Yesterday’s Federal Reserve assembly resulted in a 25 foundation level charge reduce and a revised coverage indicating fewer cuts than anticipated subsequent yr. The announcement triggered a major market retrace, with Bitcoin main the downturn.

BTC dropped 8% from its all-time excessive, briefly testing liquidity ranges earlier than bouncing above $98,000. This retrace wasn’t restricted to crypto; broader markets additionally skilled volatility in response to the Fed’s choices.

Including intrigue to the state of affairs, CryptoQuant shared knowledge revealing an enormous transfer by a longstanding BTC whale. Over 72,000 BTC had been transferred, elevating hypothesis that this might sign a market prime. Traditionally, such massive actions by early adopters typically precede vital worth shifts, as their actions affect market sentiment and liquidity.

Regardless of the drop, Bitcoin’s capability to carry above key liquidity zones has reassured some traders. Nonetheless, questions stay: is that this merely a shakeout to gasoline additional beneficial properties or a precursor to a deeper correction?

Analysts and merchants will carefully watch Bitcoin’s subsequent strikes, particularly with this unprecedented whale exercise coinciding with a pivotal second in macroeconomic coverage. The approaching days might show decisive for BTC’s short-term trajectory and its journey into worth discovery.

Bitcoin Whales Making Strikes

After Bitcoin’s large breakout from $67K to $108K, the market has witnessed a shift in sentiment as good cash begins to place itself for the approaching months. As the value surged, massive traders, together with long-time Bitcoin whales, have been actively shifting their holdings, signaling that vital adjustments could also be on the horizon.

Prime analyst Maartunn shared on-chain knowledge displaying vital whale exercise, together with the overall motion of over 72,000 BTC. Notably, 8,000 BTC, aged between 5 and seven years, had been moved on-chain in a current transaction.

That is the eighth transaction previously two weeks, indicating a sample of considerable whale actions. These transactions might be interpreted in one in all two methods:

Whales are calling for a market prime: The big-scale transfers might signify that these whales imagine BTC has peaked and are promoting their positions to capitalize on the value surge. On this case, these whales might be seeking to take earnings earlier than a possible correction or consolidation section.

Whales are repositioning for an Altseason: Alternatively, these strikes would possibly point out that whales are rebalancing their portfolios, getting ready to deploy capital into altcoins as they anticipate the market to shift towards altcoin rallies, often known as Altseason.

As these massive transactions proceed, the market is left questioning whether or not it is a sign of a prime or simply half of a bigger strategic repositioning by Bitcoin’s largest holders. Traders will carefully watch how this unfolds within the coming weeks.

BTC Holding A Bulish Construction

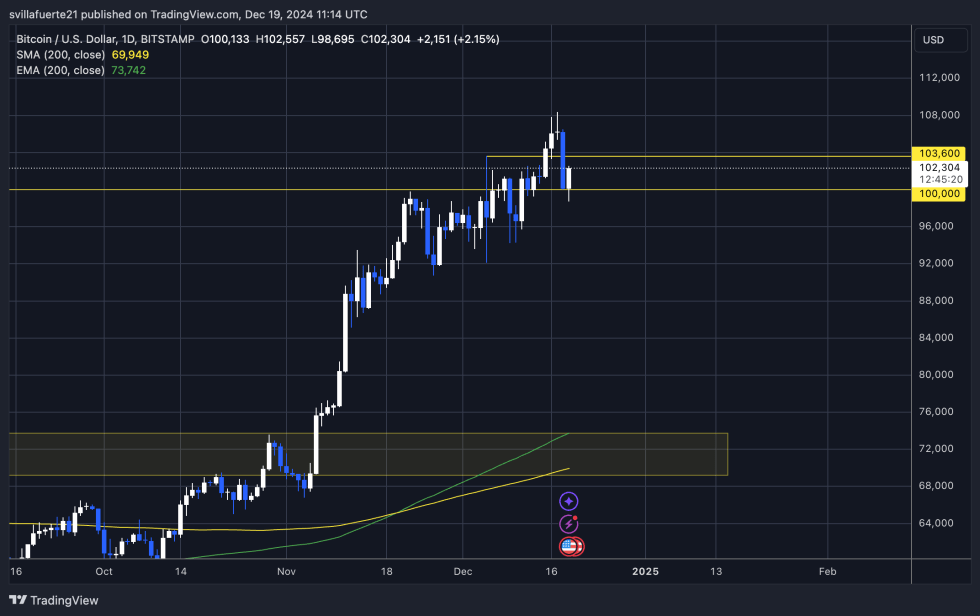

Bitcoin is buying and selling at $102,300 after testing native demand at $98,695 earlier right this moment. The value construction stays bullish, with a transparent formation of upper highs and better lows, indicating the market uptrend.

For BTC to take care of its momentum and push in direction of new highs, it should break above the $103,600 stage, which was a key pivot final week. This stage has proven vital significance because it marked a resistance level, and surpassing it will solidify Bitcoin’s bullish outlook and open the door for additional beneficial properties.

Nonetheless, a failed breakout above this stage might sign a shift in sentiment, and if BTC loses the $100,000 assist stage, a correction is more likely to observe. A drop beneath this vital threshold would point out that promoting stress is intensifying, and the market could have to retrace earlier than discovering a brand new assist base.

Merchants and traders will carefully monitor the $103,600 and $100,000 ranges within the coming hours to gauge Bitcoin’s subsequent transfer and whether or not the bullish development can proceed or if a short-term correction is imminent.

Featured picture from Dall-E, chart from TradingView

_id_c0ada7b0-18f7-48ab-9a54-50f27b579857_size900.jpg)