The crypto market witnessed a tumultuous 24 hours between Oct. 1 and a pair of, seeing a large liquidation spike. Round 85% of those liquidations have been brief positions, translating to $97.73 million in shorts liquidated in only a day. This fast motion affected 29,510 merchants, bringing the entire liquidation worth to $114.92 million. Probably the most important single liquidation order was noticed on Huobi with the BTC-USDT pair, valued at $8.39 million.

Main exchanges like OKX, Binance, and Huobi have been on the epicenter of those liquidations. They recorded liquidation values of $36.21M, $33.20M, and $27.79M, respectively. CoinEx, primarily, skilled a notable 97.94% of its liquidations in brief positions. In distinction, different exchanges oscillated between 72% and 96% in brief liquidations.

Exchanges

Liquidations

Lengthy

Brief

Fee (General)

Fee (Brief)

All

$114.56M

$17.05M

$97.51M

100%

85.12%

OKX

$36.21M

$6.52M

$29.68M

31.61%

81.99%

Binance

$33.20M

$6.10M

$27.11M

28.98%

81.64%

Huobi

$27.79M

$1.04M

$26.75M

24.26%

96.26%

Bybit

$10.94M

$2.98M

$7.96M

9.55%

72.79%

CoinEx

$4.88M

$100.37K

$4.78M

4.26%

97.94%

Bitmex

$593.91K

$100.82K

$493.10K

0.52%

83.02%

Bitfinex

$581.34K

$146.79K

$434.56K

0.51%

74.75%

Deribit

$367.16K

$68.72K

$298.43K

0.32%

81.28%

Zooming into particular person cryptocurrencies, Bitcoin was on the forefront of the liquidation charts. Inside a mere 4-hour window, Bitcoin noticed lengthy liquidations amounting to $381.54K and brief liquidations reaching a major $1.87M. Ethereum wasn’t far behind, with its 24-hour shorts touching a excessive of $4.12M.

Liquidations confer with the obligatory closure of a dealer’s place when market situations transfer towards their hypothesis, eroding the collateral they’ve posted. When buying and selling any asset, together with cryptocurrencies, merchants can undertake two major stances: ‘lengthy’ or ‘brief.’ In a protracted place, merchants are primarily betting on an upward trajectory of an asset’s value. Conversely, a brief place is taken with the expectation that the asset’s value will decline.

The mechanics of liquidation come into play when the market’s precise motion contradicts a dealer’s place. For example, if the market value rises when a dealer has a brief place or drops after they’re lengthy, the place is liquidated to forestall additional losses. This ensures the dealer’s losses don’t exceed their preliminary margin or collateral. The dominance of brief liquidations prior to now 24 hours signifies that many merchants had wager on Bitcoin’s value descending, solely to be stunned by its climb to $28,000.

The surge in Bitcoin’s value might be attributed to a number of components. After consolidating underneath $27,000 for over a month, Bitcoin broke the interim resistance, aiming for the $28,000 mark. The elevated volatility and historic knowledge suggesting bullish developments for Bitcoin in October and November have fueled optimism. The continuing volatility is predicted to stay elevated, probably growing the value.

