Please see this week’s market overview from eToro’s international analyst staff, which incorporates the most recent market information and the home funding view.

Concentrate on November’s jobs report and Powell’s speech

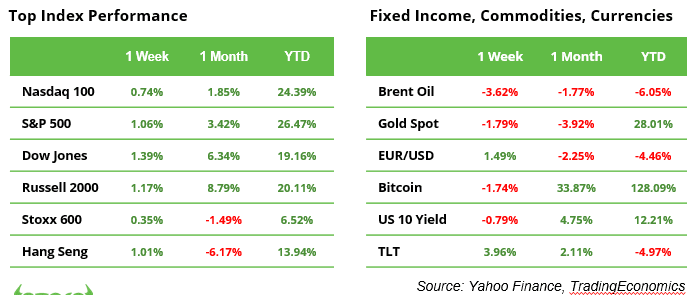

In a shortened buying and selling week as a consequence of Thanksgiving, the S&P 500 Index closed at a document excessive of 6,032 factors. With a acquire of 5.7% (see chart), November has been the very best month of 2024 thus far for the benchmark. Yr-to-date, the index is up 27.5%. This stellar efficiency has pushed its valuation to 22x ahead earnings, considerably above the 10-year historic common of 18x.

Buyers are intently monitoring U.S. authorities coverage expectations as Donald Trump prepares to enter the White Home on January 20, 2025. Regardless of his feedback about imposing tariffs as excessive as 25% on Mexico and Canada, and a further 10% on China, the announcement of nominees with extra average profiles has led many to imagine that Trump might govern extra softly than initially anticipated. Final week, the U.S. greenback softened barely, whereas the 10-year Treasury yield fell by 23 foundation factors, from 4.41% to 4.18%.

This week, market consideration will flip to November’s jobs report on Friday and Federal Reserve Chair Jerome Powell’s speech on Wednesday. These occasions will provide key information and steering forward of the Fed’s assembly on December 17-18. At the moment, markets are pricing in a 67% likelihood of one other 25-basis-point rate of interest lower. An unemployment price of 4.2%, barely increased than October’s 4.1%, is predicted to help this outlook.

A important have a look at Trump’s financial agenda

Donald Trump is planning important tax cuts to stimulate financial development and enhance company earnings. Nonetheless, this technique comes at a big value: diminished tax revenues are prone to widen the finances deficit and additional improve the nationwide debt of $36 trillion. To handle the ensuing financing hole, Trump appears to be counting on increased import tariffs. Nonetheless, commerce wars current substantial dangers: 1) They’re notoriously tough, if not unimaginable, to “win.“ 2) U.S. customers finally shoulder the burden of rising costs, and3) Financial weak point limits the effectiveness of protectionist insurance policies.

Tariffs might additionally drive up inflation, constraining the Federal Reserve’s skill to decrease rates of interest additional. Mixed with rising debt, diminished fiscal flexibility, and elevated market dangers, these components pose important threats to financial stability. The nomination of Scott Bessent as U.S. Treasury Secretary gives hope for stability. The hedge fund supervisor, identified for his pragmatic strategy, is predicted to deal with safeguarding the economic system moderately than unconditionally advancing Trump’s political agenda.

Large macro week forward: will contemporary information result in a year-end rally?

A wave of financial information this week might form market sentiment as traders search affirmation of the economic system’s resilience. The ISM studies on Monday and Wednesday take middle stage. Manufacturing PMI, presently at 46.5 (its lowest since July 2023), might present early indicators of restoration if it edges nearer to 50. In the meantime, Providers PMI, at 56 (its highest since August 2022), might spark recession fears if it weakens considerably.

ISM employment information can even set the stage for Friday’s jobs report, with key questions on the desk: Will job development stay subdued, and will the unemployment price tick increased?

Final week, the S&P 500 rebounded close to document highs, reflecting market optimism. Sturdy macro information might set off a breakout, whereas weaker figures might immediate short-term profit-taking with out derailing the broader uptrend. Moreover, softer information might gasoline rate-cut hypothesis, offering a security web towards important sell-offs.

OPEC+ meets on 5 December to debate its oil manufacturing technique

The OPEC+ alliance, managing a number of manufacturing cuts totaling over 3.9 million barrels per day (bpd), faces stress from risky oil costs and unsure demand. Discussions might embody extending a 2.2 million bpd voluntary lower, amid geopolitical tensions and shifting market situations. Including to the complexity is the return of president-elect Trump, whose insurance policies might affect U.S. manufacturing and enforcement of sanctions on Iran.

Information releases and earnings studies

Macro information:

2 Dec. U.S. Manufacturing PMI, China Manufacturing PMI

3 Dec. JOLTS job openings

4 Dec. U.S. Providers PMI, China Providers PMI

5 Dec. U.S. Commerce Steadiness

6 Dec. Non-Farm Payrolls, US Unemployment price

Company earnings:

3 Dec. Salesforce

4 Dec. Synopsys

5 Dec. UiPath, Lululemon, Ulta Magnificence

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.