In latest days, we’ve taken a peek into the portfolios of the world’s most profitable traders. Every quarter, establishments managing greater than $100 million “present their hand” by means of a type 13-F, which paperwork what they purchased and bought up to now three months.

These reviews present perception into their considering and present the place the so-called “sensible cash” is transferring. However they don’t function a step-by-step, extra like a compass that helps skilled traders spot tendencies, determine alternatives and rethink their methods.

Warren Buffet is Including to the Money Pile

“The Oracle of Omaha” Warren Buffett wants no introduction. As a worth investor, he seeks out essentially sturdy corporations with a aggressive benefit which can be buying and selling under their intrinsic worth. Buffett is known for his long-term holdings of shares, which confirms his perception in proudly owning high quality corporations. He has held American Specific inventory since 1984, Coca-Cola since 1988, and Moody’s since 2000.

His most important transfer in recent times has been constructing an enormous place in Apple, which has develop into Berkshire’s largest holding. In latest quarters, nonetheless, Buffett has begun to promote Apple, stoking fears of slowing innovation and development. When Buffett strikes, traders observe.

Warren Buffet Prime 10 Holdings (dataroma.com)

In This fall, Buffett decreased his holdings in monetary shares. He decreased Financial institution of America, considered one of his largest holdings, and reduce his stake in Capital One Monetary and Citigroup. Nonetheless, he saved American Specific, which makes up 16.8% of Berkshire’s portfolio.

By way of purchases, Buffett continued to snap up his favourite, Occidental Petroleum. Exterior of the power sector, Buffett shocked with investments in shopper shares. He almost doubled his stake in Domino’s Pizza and elevated his stake in Pool Corp. by 50%. New additions to Berkshire’s portfolio additionally embrace Constellation Manufacturers, the large behind manufacturers like Corona, Modelo and different in style drinks.

What’s attention-grabbing currently, nonetheless, isn’t what Buffett is shopping for, however reasonably that he’s not shopping for. Berkshire Hathaway’s money reserve has grown to a report $325.2 billion!

Take a look at Warren Buffett’s portfolio on eToro!

David Tepper Doubles Down on Chinese language AI

Tepper is the billionaire founding father of Appaloosa Administration, a hedge fund identified for its aggressive funding fashion. His technique combines deep elementary evaluation with a macroeconomic method. He usually makes daring bets on sectors or corporations that different traders keep away from. This makes him one of the crucial revered traders on Wall Avenue.

