Alisa Davidson

Printed: November 15, 2024 at 7:56 am Up to date: November 15, 2024 at 7:56 am

Edited and fact-checked:

November 15, 2024 at 7:56 am

In Temporary

Among the many most notable shifts within the crypto panorama this week: Ethereum is flexing its muscle tissues, Tether is diving into tokenized property, and new funding is pouring into blockchain-AI initiatives.

Curious the place sensible cash is flowing in crypto this week? This roundup covers probably the most notable shifts that occurred on the crypto panorama. Ethereum is flexing its muscle tissues, Tether is diving into tokenized property, and new funding is pouring into initiatives bridging blockchain with AI. When you’re seeking to keep forward of the curve, listed below are some potential sizzling picks to bear in mind whereas rebalancing your portfolio.

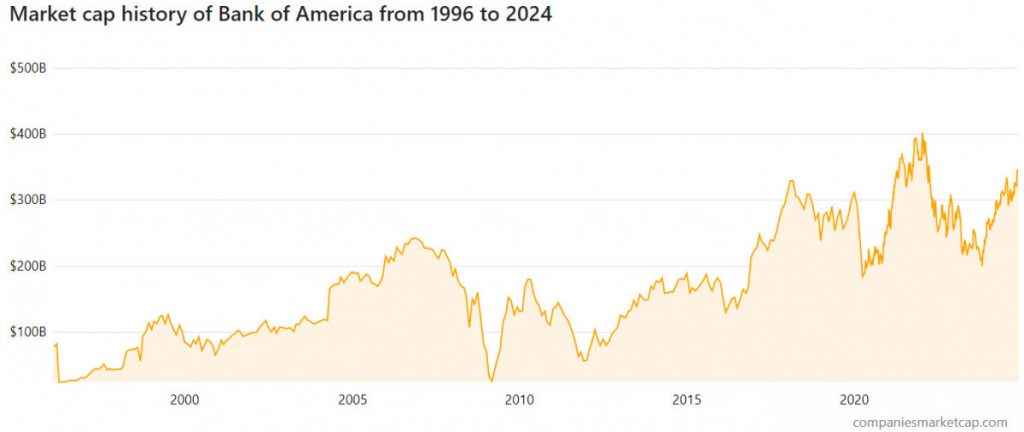

Ethereum Hits $3.2K, Surpasses Financial institution of America’s Market Cap

Ethereum simply hit $3,200, flexing a market cap of $383 billion, which places it $40 billion forward of Financial institution of America. Not unhealthy for “magic web cash,” proper? Ethereum’s rising clout is obvious as decentralized finance (DeFi) retains pulling customers away from conventional finance (TradFi). With the U.S. SEC eyeing the primary spot ETH ETFs, Ethereum’s enchantment to big-money gamers is barely getting stronger.

When you’re into DeFi, blockchain innovation, or simply the thought of holding an asset that’s outpacing Wall Avenue staples, ETH could also be worthy of consideration. Institutional gamers may discover the ETF buzz irresistible, whereas retail merchants may experience the wave of DeFi’s increasing playground.