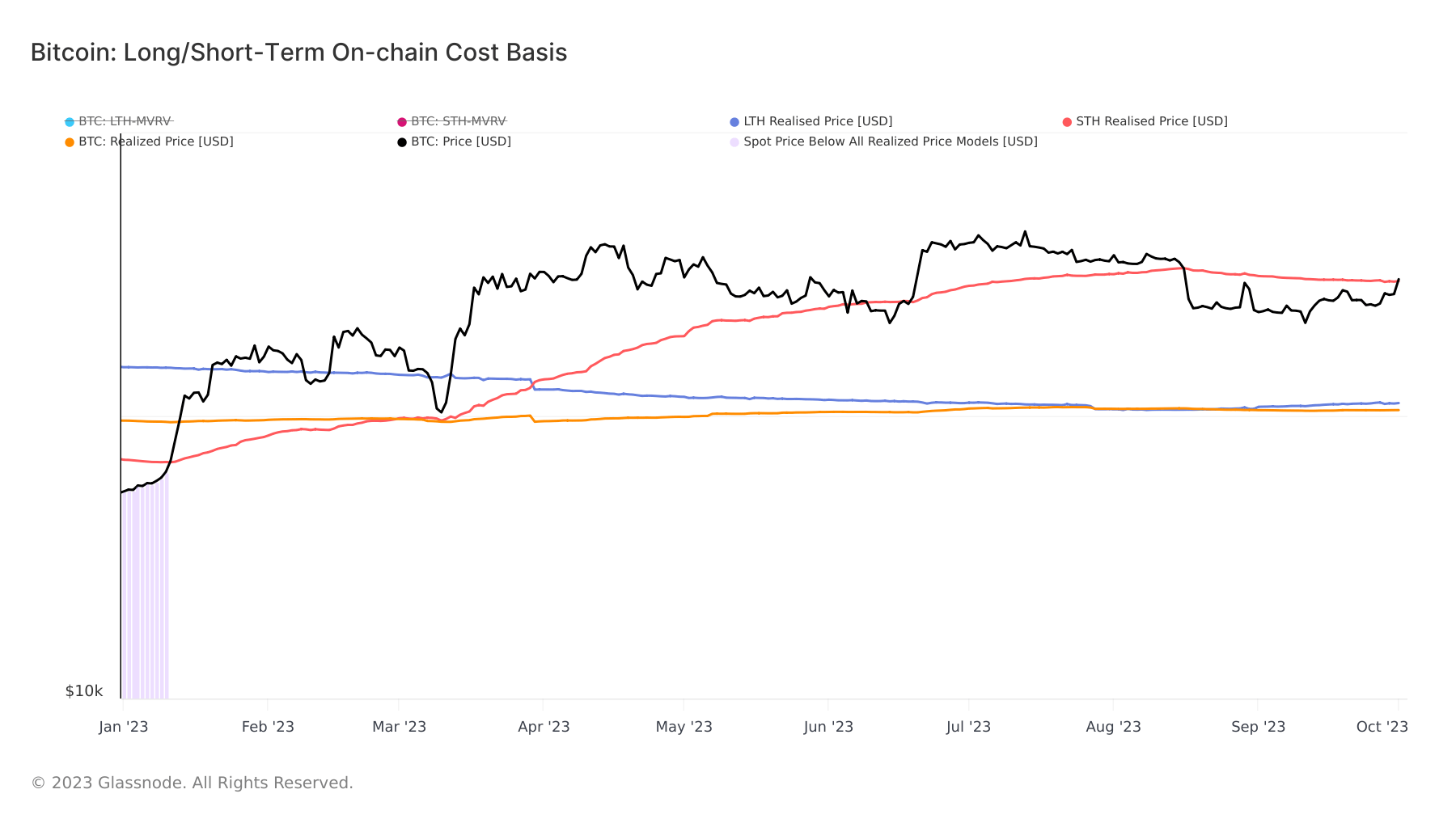

One other essential metric on this narrative is the realized value. Bitcoin has now surpassed the realized value for short-term holders, which was pegged at $27,850 on Oct. 1. When Bitcoin’s value exceeds the short-term holder value foundation, the chance of those holders promoting their property to appreciate income escalates.