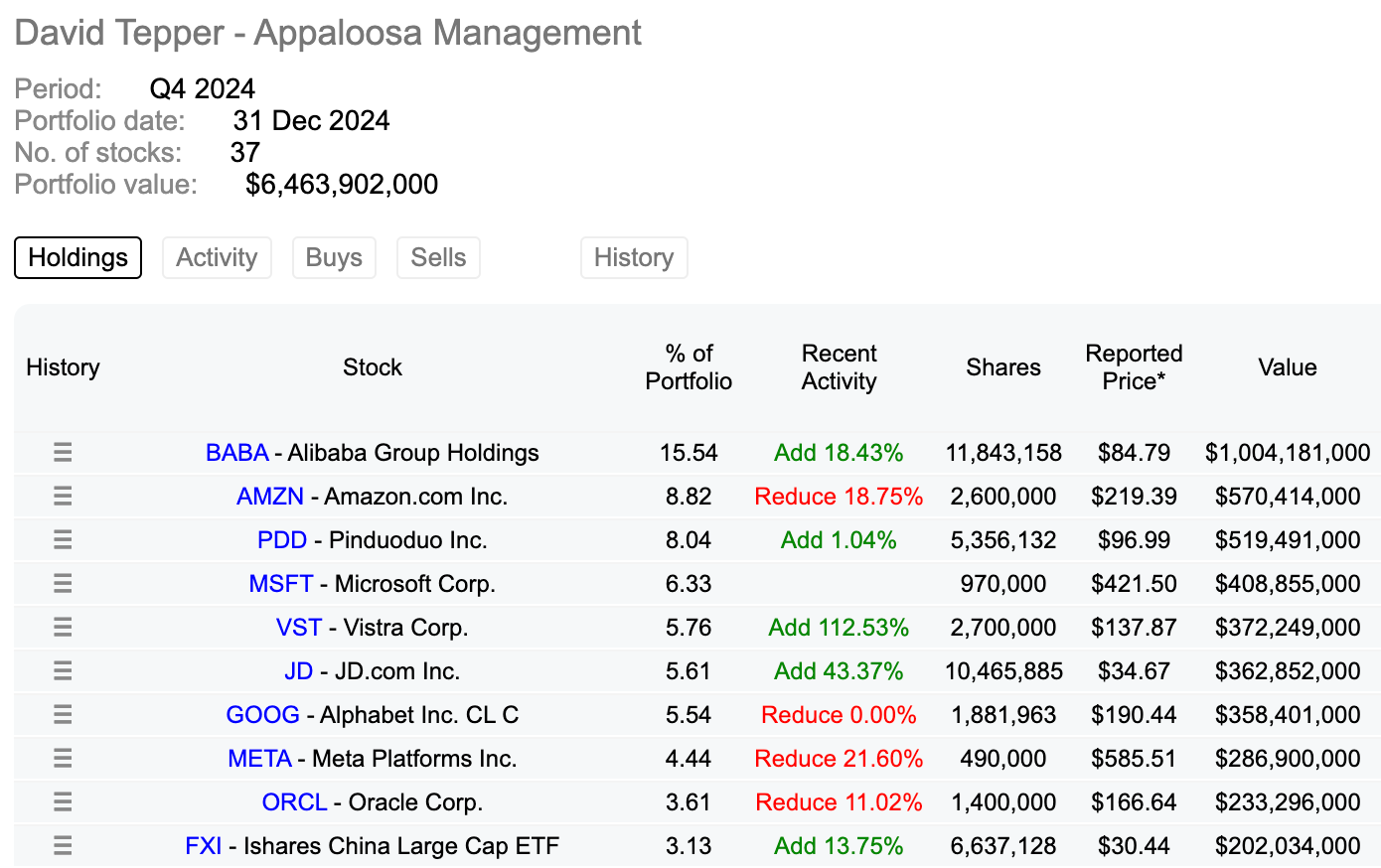

David Tepper Prime 10 Holdings (dataroma.com)

David Tepper may be very bullish on AI-and his portfolio proves it. 9 of his prime ten positions are associated to the AI revolution. In This fall, Tepper elevated his place in Vistra, a significant power provider in Texas, which has develop into a key space for knowledge heart building.

He’s betting massive on China – the place Alibaba is his greatest place. He upped it by 18%, pushing it previous the $1 billion mark. Alibaba is investing closely in AI and just lately introduced that its newest mannequin, Qwen2.5-Max, can outperform each GPT-4o and DeepSeek-V3-a daring declare that underscores its ambitions within the AI race.

Tepper additionally doubled his stake in ASML, the Dutch chipmaking business big. He additionally considerably elevated his investments in NRG Power and Develop Power, additional bolstering his bullish wager on power infrastructure for AI growth.

Then again, Tepper partially decreased stakes in Amazon and Meta, however added to Nvidia. Does this imply the potential of the “Magnificent 7” is altering?

Tepper’s latest offers present a robust concentrate on AI, power and China, suggesting he sees a giant alternative within the AI revolution.

Ray Dalio’s Bets on Broad Development

Ray Dalio is the founding father of Bridgewater Associates, one of many largest hedge funds on the earth. He employs a macro-focused, risk-balanced technique. He’s a giant believer in diversification and his views on international financial tendencies are extremely revered.

Ray Dalio Prime 10 Holdings (gurufocus.com)

Though he owns greater than 800 totally different shares in his portfolio, he has made some attention-grabbing modifications.One of the notable bets this quarter is power. Dalio doubled his positions in Vistra and Constellation Power, seemingly shopping for the dip attributable to DeepSeek.

