The latest Bitcoin value surge, which surpassed $100,000 for the primary time, is creating ripples within the long-struggling crypto lending sector, significantly by means of decentralized finance (DeFi) functions.

In accordance with a Bloomberg report, the speculative pleasure surrounding Bitcoin has not solely invigorated its buying and selling however can also be spilling over into lending platforms, signaling a possible resurgence for this crucial phase of the cryptocurrency market.

Bitcoin Funding Fee Soars Tenfold

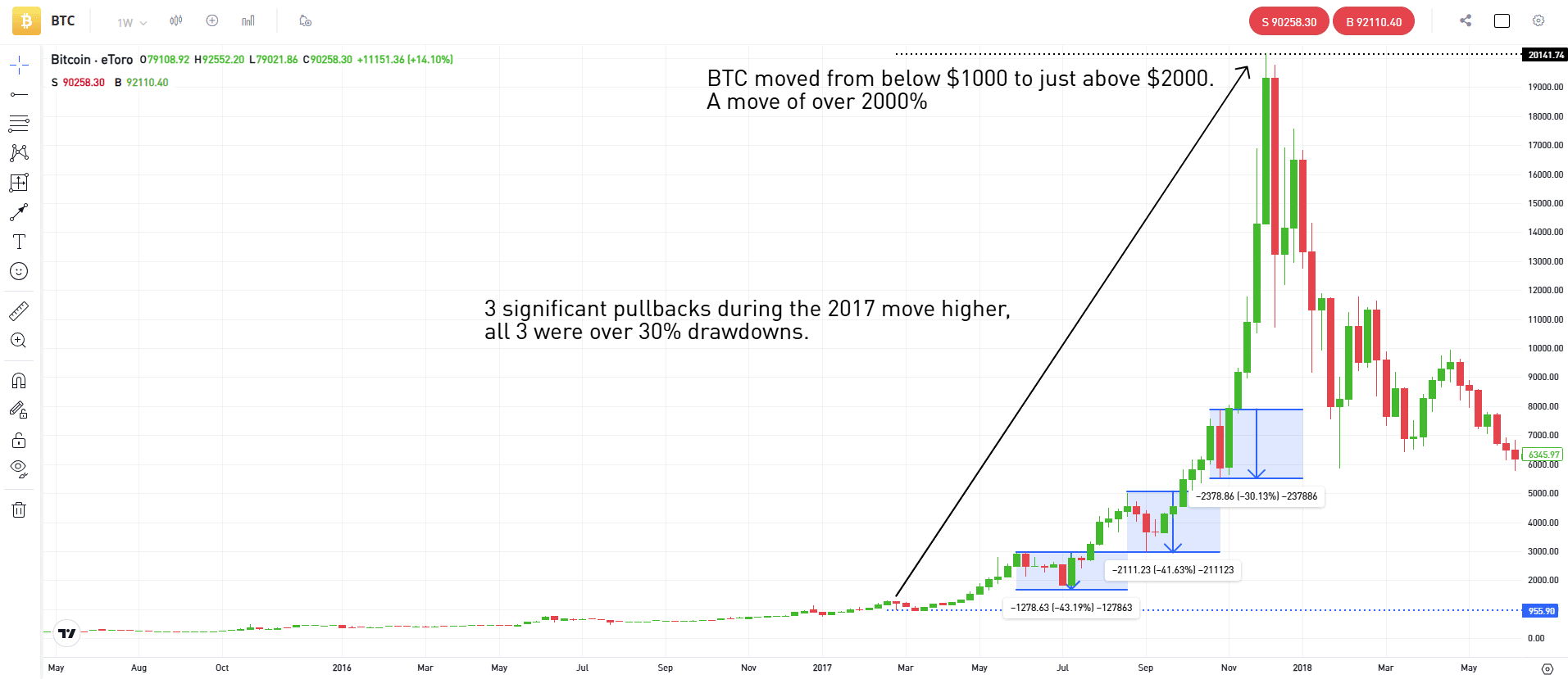

Bloomberg information reveals Bitcoin’s funding charge—the premium merchants pay to keep up lengthy positions in perpetual futures—has skyrocketed in November, growing greater than tenfold since early June.

This surge displays a rising urge for food for leverage as Bitcoin has greater than doubled in worth this 12 months, pushed by optimism surrounding the cryptocurrency’s growing integration into mainstream finance beneath the upcoming Trump administration.

The revival of the crypto lending sector is noteworthy given its tumultuous previous. In 2022 and early 2023, many lending platforms confronted vital challenges, with quite a few market gamers declaring chapter following questionable lending practices.

Nonetheless, latest information signifies that crypto lending exercise has almost tripled within the first 9 months of 2024 in comparison with the earlier 12 months, although it nonetheless lags behind the highs of 2021.

“Demand for Bitcoin-backed loans has surged as those that held from earlier than look to make the most of their wealth for purchases like properties and vehicles,” mentioned Mauricio Di Bartolomeo, co-founder of Ledn, a crypto lending platform. He famous that many new entrants are leveraging their belongings to make long-term investments.

Crypto Lending Sector Revives

Lenders play an important function within the cryptocurrency ecosystem by offering liquidity and facilitating buying and selling in a naturally unstable market. Nonetheless, conventional banks stay hesitant to increase credit score to crypto market individuals because of ongoing regulatory uncertainties.

This hole has allowed crypto lenders to flourish, significantly throughout the 2021 bull market, when corporations like Genesis and BlockFi grew to become key gamers in offering capital to debtors.

The shadow of previous failures nonetheless lingers, as evidenced by the latest responsible plea from Alex Mashinsky, co-founder of the now-defunct Celsius Community, who admitted to fraud prices. Celsius collapsed in 2022, abandoning over $1 billion in debt and a posh chapter course of to repay collectors.

Regardless of the restoration in lending exercise, present ranges stay considerably decrease than in 2021. In accordance with Galaxy Analysis, lending through DeFi functions and centralized suppliers stood at roughly half of the amount recorded within the first 9 months of 2021, though it has reached $36.8 billion—a threefold enhance from the identical interval in 2023.

DeFi platforms are significantly noteworthy, managing almost $31 billion in loans, whereas centralized suppliers accounted for $5.8 billion. That is mirrored within the whole worth locked in Ethereum-based lending apps, which has not too long ago surpassed its 2021 peak, in keeping with information from DeFiLlama.

Whereas leverage out there is certainly rising, some warning stays. Many market individuals are nonetheless cautious of lending following the turmoil of the earlier cycle when some lenders supplied unsustainable double-digit yields on unsecured loans.

Institutional lenders, specifically, are taking a extra conservative strategy. Jeffrey Park, portfolio supervisor at Bitwise Asset Administration, famous that whereas their agency beforehand lent to crypto lenders, they’ve since exited that technique because of diminished consumer curiosity in high-risk yield alternatives post-FTX collapse.

Nonetheless, some centralized exchanges and brokerages are stepping in to fill the lending void. Galaxy Digital, for instance, reported a 20% enhance in its mortgage ebook since mid-August, reaching a mean of $863 million for the third quarter.

On the time of writing, BTC was buying and selling at $99,130, up 1.5% within the final 24 hours.

Featured picture from DALL-E, chart from TradingView.com