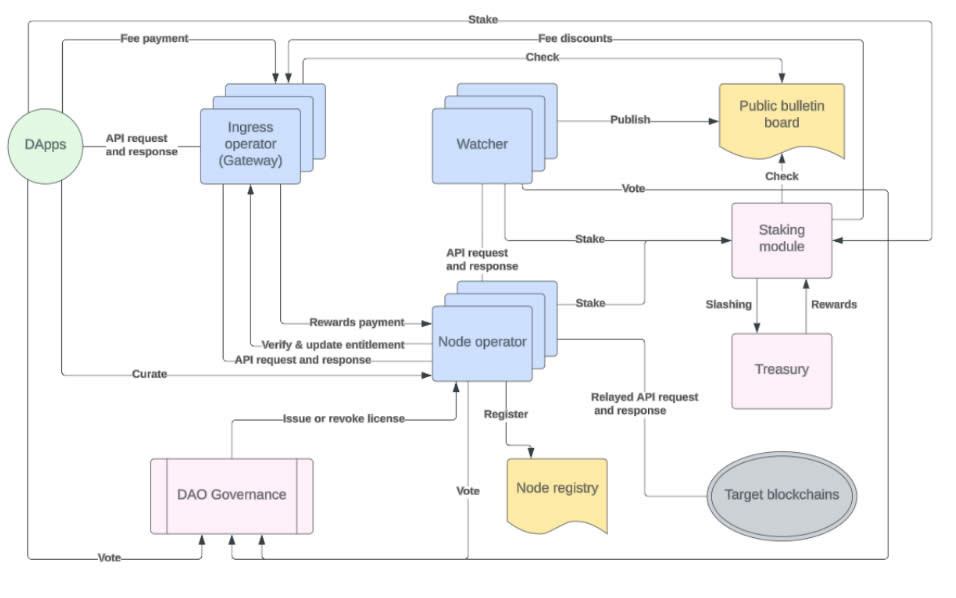

Consensys Decentralizes Infura with EigenLayer

Consensys has launched its Decentralized Infrastructure Community (DIN) as an Actively Validated Service (AVS) on EigenLayer, an Ethereum restaking protocol. DIN operates as a decentralized market for Web3 infrastructure – a sort of blockchain API hub – connecting builders to networks like Ethereum, ZKsync, Mantle, and BNB Sensible Chain. DIN’s integration with EigenLayer goals to chop prices, improve reliability, and simplify the rollout of recent decentralized providers.

This indicators shifting priorities within the blockchain ecosystem: scalable, developer-friendly infrastructure is taking middle stage. EigenLayer has already been identified for leveraging staked Ethereum to safe new providers and has locked in $13.4 billion in worth earlier this yr. This collaboration could show DIN as a key participant in shaping the spine of Web3.

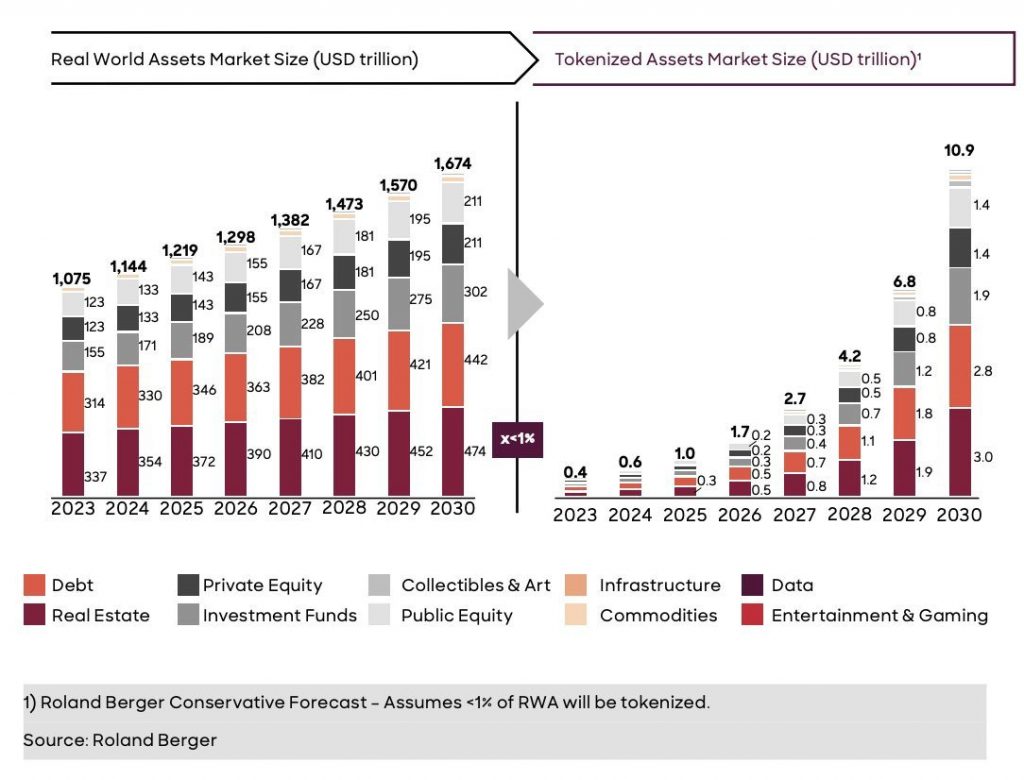

Tether Introduces Hadron for Actual-World Asset Tokenization

Tether has rolled out “Hadron,” a platform to carry real-world monetary devices – shares, bonds, commodities, and so forth – into the digital age. Hadron may have built-in KYC and AML controls, and can permit companies, asset managers, and even governments to concern and handle tokenized property. It additionally helps basket-collateralized merchandise, so large gamers can roll out their very own digital tokens backed by collections of property like commodities or currencies. Tokenized property are anticipated to hit $10.9 trillion by 2030, and thus far, Hadron is in keeping with certainly one of finance’s fastest-growing traits.

Tether is already often known as *the* stablecoin issuer with a $126 billion market cap – and now it’s increasing. So, Hadron may effectively be a key growth for these monitoring the tokenization of conventional finance.

