As part of the worldwide development of stablecoins carving out its area of interest, the Canadian Securities Directors (CSA), the watchdog group overseeing Canada’s provincial and territorial securities regulators, has stepped in with new tips to supply readability on the buying and selling and issuance of stablecoins inside its borders.

Amongst quite a few belongings holding totally different traits and utilities, on this planet of crypto, stablecoins, which tie their worth to conventional fiat currencies or different belongings, have risen in recognition.

CSA’s Interim Framework For Stablecoins

The CSA’s latest announcement on October fifth affords perception into its interim stance on “value-referenced crypto belongings,” particularly emphasizing stablecoins.

The clarification emerges as a major replace from its February assertion, wherein the CSA emphasised that stablecoins would possibly fall underneath the purview of securities and derivatives. Thus, Canadian exchanges can be restricted from buying and selling them.

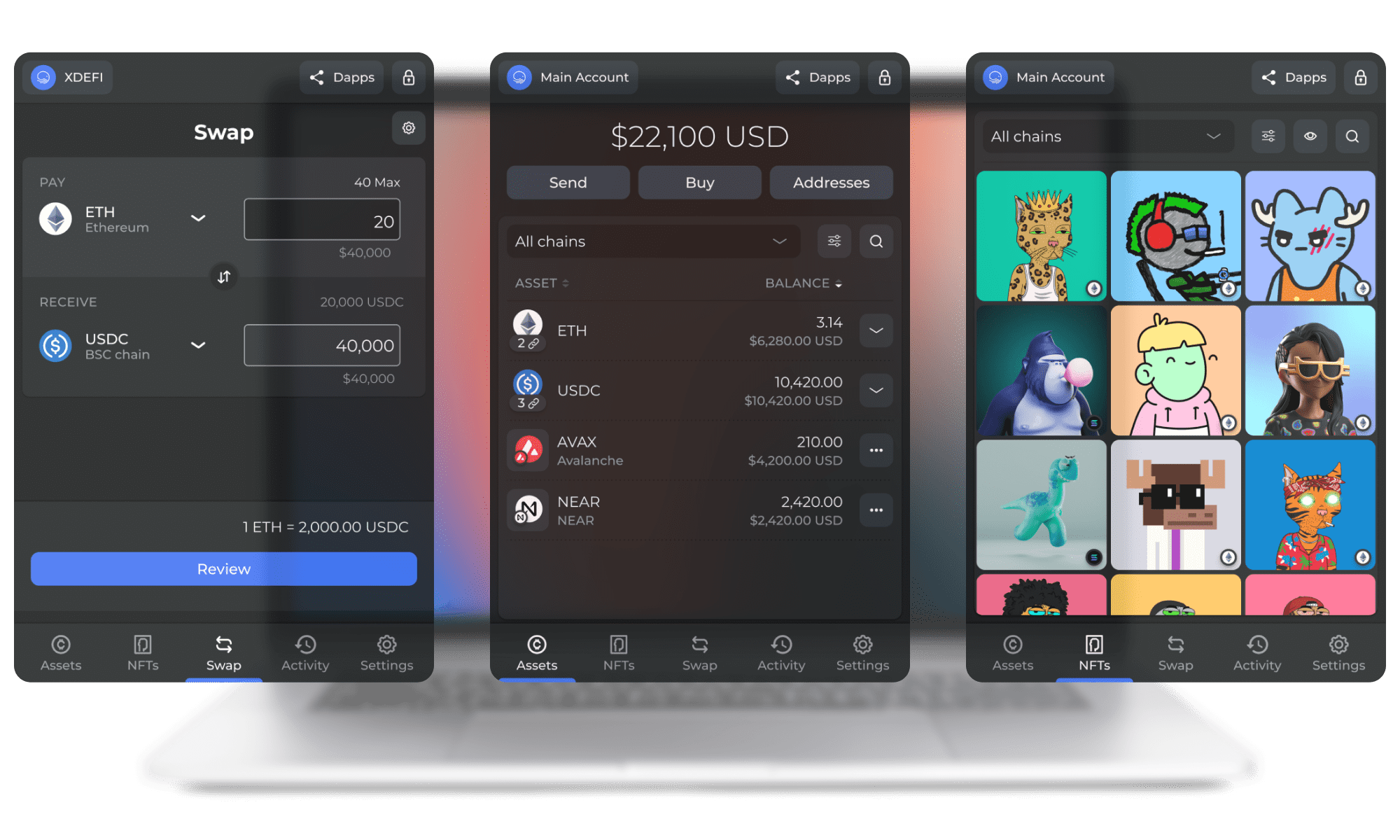

Nevertheless, this latest steering introduces a possible shift in stance. Exchanges and stablecoin issuers might commerce these belongings in the event that they adhere to set circumstances. A vital prerequisite entails the necessity for issuers to take care of a befitting reserve of belongings with a certified custodian.

Furthermore, exchanges dealing in stablecoins should guarantee transparency by publicizing pertinent particulars about their operations, governance, and asset reserves.

Stan Magidson, the CSA Chair and in addition the Chair and CEO of the Alberta Securities Fee, highlighted the importance of this framework by stating:

This interim framework, which we’ll construct upon sooner or later, units sure requirements to assist be certain that traders obtain the data they want concerning the belongings they’re buying, together with the dangers related to them.

Cautionary Observe For Traders

Whereas the brand new steering by the CSA would possibly seem to be a inexperienced mild for stablecoin buying and selling and issuance, it’s value noting the undertones of their announcement. The CSA highlighted the alleged inherent dangers related to fiat-backed crypto belongings.

In line with the CSA, assembly the regulator’s phrases doesn’t stamp these belongings as risk-free or carry an official endorsement. The report learn:

The CSA cautions Canadian traders that value-referenced crypto belongings, together with any fiat-backed crypto belongings that fulfill the interim phrases and circumstances, are topic to varied dangers and should not the identical as fiat forex. The truth that an asset satisfies these interim phrases and circumstances shouldn’t be seen as an endorsement or approval of the asset, nor give any indication that the asset is risk-free.

In the meantime, in accordance with information from DeFilLama, the stablecoin market capitalization at the moment sits at $123.88, a notable plummet from the worth recorded a yr in the past. Coincodex information reveals the stablecoin market represents 11.28% of the worldwide crypto market cap, which at the moment stands at $1.65 trillion on the time of writing.

Featured picture from Unsplash, Chart from TradingView