Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

In a latest submitting with the US Securities and Alternate Fee (SEC), Technique (previously Microstrategy), disclosed the acquisition of an extra 6,556 Bitcoin (BTC) at a mean worth of $95,167 per coin between April 28 and Might 4.

This newest acquisition brings the corporate’s whole Bitcoin holdings to 555,450 BTC, valued at roughly $38.08 billion, with a mean buy worth of $68,550 per BTC.

Technique Declares New $21 Billion ATM Providing

The acquisition was financed by way of a strategic mixture of frequent and most popular inventory gross sales. Particularly, Technique raised $128.5 million by way of its frequent inventory at-the-market (ATM) program and an extra $51.8 million from the sale of STRK most popular shares. Notably, this newest transaction exhausts the corporate’s earlier $21 billion ATM providing that was initiated final yr.

Associated Studying

Michael Saylor, co-founder of Technique and a widely known advocate for BTC, additionally shared on social media that the corporate has achieved a year-to-date Bitcoin yield of 14.0% as of Might 4, 2025. He emphasised that the agency presently holds 555,450 BTC, acquired for roughly $38.08 billion.

In a bid to additional bolster its BTC accumulation technique, Technique introduced final week plans to double its capital elevating capability. This consists of introducing a brand new $21 billion ATM providing and increasing its debt buy program to $42 billion.

These initiatives point out the corporate’s dedication to enhancing its BTC-heavy steadiness sheet, even in mild of latest monetary challenges, together with 5 consecutive quarterly internet losses.

Institutional Demand For Bitcoin Surges

Throughout its newest earnings name, Technique unveiled the “42/42 Plan,” a roadmap aimed toward elevating $84 billion in capital over the subsequent two years. The plan includes splitting the funding equally between fairness and fixed-income devices, all earmarked for future BTC acquisitions.

Regardless of reporting ongoing losses, investor sentiment stays optimistic. Technique continues to be the biggest company holder of BTC, with its holdings representing almost 3% of Bitcoin’s most provide. At present market costs round $94,000, the corporate’s bitcoin property are valued at over $52 billion.

Associated Studying

This latest buy comes amid a backdrop of sturdy institutional demand for BTC, significantly by way of regulated funding automobiles. Notably, BlackRock’s iShares Bitcoin Belief ETF (IBIT) has skilled important inflows previously two weeks, reflecting rising curiosity from institutional traders.

Nevertheless, regardless of the constructive outlook on its BTC technique, Technique’s shares have been down 2.7% in pre-market buying and selling on Monday, following a achieve of over 3% final Thursday.

Bitcoin, then again, is buying and selling at $94,596, a slight lower of 0.2% within the 24-hour time-frame, and good points of as much as 13% within the month-to-month interval for the market’s largest cryptocurrency.

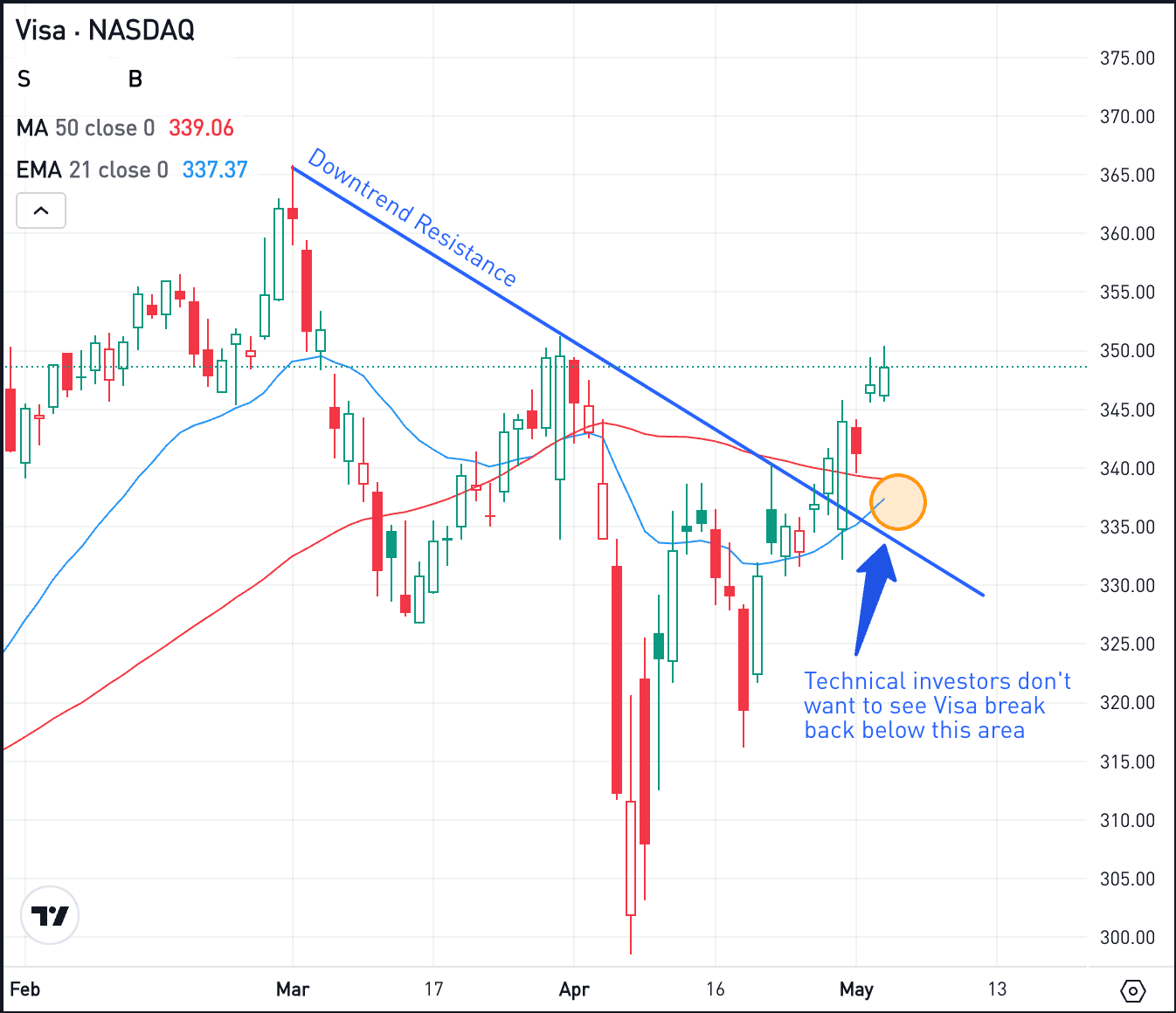

Featured picture from DALL-E, chart from TradingView.com