If the crypto market feels just a little quieter currently, it’s not simply you. In line with Coinbase’s April 2025 Month-to-month Outlook, the numbers affirm what many merchants and builders have sensed: we’re deep in a cooldown. Nonetheless, there might be a crypto rebound later this yr.

The altcoin market cap—that’s every part besides Bitcoin—has dropped about 41% since December, falling from $1.6 trillion to round $950 billion. Ouch. It’s not fairly full meltdown territory, but it surely’s a hefty comedown testing persistence throughout the board.

New Coinbase report!

Crypto coming into bear territory with complete market cap down 41% from December peak. COIN50 index under 200-day MA alerts continued weak point. However potential stabilization late Q2, restoration in Q3 doable if world situations enhance#CryptoMarkets pic.twitter.com/rdiwvNjhbh

— NeomaVentures (@NeomaVentures) April 16, 2025

And it’s not simply costs. Enterprise capital funding, the lifeblood for startups constructing within the area, can be down. In comparison with the 2021–2022 peak years, VC curiosity has plummeted by 50–60%. Why? Primarily as a result of the macro atmosphere is messy. Inflation, charge adjustments, geopolitical tensions, and lingering concern that the opposite financial shoe may drop have made buyers skittish. The outcome? Fewer checks, slower rounds, and loads of “let’s wait and see.”

Indicators of Market Sentiment

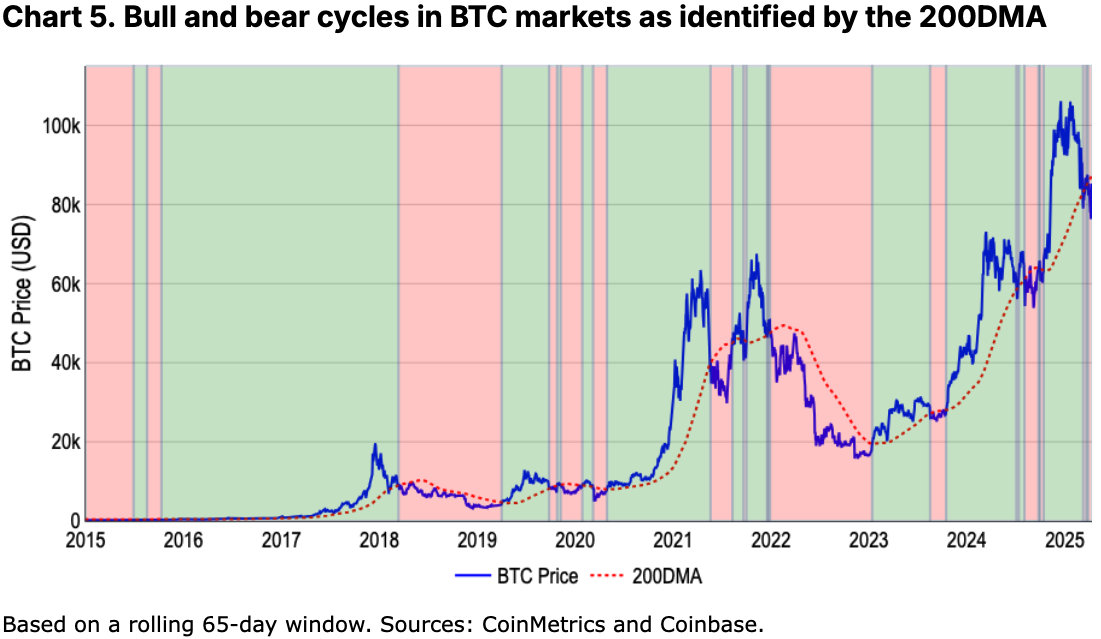

Coinbase’s head of analysis, David Duong, isn’t sugarcoating it. He says the info exhibits we’ve entered a neutral-to-bearish market, and that the bull run doubtless topped out in February. That timing strains up with many merchants asking, “Wait… was that it?”

He factors to a couple key indicators, together with the 200-day shifting common, which confirmed that between November 2021 and November 2022, Bitcoin dropped loads, about 76%, however while you modify for danger, that drop was just like the S&P 500’s 22% decline.

In different phrases, each had huge strikes relative to what’s regular for them, even when the odds look very completely different.