Zero Gravity Labs Raises $290M for Blockchain AI OS

Zero Gravity Labs (0G Labs) has locked in $290 million to construct what it’s calling the primary decentralized AI working system (dAIOS). The funding consists of $40 million from heavyweights like Animoca Manufacturers, Samsung Subsequent, and Polygon, plus a $250 million liquid line of credit score tied to token purchases. This technique goals to rework how decentralized AI apps deal with knowledge. As soon as in place, it ought to have 100% on-chain stay interactions, whereas the anticipated throughput is ready to clock a staggering 50GB per second.

The intersection of blockchain and AI is heating up, and dAIOS sits squarely on the crossroads. With a concentrate on lowering prices and complexity for AI purposes, 0G Labs may enchantment to these betting on the scalability of blockchain-based AI infrastructure. If the long run seems data-driven and decentralized, that is one undertaking to maintain in sight.

PayPal USD Hyperlinks Ethereum and Solana

PayPal’s stablecoin, PYUSD, is making strikes with a brand new integration into LayerZero, a cross-chain protocol designed for seamless blockchain transfers. This improve permits PYUSD to hop natively between Ethereum and Solana utilizing LayerZero’s Omnichain Fungible Token (OFT) Customary – no centralized middlemen like Venmo wanted. It’s a step towards making stablecoins extra versatile and DeFi-friendly. Self-custody customers on the lookout for clean cross-chain performance will discover this a welcome replace.

Total, it’s a sign that PayPal is doubling down on making PYUSD a participant within the interoperability sport, whilst its market cap has dropped from $1 billion to $513 million since August. With Ethereum seeing nearly all of PYUSD’s provide, and Solana providing high-speed, low-cost transactions, this might enchantment to these awaiting bridges between institutional finance and decentralized ecosystems. LayerZero’s integration is one other instance of cross-chain tech turning silos into highways – value monitoring should you’re eyeing infrastructure or stablecoin innovation.

Ronin’s Katana DEX Launches V3 Improve

Ronin Community is rolling out a v3 improve for its decentralized change (DEX), Katana, designed to spice up buying and selling effectivity and optimize capital utilization. The improve introduces concentrated liquidity swimming pools, customizable charges, and deeper liquidity, permitting liquidity suppliers (LPs) to raised tailor revenue margins and threat ranges. The transfer additionally reduces reliance on excessive RON token emissions, a strategic shift to enhance the community’s long-term sustainability by chopping liquidity rewards by 50% within the subsequent part of changes.

Katana’s enhancements align with the broader pattern towards extra capital-efficient DEXs. Moreover, Ronin’s integration of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) underscores its concentrate on interoperability and safety, additional strengthening its ecosystem enchantment for traders desirous about cross-chain improvements.

Cardano Basis Experiences $478M in Property

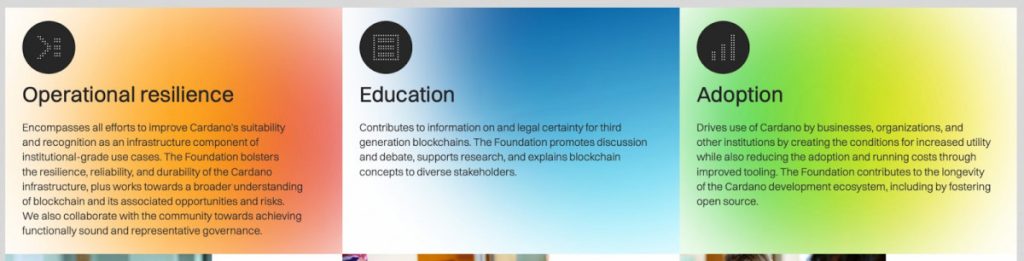

The Cardano Basis, the nonprofit driving the Cardano blockchain, closed 2023 with $478 million in property, the bulk – 82.5% – held in ADA tokens, alongside 10.1% in Bitcoin and a small slice in USD. In accordance with its Monetary Insights Report, the muse allotted $19.22 million throughout its core focus areas: schooling, adoption, and operational resilience. Notable achievements included holding the community working uninterrupted for over 2,000 days, testing decentralized governance fashions on the College of Zurich, and supporting the Valentine arduous fork.

The muse’s heavy ADA holdings mirror its confidence within the community’s potential, whereas its push into schooling and adoption – by way of initiatives like Cardano Academy and world occasions – indicators a concentrate on long-term progress. For these monitoring blockchain initiatives that prioritize resilience and scalability, Cardano’s observe file and roadmap could provide meals for thought.

Disclaimer

In step with the Belief Challenge tips, please word that the knowledge offered on this web page just isn’t meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. It is very important solely make investments what you may afford to lose and to hunt unbiased monetary recommendation in case you have any doubts. For additional data, we recommend referring to the phrases and circumstances in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Creator

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising traits and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa Davidson

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising traits and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.