Regardless of surging greater than 65% on a year-to-date (YTD) foundation, Ethereum (ETH) has been overshadowed by Bitcoin (BTC) and different cryptocurrencies like Solana (SOL) and XRP attributable to their extraordinary value beneficial properties all through 2024.

Analysts are more and more bullish on ETH, projecting five-figure value targets for the second-largest cryptocurrency.

Ethereum To Lastly Get Its Second?

The main sensible contract platform has had a comparatively modest efficiency in 2024. ETH was buying and selling at $2,350 on January 1, priced barely above $3,800, marking beneficial properties of over 65%.

Nevertheless, a 65% yearly improve is usually seen as common within the crypto business, notably throughout a bull market. Now, crypto analysts more and more recommend that ETH’s breakout second would possibly lastly be approaching.

As an example, distinguished crypto analyst and dealer @CryptoKaleo on X, mentioned that the following main cease for Ethereum is $15,000 – a greater than 3 occasions improve from present value ranges. As well as, the analyst predicted that the ETH/BTC buying and selling ratio might surge to 0.1 by January 2025.

For context, the ETH/BTC buying and selling pair – generally referred to as the ETH/BTC ratio – measures ETH’s efficiency relative to BTC. A better ratio signifies that ETH outperforms Bitcoin, whereas a decrease ratio suggests the alternative.

Trying on the weekly chart under, ETH has been in a chronic downtrend towards BTC since at the very least September 2022. Nevertheless, the pair now sits at a multi-year help stage round 0.038 and is predicted to rebound towards BTC within the coming weeks.

On a shorter timeframe, crypto observer @TheLongInvestor famous that ETH has climbed again above the higher trendline of a symmetrical triangle formation on the every day chart. The analyst instructed {that a} breakout above $4,100 might pave the best way for ETH to problem its all-time excessive (ATH) of $4,865.

ETH Funding Charges Again To Impartial Ranges

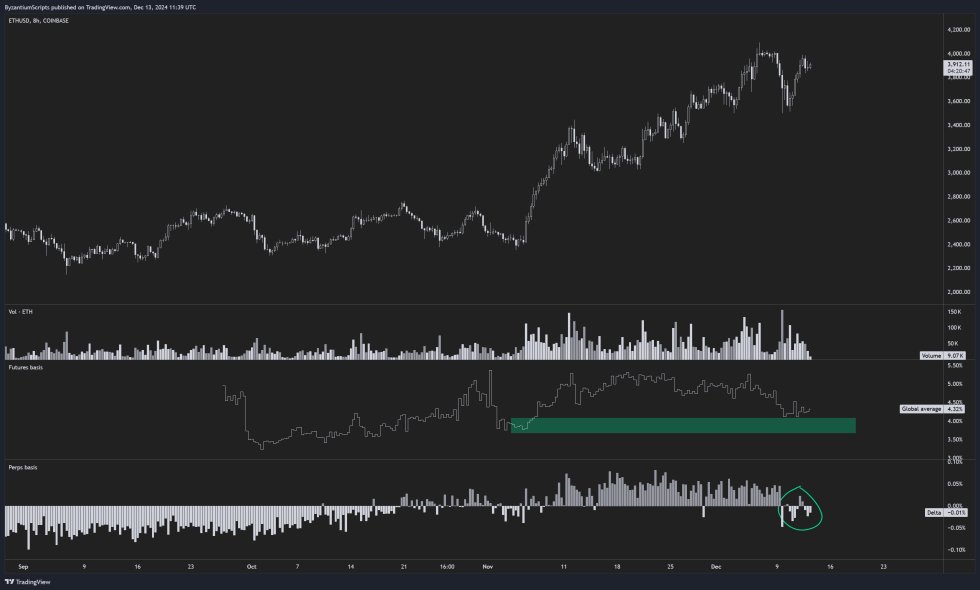

One other attention-grabbing remark comes from crypto analyst Byzantine Common, who highlighted that regardless of ETH’s regular upward value motion, its futures foundation and perpetual swap funding charges have reset to impartial ranges.

In different phrases, the market doesn’t seem like overly speculative or leveraged in favor of longs, though ETH’s value has been steadily rising. This reset might point out more healthy market situations and the potential for additional upward motion, with out the danger of extreme leverage triggering volatility.

In addition to bullish chart patterns, ETH’s fundamentals are getting stronger. A current report famous a major improve in Ethereum’s internet staking inflows, additional reinforcing its long-term worth proposition. At press time, ETH trades at $3,925, down 0.8% prior to now 24 hours.

Featured Picture from Unsplash.com, Charts from X and TradingView.com