On-chain information reveals the Bitcoin change netflow has stayed at unfavorable ranges throughout the previous week, implying the whales have been accumulating.

Bitcoin Change Netflow Has Remained Beneath Zero Lately

In a brand new submit on X, the market intelligence platform IntoTheBlock has mentioned concerning the newest development within the Bitcoin Change Netflow. The “Change Netflow” right here refers to an on-chain indicator that retains monitor of the online quantity of the asset that’s coming into into or exiting out of the wallets related to centralized exchanges.

When the worth of this metric is constructive, it means the buyers are depositing a internet variety of tokens to those platforms. As one of many primary the explanation why holders would switch their cash to exchanges is for selling-related functions, this type of development can have a bearish impact on the asset.

However, the indicator being lower than zero implies the change outflows are outweighing the inflows. The buyers usually take their cash away from the custody of those platforms after they need to maintain into the long run, so such a development can show to be bullish for BTC’s value.

Now, right here is the chart shared by the analytics agency that reveals the development within the Bitcoin Change Netflow over the previous week or so:

The worth of the metric appears to have been below the zero mark in current days | Supply: IntoTheBlock on X

As displayed within the above graph, the Bitcoin Change Netflow has held a unfavorable worth over the past week, which suggests the buyers have repeatedly been withdrawing internet quantities from the exchanges.

The online outflows have apparently continued by means of the newest plunge within the asset’s value, which might imply that the whale entities are nonetheless optimistic concerning the asset. Naturally, if the development of accumulation doesn’t break within the coming days, Bitcoin may benefit from a bullish rebound.

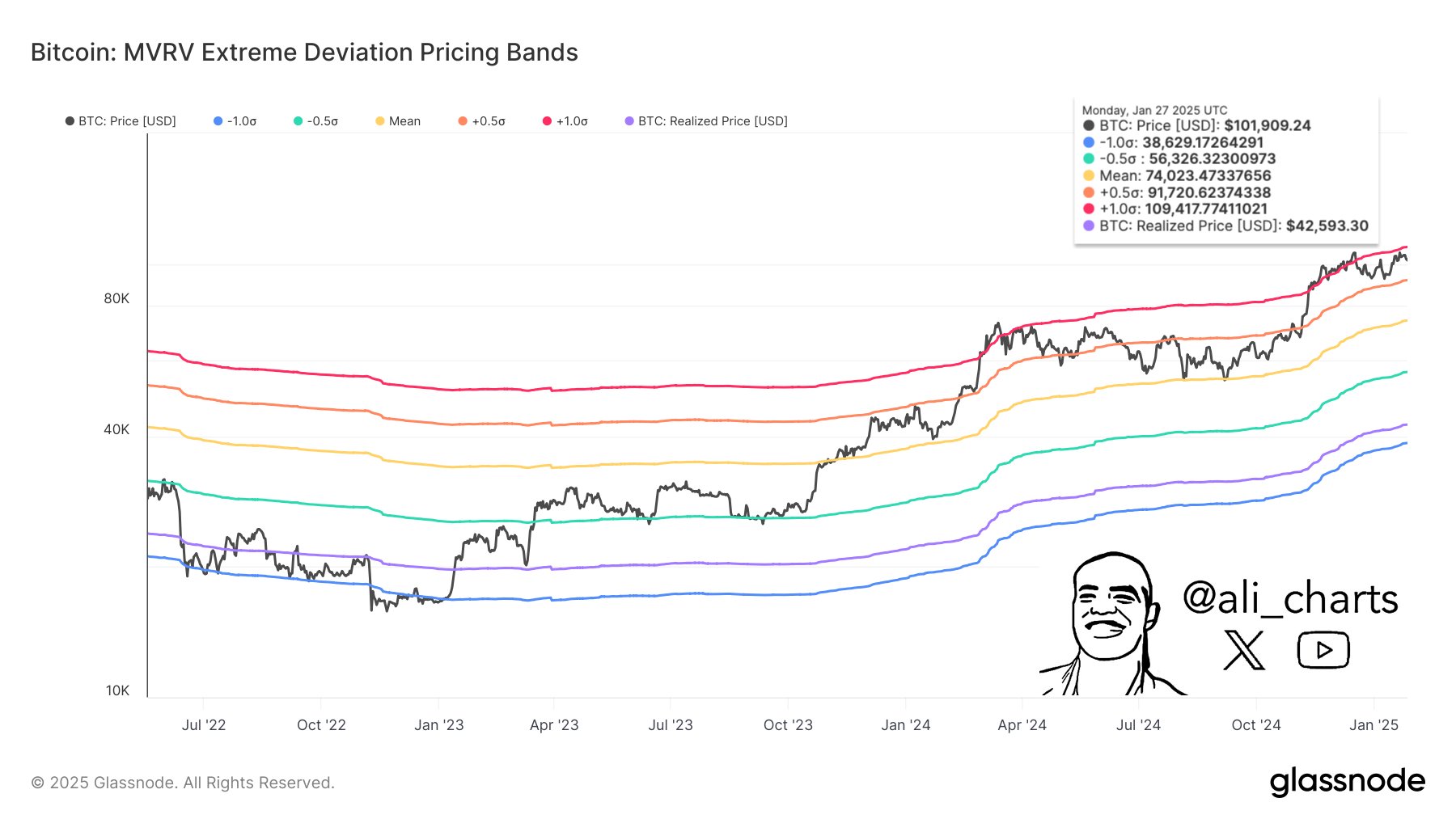

In another information, the newest correction for Bitcoin occurred following a rejection from the highest stage of the Market Worth to Realized Worth (MVRV) Excessive Deviation Pricing Bands, as analyst Ali Martinez has defined in an X submit.

The development within the numerous pricing bands of the mannequin over the previous few years | Supply: @ali_charts on X

This pricing mannequin is predicated on the favored MVRV Ratio, which mainly retains monitor of investor profitability. When holder income get too excessive, a mass selloff can change into possible, which might result in a prime within the asset. The highest pricing band of the mannequin serves as a boundary for when that is the most definitely to occur.

As Martinez notes,

Bitcoin $BTC was rejected on the higher pink pricing band at $109,400. Failing to reclaim this stage shifts focus to the following essential assist on the orange MVRV pricing band, at the moment sitting at $91,700.

BTC Worth

On the time of writing, Bitcoin is floating round $102,400, down round 2% within the final seven days.

Appears like the worth of the coin has plunged over the past couple of days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, Glassnode.com, chart from TradingView.com