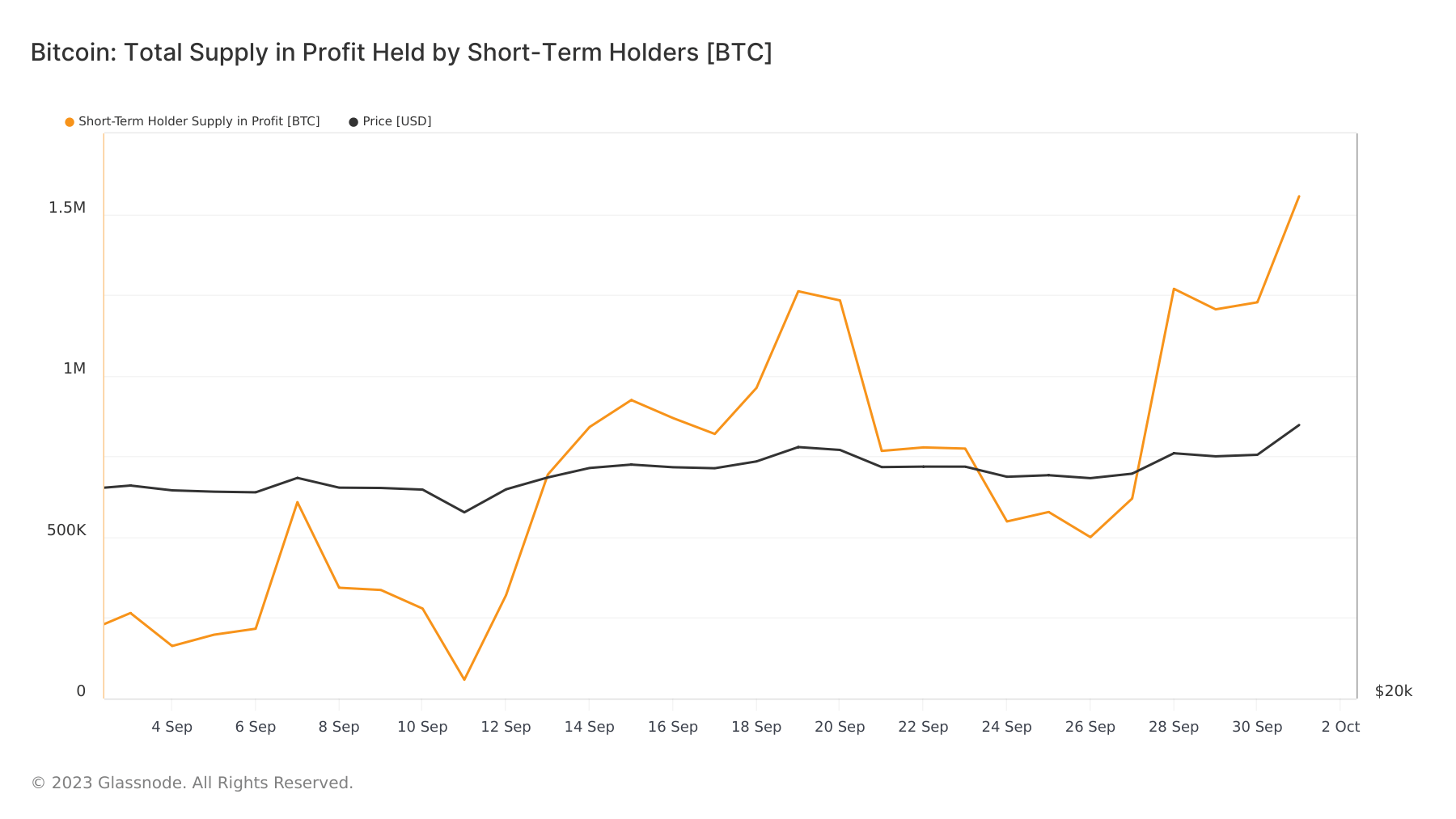

Knowledge from Glassnode reinforces this, exhibiting that the short-term holder provide in revenue surged between Oct. 30 and Oct. 1, with roughly 331,450 BTC held by long-term holders at the moment in revenue.

