Within the newest episode of the Coinstories podcast hosted by Nathalie Brunell, James Seyffart, a analysis analyst at Bloomberg Intelligence, outlined why the subsequent vital surge of Bitcoin Change-Traded Fund (ETF) adoption is more likely to come from main wirehouses, corresponding to UBS, Morgan Stanley, and Merrill Lynch. These massive establishments, which generally handle the portfolios of high-net-worth people, haven’t but broadly really useful Bitcoin ETFs—however Seyffart believes that after they do, it might spark a momentous wave available in the market.

Bitcoin ETFs See Document-Breaking Inflows

Discussing the unprecedented success of spot ETFs since they started buying and selling in 2024, Seyffart drew a comparability to gold ETFs launched a long time prior. In his phrases: “My favourite chart of that is in case you simply have a look at the gold ETF asset progress over time… Bitcoin ETFs blow away all the pieces you possibly can probably have a look at. Even in case you alter inflation-adjust, it doesn’t matter.”

He defined how essentially the most broadly traded spot Bitcoin ETF—BlackRock’s IBIT—quickly approached the asset measurement of older gold ETFs, underscoring how rapidly it gathered investor funds. At its January peak of round $122–123 billion in belongings, Bitcoin ETFs had been nearing the roughly $130 billion held by early-mover gold ETFs launched in 2004. “IBIT is the quickest ETF to $50 billion as a complete class,” Seyffart famous, emphasizing that the fund met this threshold in a matter of a few hundred days. “The earlier report was over a thousand days.”

Though the power of BTC’s worth efficiency helped amplify the whole belongings underneath administration, Seyffart harassed that the capital inflows themselves had been hanging. He cited the height at about “simply over $40 billion” of inflows in underneath a yr, with total spot ETF belongings nonetheless hovering at greater than $100 billion.

Whereas quite a lot of spot Bitcoin ETFs exist, with quite a few asset managers launching their very own funds, IBIT has “really run away” when it comes to each belongings and liquidity, in line with Seyffart. He detailed how funds from Constancy (FBTC), Grayscale (GBTC), Ark Make investments, Bitwise, and VanEck all stay worthwhile, however none comes near matching IBIT’s day by day buying and selling quantity and market depth.

Citing 13F filings—kinds sure institutional traders should file with the U.S. Securities and Change Fee—Seyffart stated that as of late 2024, roughly 25% of ETF holdings could be straight attributed to establishments that meet the submitting standards. He additional defined that hedge funds seem like the only largest identifiable group amongst these filers: “The most important holders, mockingly sufficient, are hedge funds… $10 plus billion price of these items.”

A good portion of hedge fund curiosity, in line with Seyffart, comes from a “foundation commerce,” a near-arbitrage technique wherein managers purchase the spot Bitcoin ETF whereas concurrently shorting the futures market. As a result of bitcoin futures traded on the Chicago Mercantile Change (CME) can carry a premium, merchants search to pocket the unfold when the futures contract settles.

He described this strategy as “delta impartial,” which means it doesn’t outright push Bitcoin’s worth larger or decrease: “It’s principally risk-free… You’re promoting ahead the futures contracts as a result of there’s a persistent premium and offsetting that with the ETFs. So it shouldn’t actually impression worth in some large method.”

The Subsequent Massive Catalyst

In response to Seyffart, wirehouses and different top-tier wealth managers management trillions in belongings, and lots of of them have but to systematically supply or advocate Bitcoin ETFs. Present protocol at a few of these companies permits shoppers to request Bitcoin ETF purchases, however doesn’t allow advisors to advocate them proactively. “In the event you say, ‘You’re my advisor and I would like you to place 2% in Bitcoin,’ generally they will try this. However they’re not allowed to return to you and say, ‘I like to recommend it,’” Seyffart famous, referencing what number of main brokerages classify Bitcoin-focused investing.

He emphasised that this restriction is more likely to ease over time. As quickly as the biggest wirehouses and brokerages extra broadly approve of or formally advocate BTC ETF positions—corresponding to a “2% or 5% satellite tv for pc portion” of a typical portfolio—Bitcoin ETF adoption might surge to new ranges.

Seyffart acknowledged: “The following large wave of adoption is […] firms probably shopping for [Bitcoin], clearly nations and states probably including this to their stability sheets, is one other large factor. However for the ETF facet of issues, it’s actually these wirehouses and advisers; they management trillions of {dollars} of belongings, like they’re the individuals who handle the cash of actually rich individuals.”

He added the wirehouses “management the cash of centimillionaires, billionaires, you identify it—and they’re probably the subsequent wave of adoption for these Bitcoin ETFs,” including “the ETFs had a completely unbelievable first yr. We at Bloomberg had been fairly bullish; we had been extra bullish than just about another conventional monetary analysis arm. Not fairly as bullish as a number of the actual, true Bitcoin believers and bulls, however they even blew us out of the water with what they’ve achieved.”

Finally, the Bloomberg Intelligence analyst believes that after America’s largest wirehouses uniformly endorse and advocate Bitcoin ETFs—slightly than merely permit them upon consumer request—the sector might witness “the subsequent large wave” of adoption. With billions of {dollars} flowing from institutional and high-net-worth portfolios, that wave could nicely eclipse the record-breaking launch of spot Bitcoin ETFs that passed off in 2024.

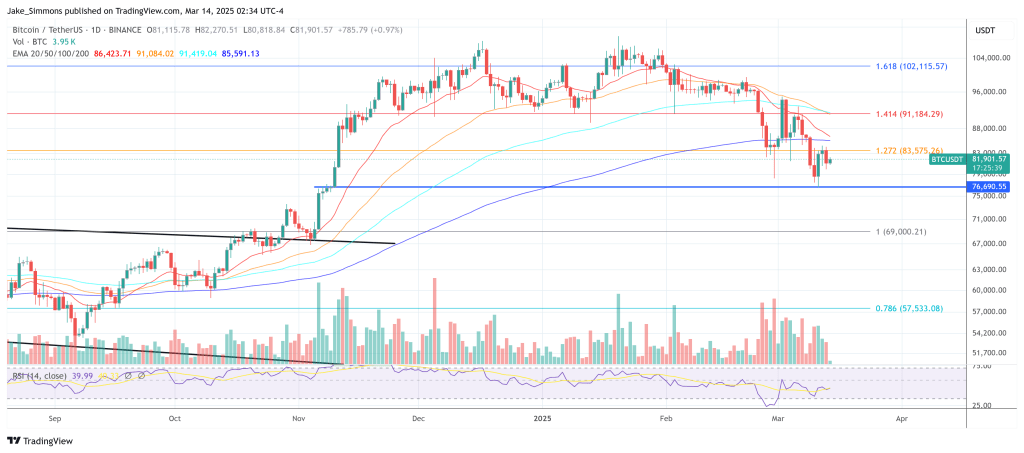

At press time, BTC traded at $81,901.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.