Public sale home Sotheby’s has issued a response to the allegations made in opposition to it by BAYC buyers. The lawsuit dismisses them as ‘opportunistic and missing benefit‘. The lawsuit entails a category motion go well with in opposition to Yuga Labs, the creators of Bored Ape Yacht Membership (BAYC), the place Sotheby’s was named as a defendant. Let’s take a better take a look at the allegations and response.

TL;DR:

Sotheby’s responds to Bored Ape investor lawsuit, labeling allegations as opportunistic and meritless.

Lawsuit entails Yuga Labs, creators of Bored Ape Yacht Membership (BAYC), and claims collaboration to deceive NFT buyers.

NFT market faces challenges resulting from macroeconomic elements and “crypto winter,” impacting Bored Apes assortment amongst others.

BAYC Vs Sotheby’s: A Lawsuit Too Little Too Late?

The buyers who personal BAYC artwork declare that Sotheby’s and Yuga Labs collaborated to deceptively promote digital artwork of their NFT assortment. The lawsuit first emerged in December 2022. That’s over a 12 months after Sotheby’s auctioned 101 NFTs from the Bored Ape assortment. This public sale generated $24 million. Now, the plaintiffs argue that this public sale lent legitimacy to future misrepresentations by the defendants.

Sotheby’s has acknowledged that it’s going to vigorously defend itself in opposition to the baseless allegations, whereas Yuga Labs echoed this sentiment, calling the criticism opportunistic and missing factual foundation. Yuga Labs has additionally confronted authorized points concerning BAYC pictures utilized by a developer that implied a partnership.

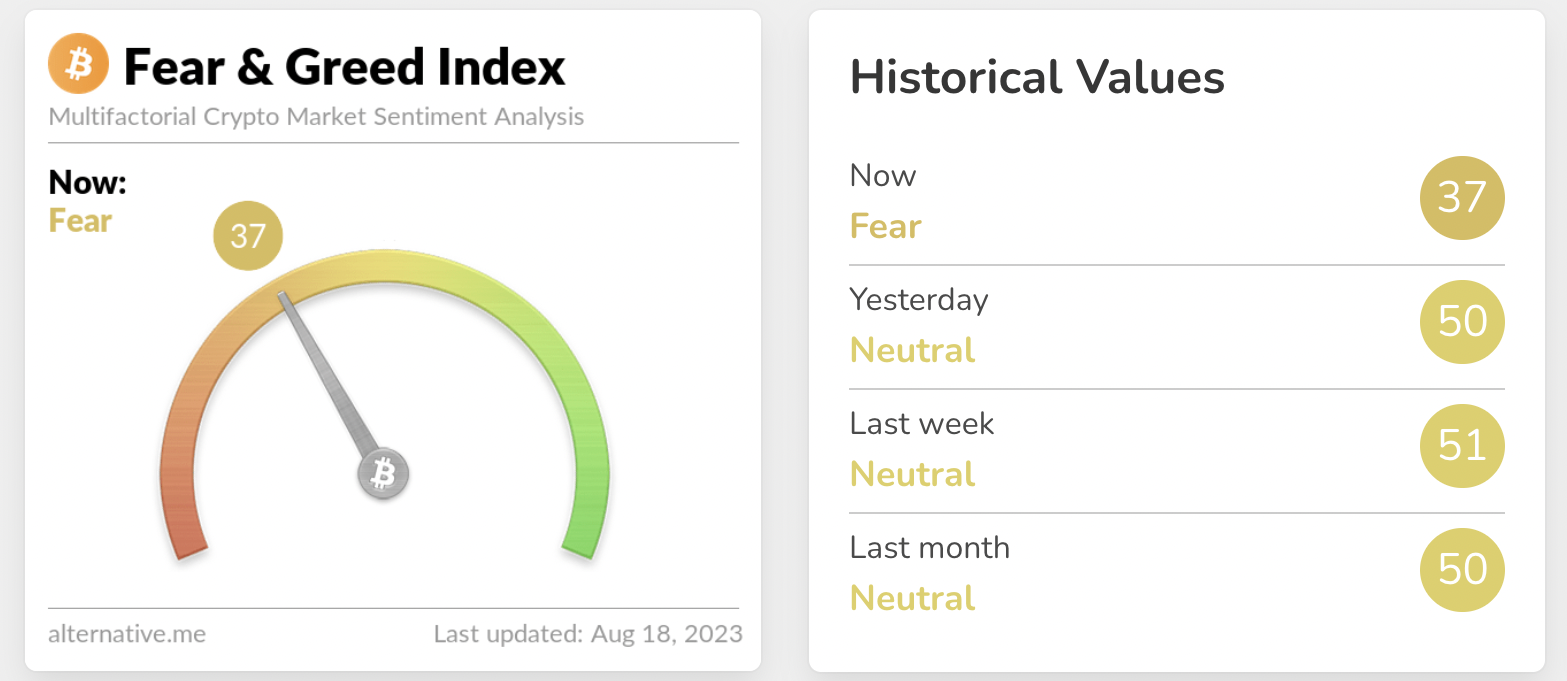

The NFT market, which had flourished in 2021 resulting from excessive cryptocurrency costs, skilled a downturn in 2022 alongside the falling crypto costs and rising rates of interest by central banks. This macroeconomic scenario, together with the so-called “crypto winter,” affected NFT gross sales, resulting in a decline available in the market.

The Bored Apes assortment can also be hit by the market’s challenges. Its token’s worth reportedly dropped over 93% from its peak in April 2022. Regardless of these setbacks, trade consultants like Devin Finzer, CEO of OpenSea, warning that the intersection of macroeconomic elements and the crypto winter might delay the present market downturn.

All funding/monetary opinions expressed by NFTevening.com are usually not suggestions.

This text is academic materials.

As at all times, make your individual analysis prior to creating any type of funding.