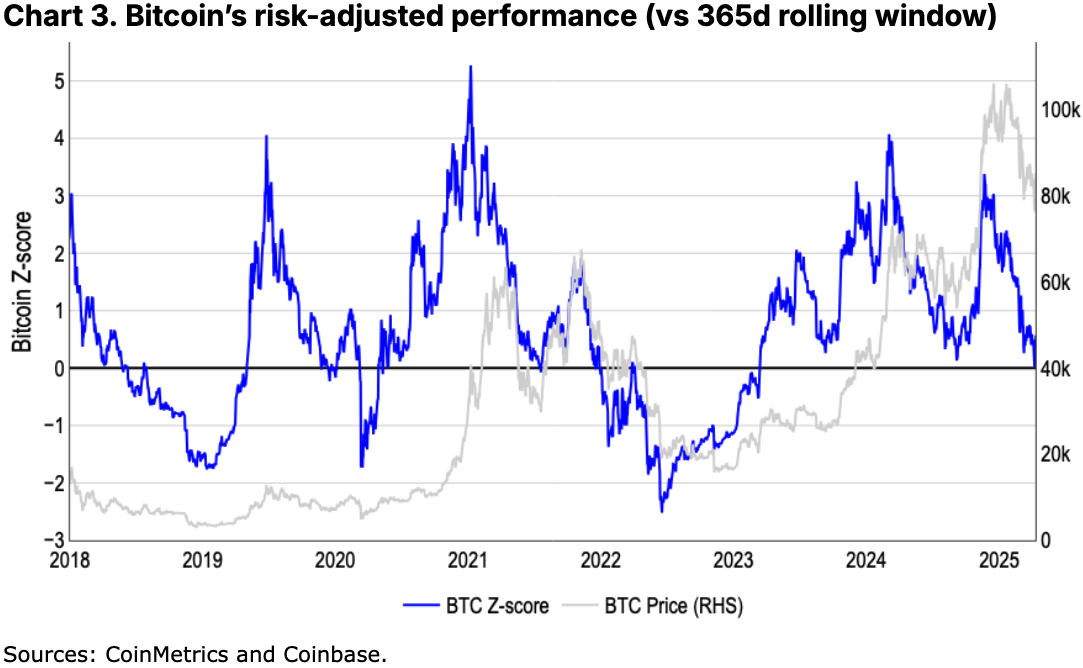

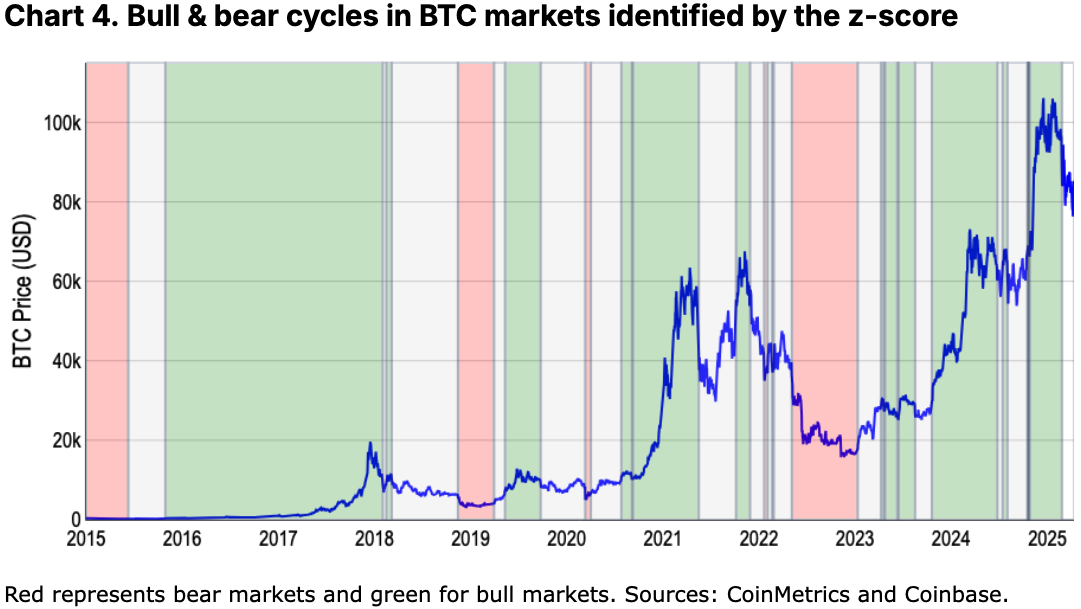

One other metric that was examined was the Bitcoin Z-score (which mainly measures how excessive present costs are in comparison with historic norms). Each are flashing yellow, not purple, however positively not inexperienced.

Z-scores work properly for crypto as a result of they modify for the way wild the worth swings will be, however they’re imperfect. They’re a bit more durable to calculate and don’t all the time decide up on traits rapidly, particularly in calmer markets. For instance, the mannequin confirmed the final bull run resulted in late February, however since then, it’s referred to as every part “impartial,” which exhibits it could possibly lag behind when the market shifts quick.

So yeah, it’s honest to name this second what it’s: a pause, a reset, perhaps even the early days of one other “mini crypto winter.”

7d

30d

1y

All Time

DISCOVER: Greatest New Cryptocurrencies to Put money into 2025

Potential for Crypto Rebound within the Second Half of 2025

However, and it’s an enormous however, Duong additionally sees gentle on the finish of the tunnel. Whereas Q2 may be bumpy, Q3 may look very completely different.

Why the optimism? In line with Coinbase, a lot of these pullbacks will be wholesome. They shake out the noise, reset valuations, and funky down overheated sentiment. And as soon as sentiment bottoms out, a rebound can hit quick and exhausting, particularly if the macro image improves or new narratives kick in.

That’s not a promise, after all. However it’s a reminder that crypto’s cycles are cyclical. Issues go down, however they typically come again stronger.

Proper now, the market is taking a breather. Costs are down, funding is tighter, and plenty of buyers are on the sidelines. However as Coinbase factors out, that doesn’t imply it’s sport over. These pauses typically lay the groundwork for the subsequent wave, particularly if confidence returns and macro headwinds settle down.

So, whether or not you’re constructing, investing, or simply watching from the sidelines, control the second half of 2025. There might be a crypto rebound and the market would possibly shock you, once more.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

Altcoin market cap has dropped 41% since December 2024, falling from $1.6 trillion to round $950 billion.

Enterprise capital funding in crypto is down 50–60% from peak ranges, as buyers navigate macroeconomic uncertainty.

Coinbase analysis suggests the market is in a neutral-to-bearish part, with indicators just like the 200-day common and Bitcoin Z-score flashing warning.

Regardless of the downturn, Coinbase sees potential for a Q3 rebound, noting that cooldowns typically reset valuations and sentiment earlier than restoration.

Whereas Q2 could stay uneven, the second half of 2025 may mark the beginning of a brand new wave—if macro situations stabilize and new narratives emerge.

The put up Crypto Market Slumps 41%, However Coinbase Sees Q3 Comeback appeared first on 99Bitcoins.