Key Takeaways:

The rate of interest minimize by the Fed didn’t convey the anticipated positivity within the crypto market, which as a substitute triggered a large sell-off, with Bitcoin sinking under $99,000.The fears of the Fed slowing its price cuts in 2025 and growing inflation have weakened investor sentiment.The market has adopted a “wait-and-see” angle, with traders ready for additional financial and financial insurance policies which might be going to be in place.

The cryptocurrency market simply skilled a wild day within the wake of the Federal Reserve’s announcement for a price minimize. As a substitute of rejoicing, traders have seen a robust sell-off, driving Bitcoin and lots of different altcoins into steep declines. What does this say for the way forward for the crypto market, and what’s going on?

Shock from the Fee Minimize Determination

On December 18, 2024, the Federal Reserve formally introduced a minimize within the benchmark price by 0.25% to maintain it throughout the vary of 4.25%-4.50%. This, generally, would sound optimistic, since a minimize within the rate of interest would usually increase so-called ‘dangerous property,’ together with cryptocurrencies. The market, nevertheless, reacted fairly contrarily, beginning to transfer utterly in the wrong way.

Why is the Crypto Market “Bleeding”?

Doused Expectations: The crux of the problem lies in indicators about 2025. Powell steered the Fed has tempered expectations and now sees two rate of interest cuts subsequent 12 months as a substitute of 4. That hawkish reassessment has led traders to fret the financial coverage might be much less “accommodative” than their expectations.Accelerating Inflation: The Fed additionally elevated its projection for PCE inflation on the finish of 2025 to 2.5% from 2.1%, hinting that inflationary pressures persist, and a smooth price minimize by the Fed can be arduous to implement quickly.Panic Promoting: These elements mixed helped dampen market sentiment. Traders are nervous about slower financial development prospects and a possible decline in capital circulation into cryptocurrencies. The end result has been an entire sell-off.

Extra Information: How Does This Newest US Inflation Information (CPI at 2.7%) Mirror at The Crypto market?

Crypto Market “Shaken”

Bitcoin PlummetsInstantly after the Fed’s transfer, Bitcoin fell practically 5.4%, to $100,314. The cryptocurrency had surged to $108,000 following this week’s CPI information, which confirmed inflation cooled greater than anticipated. The euphoria was short-lived.

Bitcoin fell

Altcoins Take a HitIt was not the one casualty. Main altcoins additionally suffered. Ethereum declined by greater than 6%, whereas XRP, Solana, and Dogecoin dropped round 10%, 7%, and 9%, respectively. The whole crypto market cap was wiped off upwards of $200 million in lower than someday.

Mass LiquidationsThis value drop led to the liquidation of practically $700 million price of derivatives contracts previously 24 hours. Bitcoin and Ethereum every noticed over $100 million in lengthy positions liquidated.

Bitcoin: -5.4%Ethereum: -6%XRP: -10%Solana: -7%Dogecoin: -9%

Inventory Market Additionally “Wobbles”

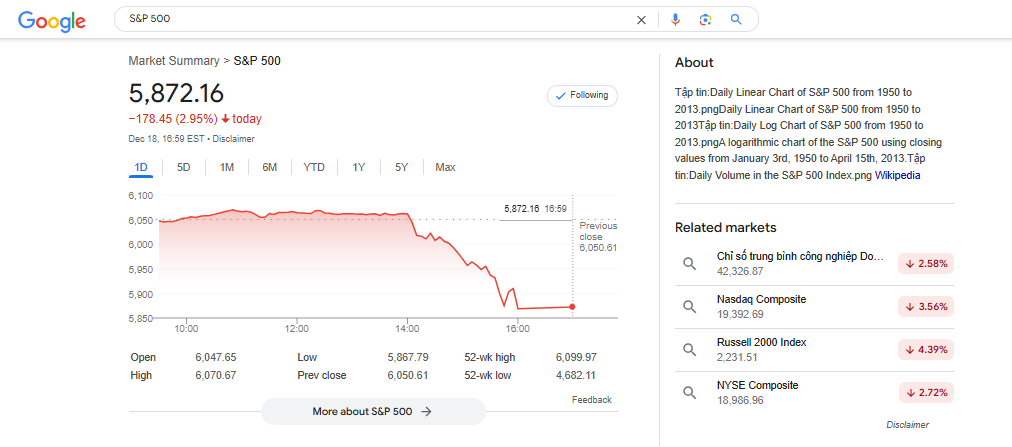

Furthermore, the Fed’s choice considerably hit the inventory market as effectively. The S&P 500 index declined noticeably. This underscores the shut correlation between crypto and equities in reacting to modifications within the Fed’s insurance policies.

S&P 500 fell

Impression on the Close to Future

The “Wait-and-See” PartThe crypto market is in a “wait-and-see” mode. Traders will observe the following financial information carefully, together with the actions of the Fed and different central banks.

Elevated Volatility DoubtlessWithin the quick run, the market is prone to be very risky, notably because it enters the Christmas interval when there’s normally low liquidity.

Lengthy-Time period ElementsNonetheless, it ought to be underlined that the crypto market demonstrated very robust development all through 2024, regardless of inflation and high-interest charges. Influential long-term development drivers for cryptocurrencies could come from favorable regulatory modifications, extra institutional investments, or the formal approval of Bitcoin exchange-traded funds.

As an example, Bitcoin ETFs have seen big inflows of cash, much more than conventional gold ETFs. Which means that establishments are lastly beginning to pay extra consideration to crypto.

Observations

This time round, the transfer by the Fed is an financial one however a “shock,” notably to the crypto market, which had been using excessive after immense development in current instances. Super disappointment and nervousness are pure when helpful property drop in worth inside hours.

However, this serves as a reminder: the sudden, together with danger, is inherent in crypto. Traders ought to maintain a cool head, consider data with care, and keep away from being swayed by short-term feelings. Don’t be overly pessimistic throughout “bloodbaths,” as they might current alternatives to purchase high quality property at higher costs.

Conclusion

The crypto market has its personal guidelines and may be very prone to macroeconomic influences. The Fed’s choice is amongst many, and understanding such developments is essential for any crypto investor.

Keep in mind, investing is a long-term recreation. Brief-term ups and downs shouldn’t shake your resolve. Continue learning, maintain researching, and make knowledgeable choices.