Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is flashing a sell-off sign, hinting at a notable worth decline within the coming days. Over the previous three days, sentiment throughout the cryptocurrency panorama has shifted noticeably towards the bearish aspect, resulting in a considerable worth drop.

Ethereum (ETH) Technical Evaluation and Upcoming Ranges

Nevertheless, this worth decline is predicted to proceed as ETH has fashioned a bearish worth motion on the each day timeframe. Based on skilled technical evaluation, ETH has damaged out of a bearish Head-and-Shoulders sample and breached an important help stage at $3,250.

This breakdown of bearish worth motion has pushed merchants towards quick positions, which might affect ETH’s worth within the coming days. Historic information signifies that $3,250 has been a powerful help stage for ETH over the previous three months, persistently offering a ground every time market sentiment turned bearish.

Nevertheless, this time, the altcoin has failed to carry this stage. Primarily based on latest worth motion, if ETH closes a each day candle under the $3,200 stage, there’s a robust risk of an 11% drop, taking it to the $2,850 help stage.

Bearish On-Chain Metrics

This bearish outlook has prompted merchants to take quick positions, as reported by the on-chain analytics agency Coinglass. At present, the ETH lengthy/quick ratio stands at 0.884, indicating robust bearish sentiment amongst merchants. Moreover, information reveals that, as of press time, 53.07% of high merchants maintain quick positions, whereas 46.93% maintain lengthy positions.

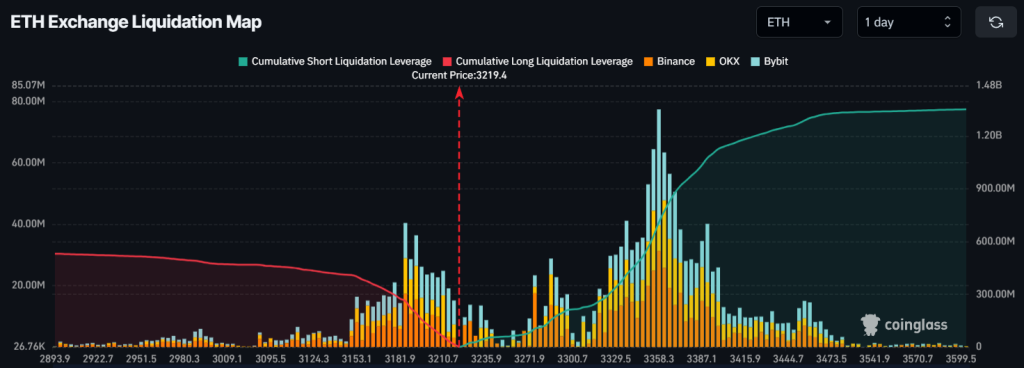

Main Liquidation Ranges

As well as, the key liquidation areas are on the $3,185.5 stage on the decrease aspect and $3,361.9 on the higher aspect, with merchants closely over-leveraged at these ranges, as revealed by the ETH trade liquidation map.

If the present sentiment stays unchanged and the worth drops to the $3,185.5 stage, practically $261.01 million price of lengthy positions shall be liquidated. Conversely, if the sentiment shifts and the worth rises to the $3,361.9 stage, roughly $708.16 million price of quick positions shall be liquidated.

This information reveals that the quick positions created by sellers are greater than double the lengthy positions held by patrons, signaling a powerful bearish sentiment.

Present Value Momentum

At present, ETH is buying and selling close to $3,225, having skilled a worth decline of over 1.65% up to now 24 hours. Nevertheless, throughout the identical interval, its buying and selling quantity has dropped by 29%, indicating lowered participation from merchants and buyers.