On the identical time, he trimmed his investments within the “Magnificent Seven”-reducing his stakes in Google, Meta, Amazon, and Microsoft by about 20%.

Conversely, he doubled his holdings in PayPal and Salesforce and massively elevated his funding in AT&T by 400%- is he seeing hidden worth within the telecom? Past that, he wager on the tobacco sector. He elevated his stake in Altria by 85% and in British American Tobacco by as a lot as 260%.

Dalio’s trades verify the narrative that power corporations could be the hidden winners of the AI revolution. His discount of the “Magnificent Seven” can be attention-grabbing.

Learn my evaluation of Vistra!

Michael Burry Exits Chinese language Bets

Michael Burry, finest identified for “The Massive Quick”, gained worldwide consideration by predicting and benefiting from the 2008 actual property crash. Burry is a elementary investor specializing in undervalued and ignored belongings. His trades appeal to appreciable consideration due to his unconventional view of the market.

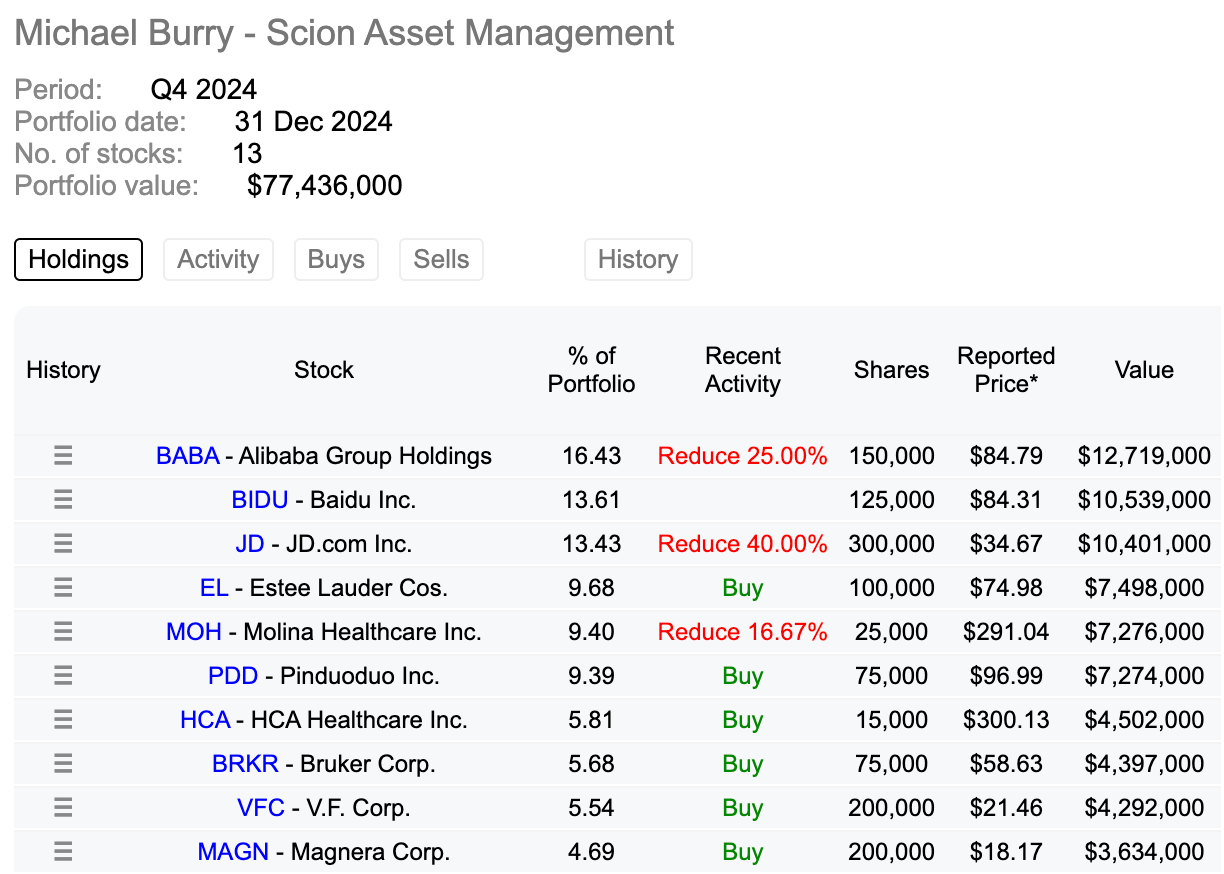

Michael Burry Prime 10 Holdings (dataroma.com)

Burry is thought for its fast portfolio changes-and This fall was no exception. This time he considerably decreased his publicity to Chinese language shares Alibaba and JD, signaling a transfer away from corporations he beforehand trusted.

Burry is thought for his rapid-fire portfolio modifications—and This fall was no exception. This time, he massively decreased his publicity to Alibaba and JD, signaling a shift away from corporations he had beforehand wager on.

As an alternative, he wager on Estée Lauder, China’s Pinduoduo, and HCA Healthcare. Burry’s trades are sometimes short-term, tactical bets aimed toward making the most of market anomalies, reasonably than long-term investments. Given his monitor report of recognizing mispriced belongings—just like the notorious housing bubble brief—his strikes usually catch traders’ consideration.

