Many cryptocurrency buyers at this time make funding selections with out an satisfactory understanding of the market. Regardless of the surging recognition of cryptocurrencies, a persistent fog of confusion, worry, and uncertainty nonetheless hangs over the trade.

This pervasive lack of awareness not solely impacts particular person buyers however has far-reaching results available on the market and the cryptocurrency trade as an entire.

To deal with this urgent situation, a number of platforms, akin to Crypto Literacy, have launched campaigns geared toward encouraging folks to be taught extra about digital currencies.

As a part of this initiative, Crypto Literacy performed a quiz in 2022, reaching out to 1,000 people who had been already acquainted with cryptocurrencies throughout america, Mexico, and Brazil.

Surprisingly, 91% of contributors couldn’t accurately reply greater than 60% of the quiz questions, implying that many could also be buying and selling cryptocurrencies solely for speculative functions, fueled by the attract of short-term positive factors or social media hype.

The present state of crypto funding literacy is trigger for concern, and the results are multifaceted.

Initially, it leaves buyers weak to the extremely unstable and unpredictable nature of the cryptocurrency market. And not using a stable grasp of the basics, buyers are basically playing with their hard-earned cash, risking substantial losses.

Additionally, this lack of awareness amongst buyers contributes to market instability. Wild value fluctuations pushed by uninformed selections can result in speedy and extreme market corrections, eroding belief and scaring away potential long-term buyers.

On a broader scale, the trade’s credibility is at stake. The cryptocurrency market’s progress and mainstream adoption depend upon fostering belief and confidence amongst numerous stakeholders, from retail buyers to institutional gamers. When a majority of contributors function blindly, the trade’s repute suffers.

To deal with these considerations, buyers should comprehensively perceive digital currencies earlier than making funding selections.

This text serves as a launchpad for cryptocurrency fans embarking on a journey in the direction of changing into well-versed in crypto funding literacy.

What’s Crypto Literacy?

Crypto Literacy is all about how properly buyers perceive the cryptocurrency market. It’s essential to know that the present extended market downturn won’t be the final. Folks comparatively new to crypto investing may need been stunned by how dangerous issues have gotten recently.

This demonstrates the need and worth of crypto buyers gaining funding literacy as this data will help them make higher selections during times of uncertainty.

Framework for Crypto Funding Literacy

In accordance with Bybit, there are three main milestones for typical crypto buyers. These embody:

Selecting a crypto challenge.

Selecting a supplier.

Managing their crypto portfolios.

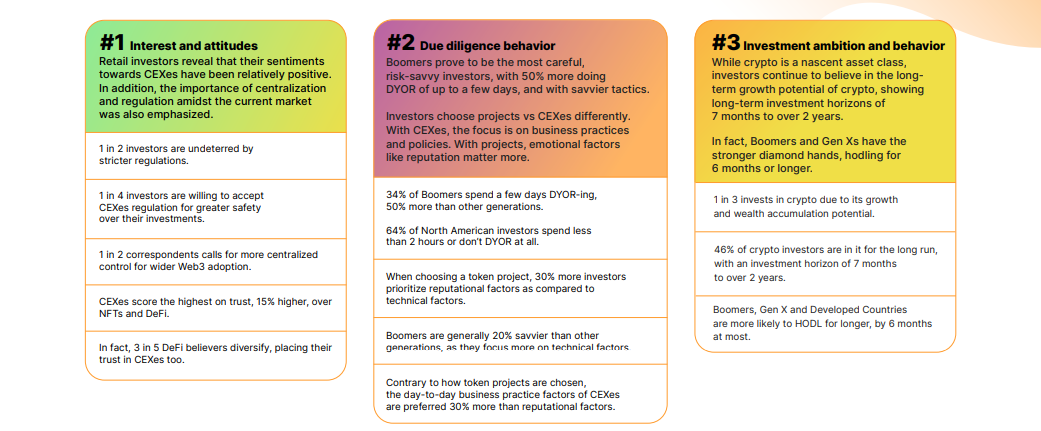

Bybit developed a framework (illustrated beneath) to elucidate why every of those milestones issues and what we will be taught to change into higher at investing in cryptocurrencies.

Crypto Funding Literacy Framework

Investing within the crypto market requires meticulous analysis because of the large variety of current cryptocurrency tasks and their related cash or tokens.

A Crypto Funding Literacy report by Bybit and Toluna emphasizes the excellence between researching crypto property and conventional investments. This report collected information from 10,500 people throughout 19 totally different markets, together with 1,748 who recognized as “crypto buyers.” Its main goal was to evaluate folks’s understanding of cryptocurrencies and their analysis practices earlier than investing.

The report revealed {that a} important variety of Individuals entered the cryptocurrency market with out conducting satisfactory analysis. Particularly, 64% of North Individuals spent lower than two hours analyzing a cryptocurrency challenge earlier than investing.

Some buyers thought-about components such because the repute of the people behind a challenge, whereas others centered on technical particulars, together with the performance of a cryptocurrency and its supposed use.

One factor to bear in mind is that simply because a cryptocurrency appears credible doesn’t imply it’s a superb funding asset.

For instance, let’s take a look at the FTX alternate and its FTT token. The FTT token was designed to enhance the utility of the FTX alternate. Utilizing the token, customers may earn free rebates and particular reductions on their buying and selling charges. They might additionally stake FTT to obtain excessive referral bonuses.

