The relentless rally in Treasury yields and the US greenback is giving inventory buyers pause. Merck has a elementary and technical growth.

Friday’s TLDR

Rising yields are value watching

So is a rising greenback

Breaking down Merck inventory

The Backside Line + Every day Breakdown

We rode by 2024 with a number of delicate corrections within the inventory market, however ended with spectacular features. Bitcoin had its ups and downs too, however capped the 12 months with a large rally, topping $100,000 for the primary time.

With a lot momentum going into December, why then have threat property like shares and crypto been wavering recently?

Earlier this week, I talked about the rising US greenback and rising Treasury yields, that are appearing as headwinds for shares.

Now, it’s value stating that these correlations don’t essentially (or all the time) transfer in lockstep. Shares can rally whereas yields and/or the greenback are shifting larger. In truth, threat property have moved larger since each yields and the greenback bottomed in September. However when the greenback and yields are rising — notably when they’re rising in a considerably relentless method and doing so collectively — it may weigh on threat property.

The Greenback

A rising greenback squeezes the income for multinational firms. Consider US firms that do enterprise in different international locations. The gross sales they generate in native currencies (like euro) at the moment are value much less after they convert them to {dollars}. This weighs on earnings, which is a significant factor in whether or not shares go up or down.

The US Greenback may be adopted right here on eToro. Discover the way it’s up nearly 10% from the lows in September — that’s a giant transfer for the greenback.

There are positives to the next greenback, too. Touring overseas is cheaper, whereas import costs are additionally decrease. On the flip aspect although, touring to the USA turns into costlier for overseas vacationers. There are plenty of shifting components with currencies.

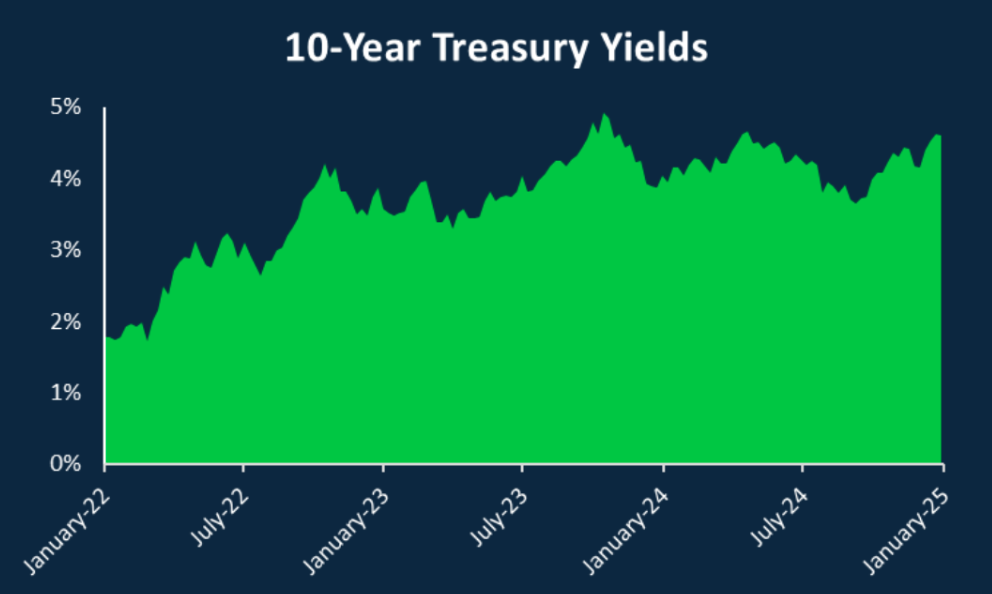

Treasury Yields

After we have a look at rising yields, Treasuries are competing with shares and are sometimes thought of “threat free” from a principal standpoint. When the yield of those so-called “risk-free” property will increase, it makes them extra engaging vs. different property, like shares.

Proper now, the regular transfer larger in yields is creating some pause for inventory buyers.

Yields started rising in mid-September — sarcastically proper round when the Fed first lower charges — and at this week’s excessive, the 10-year Treasury yield was up a whopping 30.9% from the September lows when it was buying and selling round 3.6%.

After clearing the 4.5% mark, there’s a rising fear that the 10-year will shoot again as much as 5% prefer it did in October 2023. Yields topped round that mark — and that’s additionally when shares bottomed amid an ~11% pullback within the S&P 500.

That’s not a prediction for the present state of affairs, however simply provides some context to the present setting.

The Backside Line

Traders must do not forget that risk-assets don’t go up in a straight line. Deep down, buyers know this, however this actuality can get misplaced within the shuffle as soon as our feelings become involved and we begin to see some crimson ink in our portfolios.

If the greenback and yields proceed to rise, it will increase the chances that these turn out to be bigger headwinds and put extra stress on threat property. On the flip aspect, yields and the greenback aren’t the end-all, be-all for shares, and will they transfer decrease, it may gain advantage shares and crypto.

Need to obtain these insights straight to your inbox?

Enroll right here

The setup — Merck

Merck is a reputation that’s turn out to be fascinating after we mix the basics and technicals collectively.

Particularly, the inventory is breaking out over downtrend resistance on the day by day chart and is close to an space on the weekly chart that’s usually been assist. On the elemental aspect, the inventory is buying and selling close to a historic trough after we have a look at the price-to-earnings and price-to-free-cash-flow valuations. Lastly, analysts count on Merck to generate earnings and free money movement progress in extra of 20% in 2025.

(I wrote a deep-dive on Merck earlier this week, for these ).

Above is the day by day chart, highlighting the current breakout in MRK shares. If the inventory is ready to preserve this breakout intact, extra bullish momentum may very well be on the way in which.

Nonetheless, energetic buyers who wish to preserve a good threat profile can think about using a stop-loss beneath the current low close to $94 in an try and include their losses. Keep in mind, shares can all the time hole down beneath your anticipated stop-loss.

Choices

For some buyers, choices may very well be one different to take a position on MRK. Keep in mind, the chance for choices consumers is tied to the premium paid for the choice — and shedding the premium is the total threat.

Bulls can make the most of calls or name spreads to take a position on additional upside, whereas bears can use places or put spreads to take a position on the features truly fizzling out and MRK rolling over.

For these seeking to be taught extra about choices, think about visiting the eToro Academy.

Disclaimer:

Please notice that attributable to market volatility, among the costs might have already been reached and situations performed out.