Invoice Ackmann Suprised Markets With Aggressive Bets

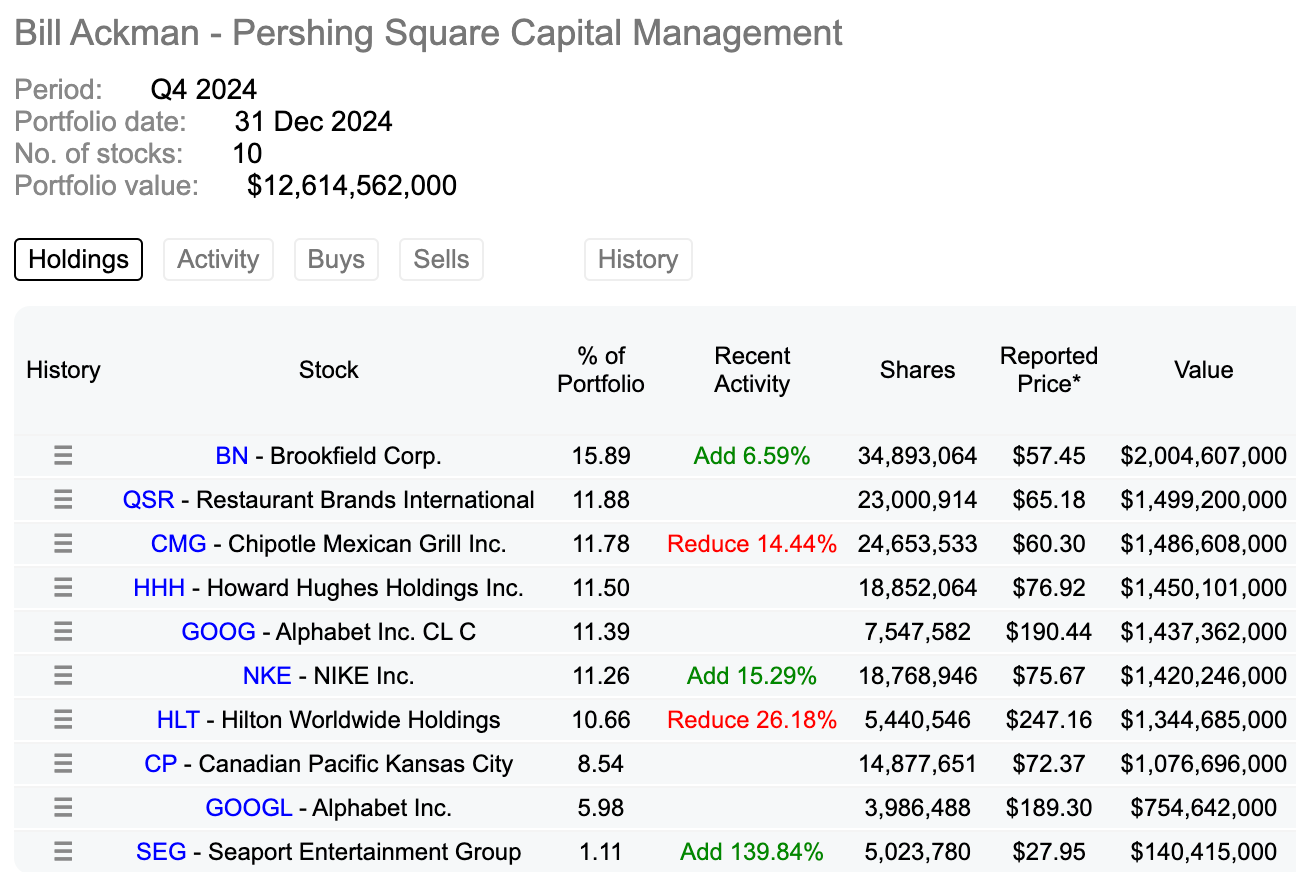

Invoice Ackman is an activist investor, that means he doesn’t simply purchase shares, he buys affect. His technique usually entails taking giant positions in corporations and pushing for modifications to enhance shareholder worth.

Invoice Ackman Prime 10 Holdings (dataroma.com)

In This fall, Ackman made some notable strikes, including to his stakes in BN, Nike, and Seaport whereas persevering with to trim his positions in Hilton and Chipotle—each of which have been large winners for him over time.

However the greatest headline? An enormous $2.3 billion stake in Uber. Ackman is bullish on the ride-hailing and supply big, calling it “one of many best-managed and highest-quality companies on the earth.” He believes Uber is buying and selling at an enormous low cost to its intrinsic worth.

