The crypto sell-off continues, and prime altcoins, together with Bitcoin, Ethereum, and Solana, are feeling the warmth. SOL holders are already exiting, cashing out, and fueling the sell-off towards the $100 psychological stage.

Amid this growth and fast-fading optimism, it’s rising {that a} giant portion of transactions on Solana—which is among the many cash analysts say will explode in 2025—may, in spite of everything, be bot-driven.

Are Most Solana Transactions Pretend?

In a put up shared on X, one observer famous that onchain exercise on Solana is probably not as natural because it appears and will be pushed by aggressive bots.

This commentary, in flip, raises questions concerning the authenticity of onchain exercise on the favored sensible contract community and its doable impression on community well being.

In his findings, the analyst notes that 122 distinctive addresses had been accountable for posting at the very least 100,000 each day transactions previously week alone. In comparison with different addresses, these few accounts contribute a staggering 44.2% of all transactions on the trendy chain.

(Supply)

That only some addresses are accountable for practically half of all transactions on an in any other case busy community is suspicious and will recommend doable manipulation makes an attempt. Normally, the exercise and well being of any public ledger are judged by the variety of addresses and transactions posted.

When there are extra transactions, validators operating to safe the platform receives a commission and, thus, make investments much more to boost safety and sustain with rising demand. Nevertheless, if transactions start falling, customers could search alternate options, which, in flip, could negatively impression costs.

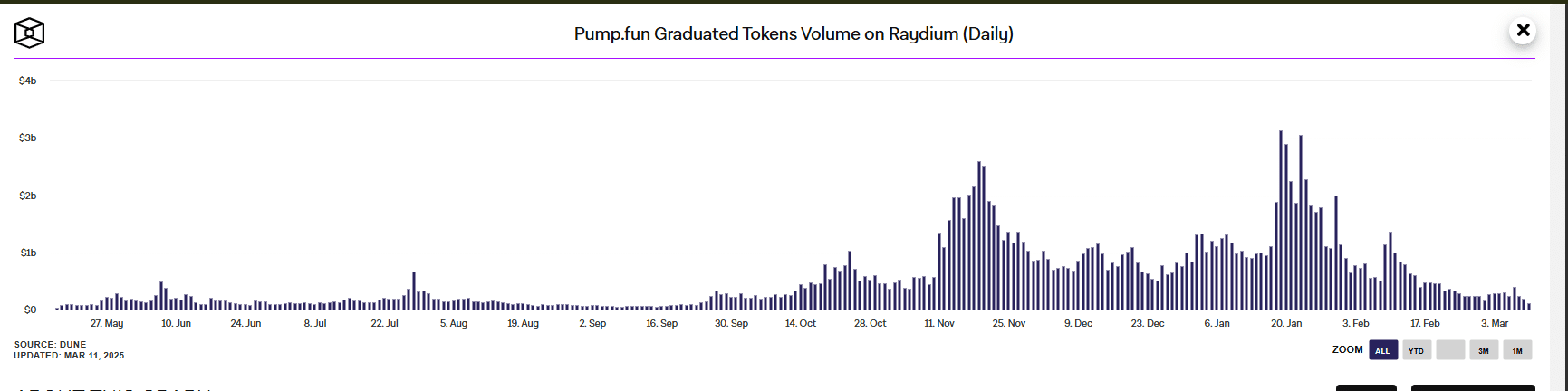

Falling Meme Coin Exercise Dents SOL Costs

7d

30d

1y

All Time

Buying and selling exercise and quantity are subdued, following SOL costs and meme coin exercise. At its peak, Solana posted a whole lot of hundreds, if not thousands and thousands, of each day transactions as merchants scrambled to pick the following PNUT or a number of the greatest meme cash to commerce.

Throughout this time, it was regular for speculators to strike massive, making 100X returns and churning thousands and thousands from their small investments. This is now altering as fewer meme cash are launched, and speculators tighten their purses, anticipating extra losses and a drop in exercise as crypto costs droop.

Excessive-profile scams and rug pulls, in some cases promoted by world leaders, have eroded belief in Solana and its standard meme coin launchpad, Pump.enjoyable.

(Supply)

The scalable nature of Solana and the power to put up transactions cheaply permit bots to deploy and manipulate the true stage of onchain engagement.

Not like Ethereum, customers can switch cash or put up contracts on-chain whereas paying solely a fraction of the charges. Whereas this will increase exercise, it’s a double-edged sword, as it could flip the chain right into a hub for bots, bloating the community and manipulating buying and selling volumes by way of wash buying and selling, for instance.

Most of those bots are used for high-frequency buying and selling, exploiting arbitrage alternatives, and even sniping a number of the greatest meme cash to purchase in 2025.

[/key_takeaways_list]

Solana is a well-liked chain powering meme cash

Are bots accountable for most transactions onchain?

Meme exercise falling on Solana

[/key_takeaways_list]

[/key_takeaways]

The put up Are Transactions on Solana Largely Bot-Pushed? When Will SOL Recuperate? appeared first on 99Bitcoins.