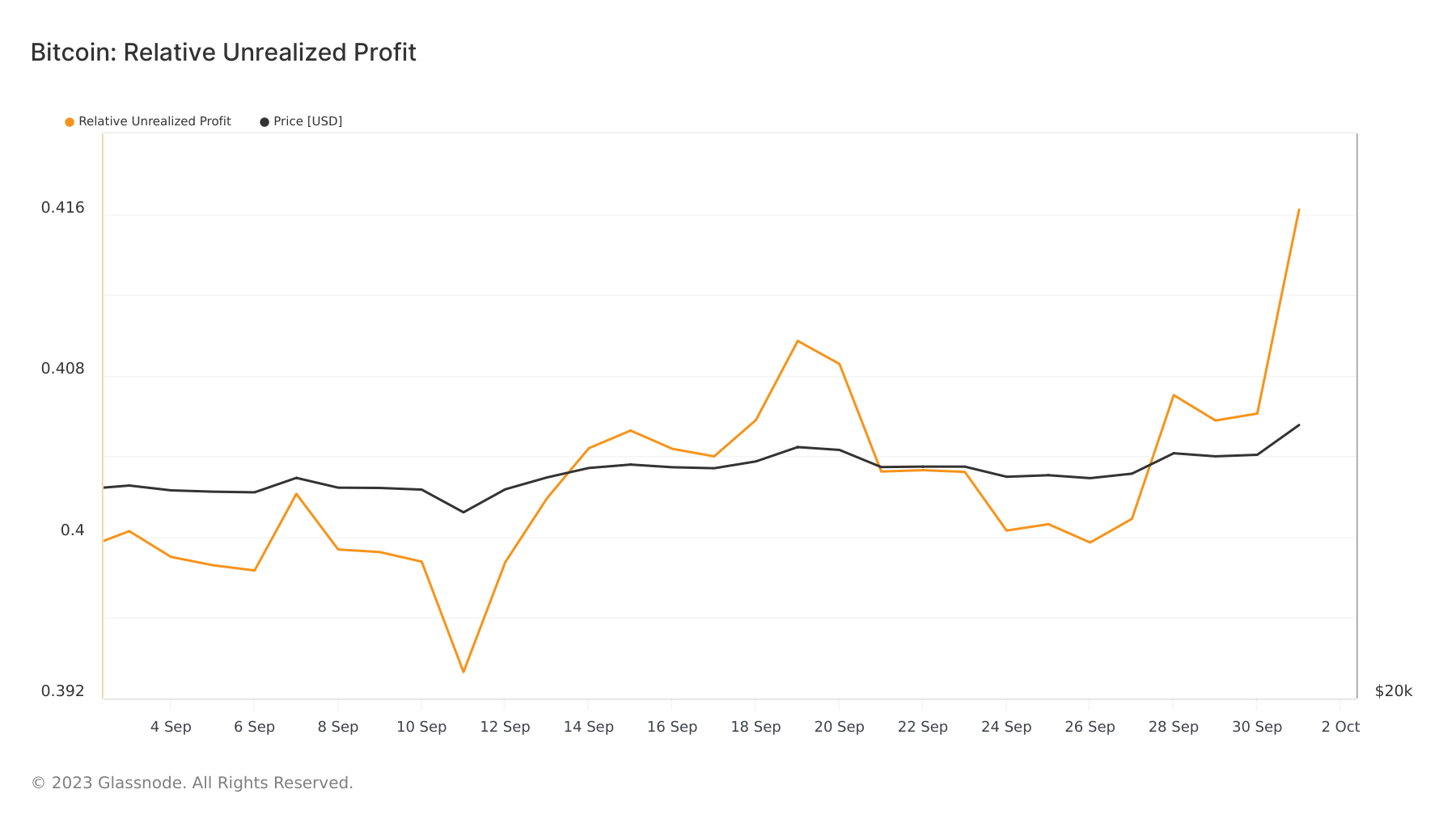

The latest liquidations and Bitcoin’s value motion recommend a bullish momentum. The market is witnessing a shift in sentiment, with merchants changing into more and more optimistic. Nevertheless, it’s essential to notice {that a} rise in unrealized income seen out there creates a barrier to Bitcoin’s additional development. With an growing variety of market members now sitting on unrealized good points, expectations of additional volatility may push them to promote their positions, pushing costs down.

The submit Bitcoin’s surge to $28K results in $114M in liquidations in 24 hours appeared first on CryptoSlate.