Nvidia Is Altering Course

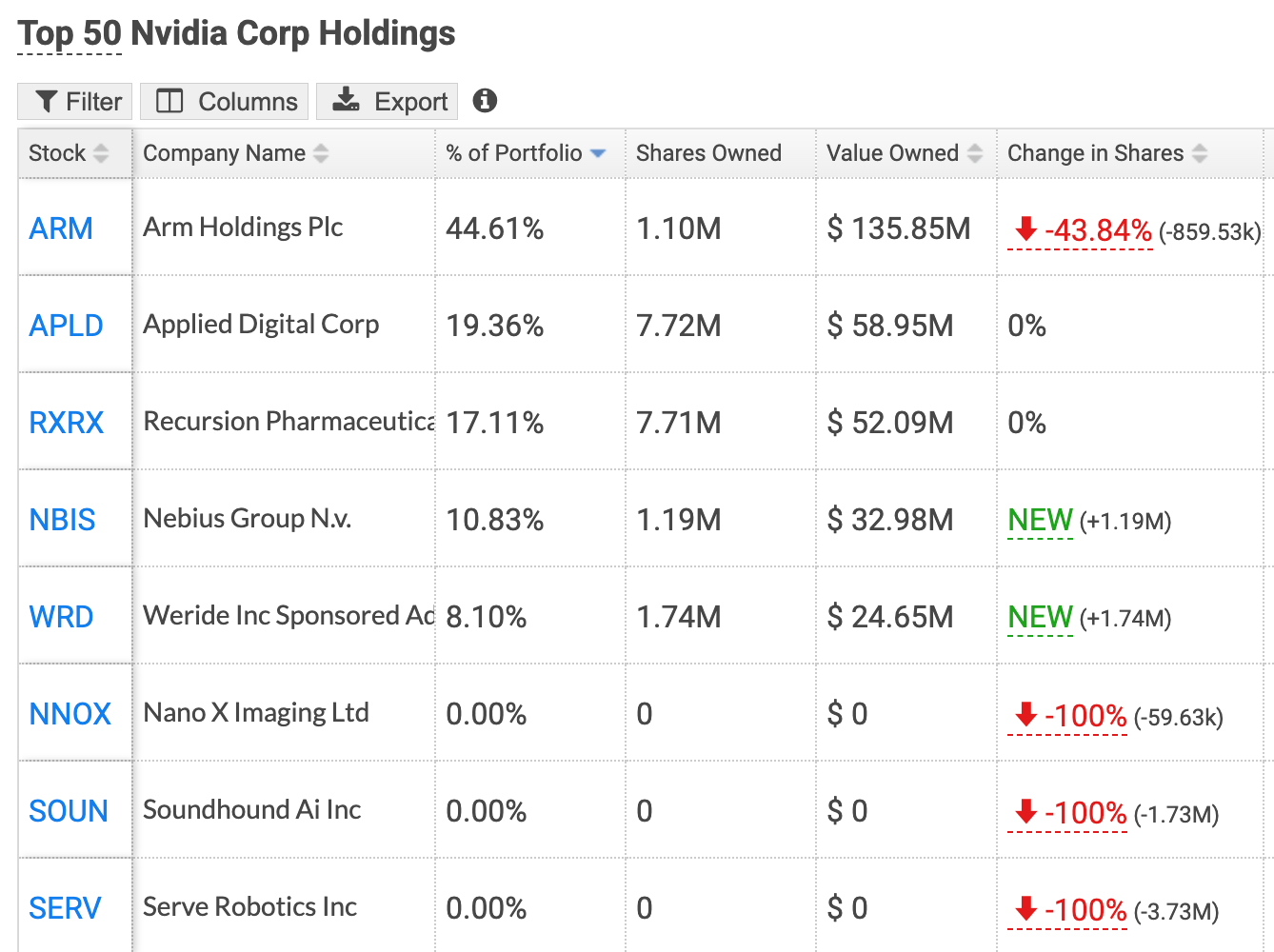

Sure, you learn that proper—Nvidia isn’t simply promoting chips, but additionally actively investing. It’s strategically investing in small corporations, particularly within the AI house. And when Nvidia modifications course, the market takes discover – usually in a giant approach.

Nvidia Prime 10 Holdings (hedgefollow.com)

In This fall, Nvidia slashed its stakes in 4 AI corporations:

ARM (-3% after the discharge)

SoundHound (-30% after the relese)

Nano-X (-12% after the relese)

Serve Robotics (-43% after the relese)

Every of those shares took a success after the information broke, however it’s price noting that they’d already skilled large rallies over the previous yr—SoundHound, for instance, had surged by lots of of %. Whether or not Nvidia is shedding curiosity of their enterprise fashions or just locking in income, the cuts sign a shift in its focus. So the place is Nvidia transferring its cash now? Self-driving know-how. The chip big made contemporary investments in:

Nebius Group, an AI infrastructure firm

WeRide, a Chinese language self-driving tech startup

With autonomous automobiles anticipated to be a $2 trillion business by the top of the last decade, Nvidia appears to be positioning itself on the heart of this transformation. Whereas the corporate’s core enterprise stays in AI {hardware}, its funding strikes counsel a long-term wager on AI-driven mobility and transportation.

You understand what they are saying—”cash by no means sleeps,” and neither do these prime traders. With market tides shifting quickly in latest weeks, it’s extra essential than ever to guage your holdings and spot alternatives—or dangers—earlier than they unfold.

Whereas 13-F filings should not a step-by-step information, they provide a roadmap for the place a few of the sharpest minds in investing see worth. Whether or not it’s Buffett hoarding money, Tepper doubling down on AI, or Ackman making a daring transfer into Uber, these filings can present a place to begin on your analysis.

In spite of everything, if the neatest cash within the sport is transferring, shouldn’t we be paying consideration?

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding aims or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.