FTT’s worth was solely hinged on the FTX’s fortunes because it lacked utility extending past its native ecosystem and was borderline ineffective exterior the alternate. For literate buyers, this could’ve been sufficient warning to not over-invest in a centrally managed token with an evident threat of a “single level of failure.”

Unsurprisingly, most individuals who invested closely within the token suffered important losses after the alternate encountered severe points, finally resulting in its chapter in 2022. This state of affairs underscores the significance of conducting thorough analysis earlier than making any funding.

Completely different age teams exhibit various ranges of threat tolerance. Older buyers, usually known as ‘boomers,’ are likely to strategy investments extra cautiously. They prioritize technical evaluation earlier than making a choice. On common, they’ve about 20% extra data on this space. Additionally, round 34% of boomers spend a number of days researching their investments.

Advantages of Cryptocurrency Funding Literacy

The next are a number of the advantages of crypto funding literacy:

Higher Understanding of the Market

Funding literacy helps you grasp how the cryptocurrency market works. It permits you to acknowledge market tendencies and make knowledgeable selections about shopping for or promoting cryptocurrencies.

Diminished Danger of Fraud

Funding literacy equips you with the power to establish potential fraud inside the cryptocurrency market. It is possible for you to to acknowledge warning indicators and avoid scammers.

Improved Danger Administration

Funding literacy will help you make a plan for managing dangers if you put money into cryptocurrencies. Having the ability to successfully handle your dangers will prevent from big losses.

Elevated Returns on Funding

With satisfactory funding literacy, you possibly can establish worthwhile funding alternatives within the crypto market. This allows you to assess the market and make prudent judgments that may enhance your returns.

Smarter Portfolio Administration

Funding literacy helps you effectively handle your crypto portfolio. You possibly can diversify your investments and make well-calculated selections to enhance the general efficiency of your portfolio.

Enhance Your Crypto Funding Literacy

Perceive Why You Are Investing in Crypto

Earlier than you begin investing in cryptocurrencies, it’s important to know why you need to do it. Remember the fact that there are various funding choices, a few of that are safer than cryptocurrencies.

Do you need to put money into cryptocurrencies simply because they’re fashionable, or do you’ve a selected motive for selecting a specific token?

Folks put money into cryptocurrencies for numerous causes, so it’s essential to outline your targets.

Perceive How Crypto Works

Earlier than you dive into cryptocurrency investments:

Be sure you perceive the fundamentals of how the crypto world operates.

Take a while to familiarize your self with cryptocurrencies past the well-known ones like Bitcoin and Ether.

Attempt to grasp the idea of blockchain expertise, even should you don’t have a pc science or coding background.

In case you’ve determined to put money into a selected cryptocurrency, discover out about its sensible use circumstances and what units it aside from the competitors. The extra you understand about cryptocurrencies and blockchain expertise, the higher outfitted you’ll be to guage funding alternatives.

Develop an Funding Technique

Create a method that aligns together with your experience, whether or not long-term, short-term, or market-neutral. In case you’re new to cryptocurrency investing, it’s advisable to keep away from shorting steadily. You should utilize numerous instruments like futures, spot contracts, choices, and perpetual contracts to handle threat or improve potential returns.

Be a part of an On-line Crypto Neighborhood

Because the cryptocurrency trade evolves quickly, staying knowledgeable is essential. One motive for the trade’s progress is the energetic neighborhood of fans and buyers who share data and insights. Contemplate becoming a member of on-line communities akin to X, CoinMarketCap Neighborhood, Fb, and many others., to remain up to date on what’s occurring on the planet of cryptocurrencies.

Select a Buying and selling Platform

There are numerous methods to commerce cryptocurrencies, however remember that utilizing DeFi (Decentralized Finance) platforms might require extra experience. Most centralized exchanges supply a variety of choices, together with futures, spot contracts, and structured merchandise. When depositing your funds, make sure that to verify the alternate’s Proof-of-Reserves to make certain your funds are adequately backed up.

Learn Crypto Whitepapers

Don’t rely solely on phrase of mouth when assessing a cryptocurrency. Take the time to learn the whitepaper related to a challenge earlier than investing. Each cryptocurrency challenge ought to have a whitepaper, and its absence ought to elevate a purple flag.

A whitepaper is a precious useful resource for understanding the challenge’s targets. It sometimes features a timeline, a complete overview, and particular challenge particulars. If a whitepaper appears incomplete or deceptive, it may point out underlying issues with the challenge.

In Conclusion

Studying the way to put money into cryptocurrencies is a lifelong journey that calls for dedication, data, and the willingness to take calculated dangers. You possibly can change into a extra knowledgeable and profitable crypto investor by making use of the data and abilities acquired all through this course of.

To develop crypto funding literacy, begin with small investments and keep up to date on the most recent information, tendencies, and laws within the crypto market. This may improve your possibilities of making worthwhile investments.

You will need to notice that crypto funding isn’t a get-rich-quick scheme. To succeed, you want perseverance, diligence, and self-control. Perceive the dangers concerned, make investments solely what you possibly can afford to lose, and also you’ll be heading in the right direction.

Disclaimer: This text is meant solely for informational functions solely and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. At all times conduct due diligence.

If you need to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, and Instagram, and CoinMarketCap Neighborhood.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

.png#keepProtocol)