Open banking was anticipated to revolutionize monetary providers in Europe, however years after its introduction, adoption has fallen in need of expectations. Whereas regulation like PSD2 laid the groundwork for better monetary information sharing, the precise implementation of open banking has been fragmented, inconsistent, and underwhelming. Many monetary establishments nonetheless deal with open banking as a compliance train slightly than a possibility for innovation, leaving shoppers and companies with restricted, disjointed experiences as an alternative of the seamless monetary ecosystem that was promised.

On this unique interview recorded at FinovateEurope 2025, David Barton-Grimley, Technique Director at 11:FS speaks with Finovate VP Greg Palmer to debate why open banking has floundered in Europe, the underlying points slowing adoption, and what wants to alter for it to ship on its full potential. From poor API requirements to a scarcity of clear monetization methods, Barton-Grimley explores among the underlying implementation points and addresses how monetary establishments can shift their method to make open banking work for each shoppers and companies.

“Too typically the dialog about open banking could be very binary,” Barton-Grimley mentioned. “Is it profitable, and what does success even imply on this class? It’s rising, and we’re seeing year-on 12 months multi-digit uptake of it as individuals are getting used to it and utilizing it.”

11:FS is a digital monetary providers consultancy that helps banks, fintechs, and companies keep present with altering calls for. The corporate is thought for its deep business experience, analysis, and advisory providers that assist monetary establishments design and launch really digital monetary merchandise. With a mission to make monetary providers “really digital” slightly than simply digitized variations of previous fashions, 11:FS works with among the largest names in banking and fintech to drive actual innovation in open finance, embedded banking, and digital transformation.

As Technique Director at 11:FS, David Barton-Grimley makes a speciality of serving to banks and fintechs navigate the evolving monetary panorama. He has suggested monetary establishments on find out how to construct higher digital banking experiences and leverage open finance as a aggressive benefit. At 11:FS, Barton-Grimley works intently with monetary providers leaders to develop and execute methods that drive progress, buyer engagement, and long-term success in an more and more digital-first world.

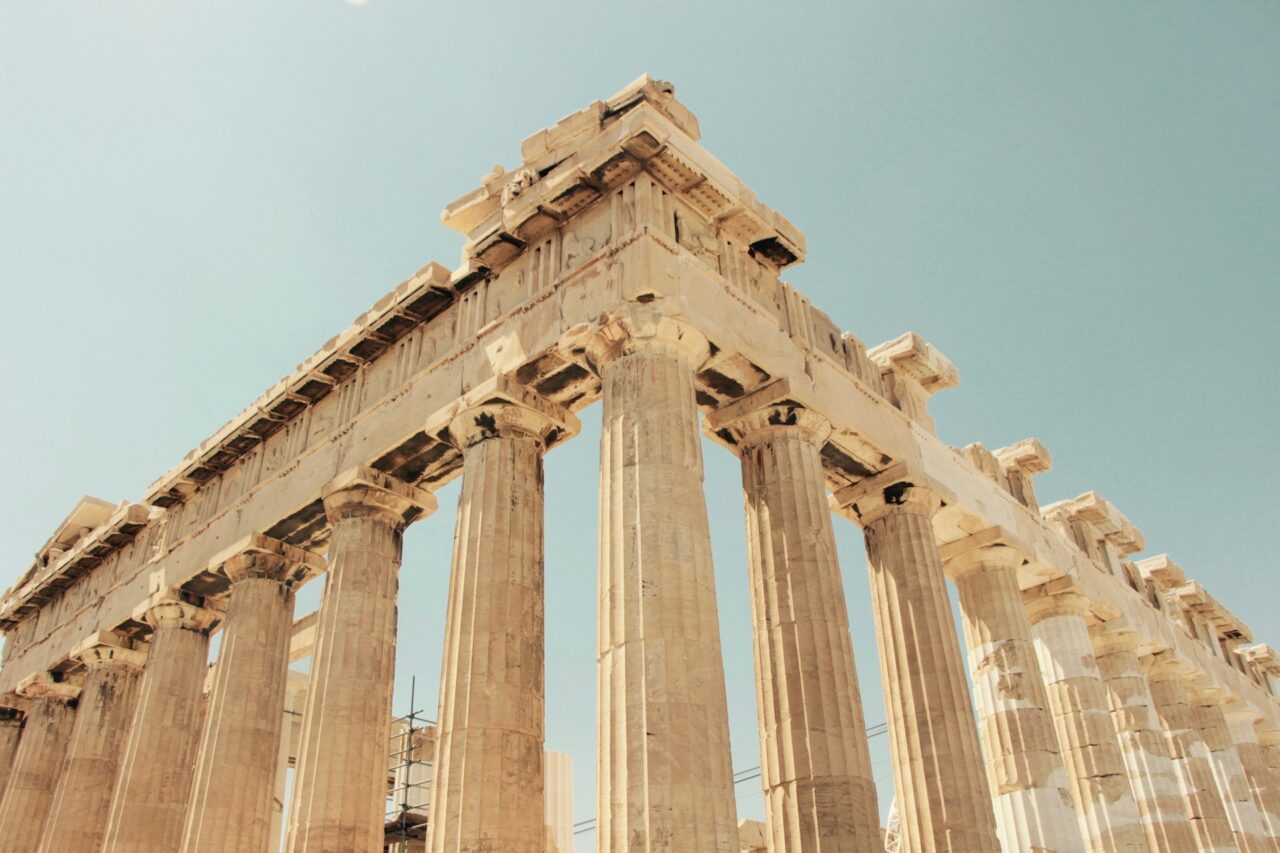

Picture by Jeff Vinluan

Views: 26