The Bitcoin value efficiency in 2024 is one for the historical past books, with the premier cryptocurrency crossing the $100,000 mark for the primary time ever. Nonetheless, hitting this milestone opened the door to a different dialog — when will the market prime be in?

Consequently, a number of predictions of the Bitcoin value prime have emerged from the crypto crowd over the previous few weeks. The newest on-chain statement means that the market won’t have peaked or won’t be near a peak simply but.

Realized Revenue Ratio Comparatively Low In contrast To Earlier Cycles

In a current Quicktake put up on the CryptoQuant platform, an analyst with the pseudonym CryptoOnChain defined how whale habits and actions might assist establish the highest for the Bitcoin market. The related metric right here is the realized revenue ratio, which measures to ratio at which an investor cohort is exiting the market.

The “realized revenue ratio” metric calculates the proportion of cash bought at a revenue relative to the whole quantity of transactions. A excessive worth for this metric indicators that the market is nearing its peak, with individuals starting to dump their belongings for revenue.

A low realized revenue ratio, however, reveals that fewer market individuals are promoting their luggage for revenue. This typically indicators sustained investor confidence and religion within the additional value progress of a cryptocurrency.

In keeping with CryptoOnChain, the realized revenue ratio for numerous cohorts of Bitcoin whales (holding between 10 to 100, 100 to 1,000, and 1,000 to 10,000 BTC) is notably decrease in comparison with the final cycles. As noticed within the chart beneath, it seems that the whales are but to start profit-taking.

Supply: CryptoQuant

This means that the Bitcoin whales, who’re influential market entities, consider that the premier cryptocurrency is but to achieve its peak within the cycle. As of this writing, the Bitcoin value sits simply beneath $102,000, reflecting no important change up to now 24 hours.

40,000 BTC Moved Out Of Centralized Exchanges: CryptoQuant

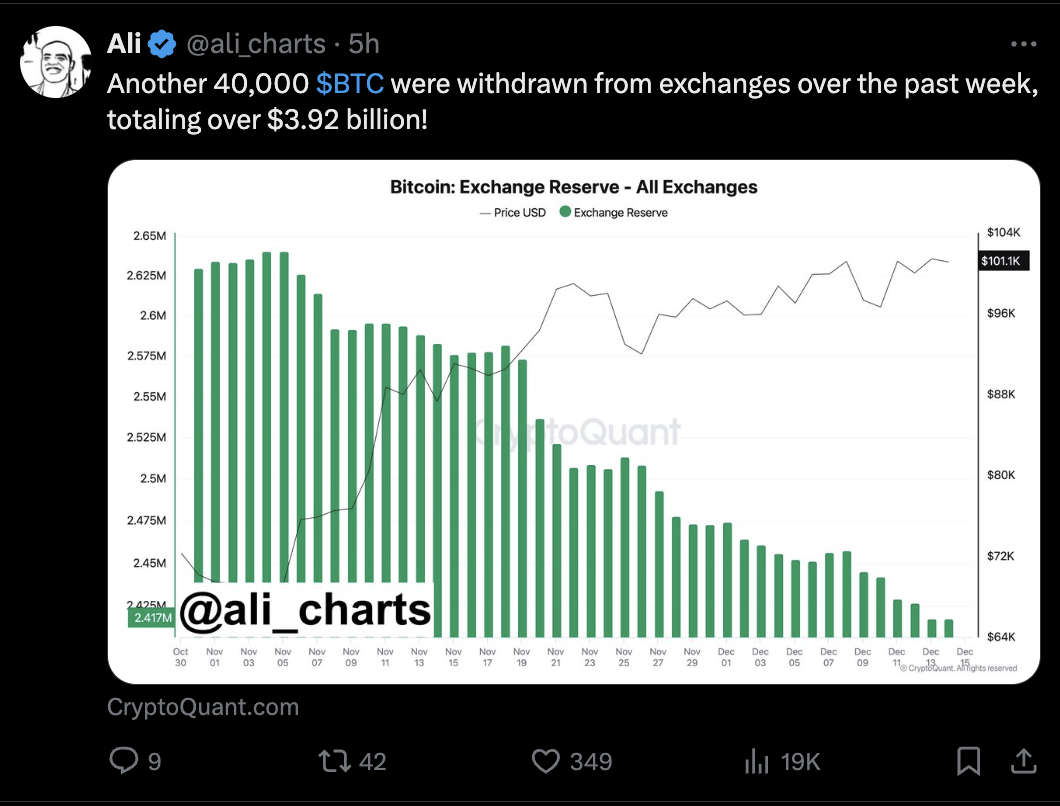

One other knowledge level appears to help the notion that market individuals are at the moment holding out for increased positive factors. Distinguished crypto pundit Ali Martinez took to the X platform to share that important quantities of Bitcoin have been flowing out of centralized exchanges up to now few days.

Supply: Ali_charts/X

Over 40,000 BTC (price round $3.92 billion) had been despatched out of exchanges over the previous week. This motion of belongings to non-custodial wallets signifies rising confidence amongst buyers, with a concentrate on the long-term promise moderately than fast short-term positive factors.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Unsplash, chart from TradingView