows. In the meantime, Bitcoin ETFs noticed $541.1 million in outflows this Monday. Reportedly, Bitwise’s BITB, AKR Make investments’s ARKB, and Grayscale’s Mini Belief (BTC) had file outflow days on November 4.

BTC ETFs see $541 million in outflows on Nov. 4. Supply: Farside Traders

Based on information from Farside Traders, BITB and BTC noticed $79.8 million and $89.5 million in outflows, respectively, whereas ARB registered $138.3 million in unfavourable web flows. Nonetheless, Constancy’s FBTC led yesterday’s losses with $169.6 million in outflows, its second worst-performing day.

BlackRock’s IBIT was the one BTC ETF to see a optimistic web move yesterday, with $38.4 million in inflows.

BTC ETFs To Proceed Thriving

Bitcoin ETFs’ large outflows occurred simply sooner or later earlier than the US elections. Specialists concurred that the market volatility and hypothesis surrounding the election’s final result have affected the funding merchandise.

In a Tuesday interview, Bloomberg analyst Eric Balchunas famous that the election is an enormous variable that would additional influence Bitcoin’s worth motion and ETFs’ efficiency.

Nonetheless, he considers that the funding merchandise’ web move, which is at $29 billion, has held “actual thought” all through the “couple of downturns” seen this yr, suggesting BTC ETFs’ efficiency will surpass all expectations for its first yr, even when the election’s final result negatively impacts the market.

Balchunas referred to as ETFs the “premier automobile” for conventional buyers and a “disruptive powerhouse” that has “quite a lot of non secular connection” with Bitcoin. To the analyst, these connections make Bitcoins ETFs a robust long-term mixture.

In the meantime, Bitwise’s Chief Funding Officer (CIO), Matt Hougan, considers that “crypto has already gained” whatever the election’s final result however instructed {that a} Trump victory can be higher for the market within the quick time period.

To Hougan, the one doable “dangerous” final result can be a Democratic sweep. Nevertheless, he would stay bullish on that state of affairs and purchase the dip because the previous 4 years have taught him that “Washington can’t cease crypto.”

In the end, Bitwise’s CIO asserted that spot crypto-based ETFs will proceed to see inflows, and the trade will proceed to develop, even when the market slows down.

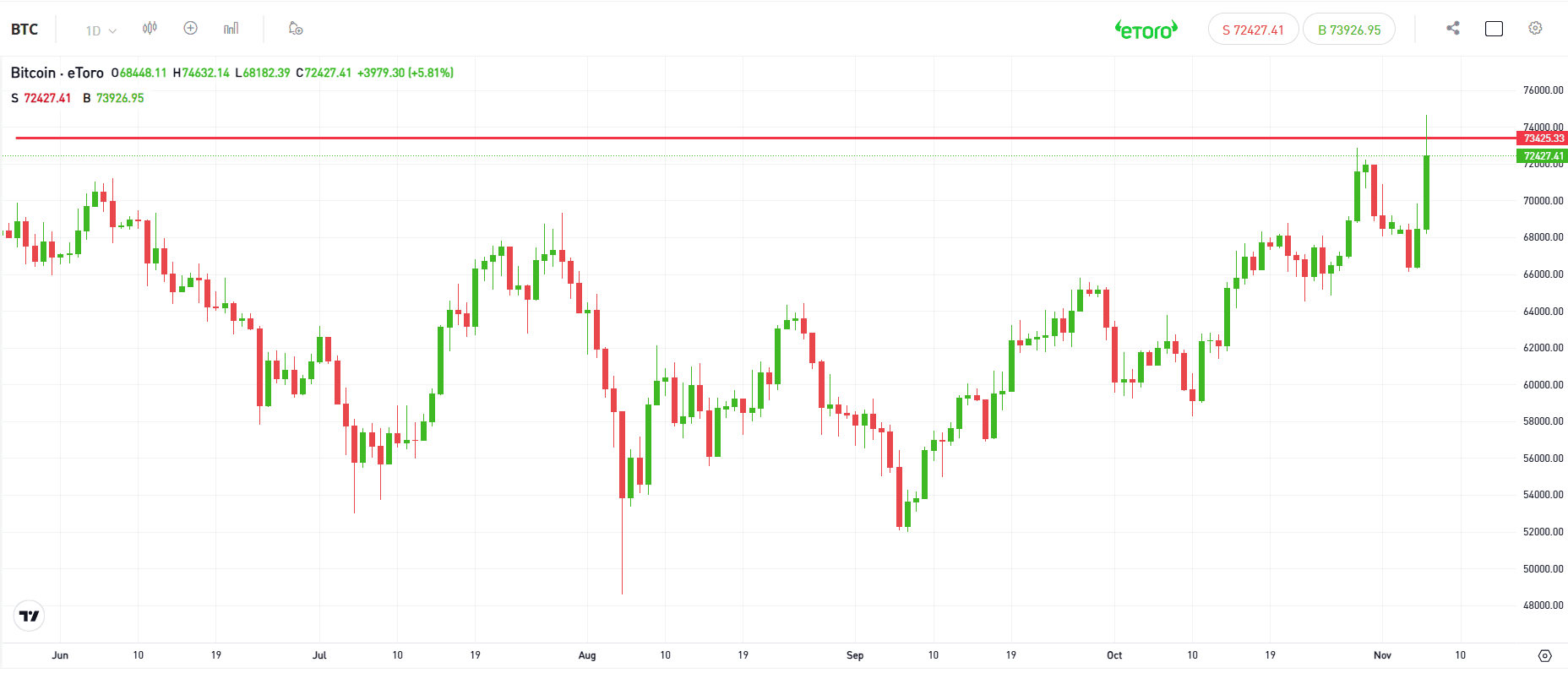

Bitcoin is buying and selling at $68,738 within the weekly chart. Supply: BTCUSDT on TradingView

Featured Picture from Unsplash.com, Chart from TradingView.com

_id_c0ada7b0-18f7-48ab-9a54-50f27b579857_size900.jpg)