Choices are sometimes a number one market indicator, reflecting merchants’ expectations for worth path and volatility. This dynamic is very true for Bitcoin, because the sheer measurement of the derivatives market has traditionally outpaced spot buying and selling.

In contrast to futures, that are fairly simple buying and selling devices, choices buying and selling incorporates methods that hedge dangers or speculate on worth and volatility. The complexity of this buying and selling instrument signifies that any modifications available in the market — be it open curiosity, quantity, or the ratio of choices to futures OI — can considerably influence Bitcoin’s worth.

With choices turning into a dominant pressure within the derivatives market, it’s important to know the way it impacts durations of elevated worth volatility.

The choices/futures open curiosity ratio tells us how a lot affect choices merchants have relative to futures and perpetual contracts. In December, this ratio remained in a comparatively reasonable vary, signaling that choices hedging habits was influencing Bitcoin’s worth.

As Bitcoin reached an all-time excessive of over $103,000, choices merchants probably elevated hedging exercise to handle delta threat, amplifying worth swings. The rise on this ratio reveals that choices weren’t only a secondary market however performed a significant function in worth discovery.

Nonetheless, as the worth started to say no, the ratio’s moderation urged that the affect of perpetuals and futures reasserted itself — however the lingering results of earlier hedging probably exacerbated the worth drop.

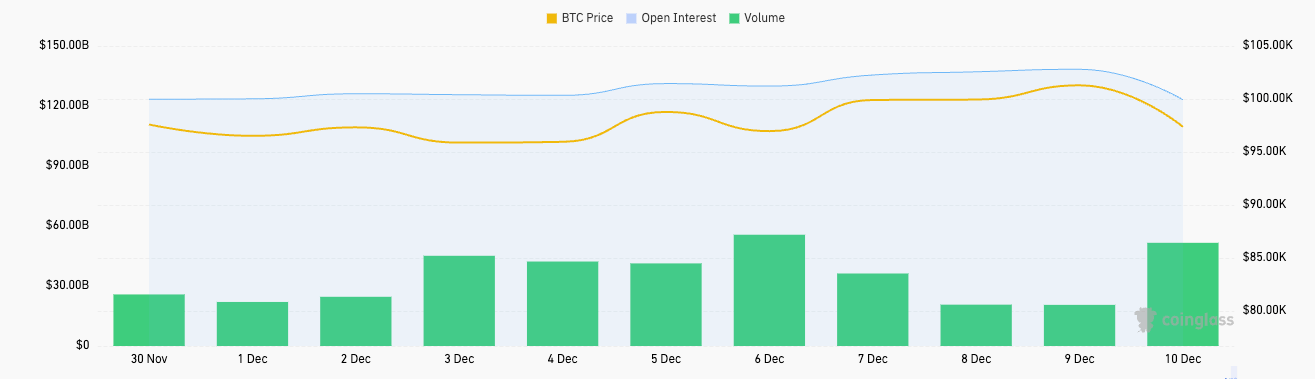

Open curiosity and buying and selling quantity knowledge from CoinGlass additional affirm this. Open curiosity grew steadily in December after a short-lived contraction following its ATH in late November. This regular development signifies market exercise has been ramping up as Bitcoin neared its ATH.

This development probably included a mixture of directional merchants speculating on continued worth will increase and volatility merchants positioning for larger implied volatility. The spikes in quantity we’ve seen previously week observe the rise within the ratio, indicating vital buying and selling exercise for choices. Nonetheless, as Bitcoin dropped from its ATH of $101,200 on Dec. 9, OI and quantity declined, marking a pointy drop in participation.

The unwinding of those positions probably pushed the worth down as choices dealer who hedged delta publicity earlier started closing out their merchants, lowering demand for BTC and rising promoting strain.

The lowered buying and selling quantity additional compounded the influence. Decrease quantity means lowered liquidity, making the worth extra delicate to large trades. This aligns with the choices/futures ratio, which hovered at ranges the place hedging exercise turns into very impactful, particularly in a much less liquid surroundings. As choices merchants adjusted their positions to replicate the declining worth, their hedging exercise probably concerned promoting futures or spot Bitcoin, additional pressuring the worth downward.

All of this knowledge factors to the truth that choices markets have an outsized function during times of volatility. The open curiosity ratio displays the rising affect of choices and reveals they’re now central to cost discovery. December has demonstrated how this affect can amplify worth will increase and drops, significantly throughout decreased liquidity.

The publish Choices wield outsized affect on Bitcoin’s volatility appeared first on CryptoSlate.