Key Takeaways

Buying and selling quantity, liquidity and volatility are all falling within the crypto markets

Even Bitcoin’s sturdy rise to date this 12 months has been regular and methodical slightly than by way of sudden spikes, as prior to now

Bitcoin dominance is rising, uncharacteristic during times of value will increase, highlighting a possible divergence

Regulatory crackdown is suppressing market participation via lawsuits in opposition to exchanges and heightened authorized uncertainty

Volatility ought to return ultimately, however earlier six months have been probably the most placid in current reminiscence

It’s all quiet on the blockchain entrance.

The crypto markets proceed to plod together with quantity, liquidity and volatility all terribly low. All throughout the board, the numbers level to market participation decreasing incessantly.

Even Bitcoin’s rise year-to-date, which is spectacular to date at 76%, has come via regular, methodical features. This contrasts sharply with earlier bull markets, which have seen the asset spike greater in very brief time intervals. Then once more, the market appears not sure of whether or not it is a bull market, a bear market, or one thing in between.

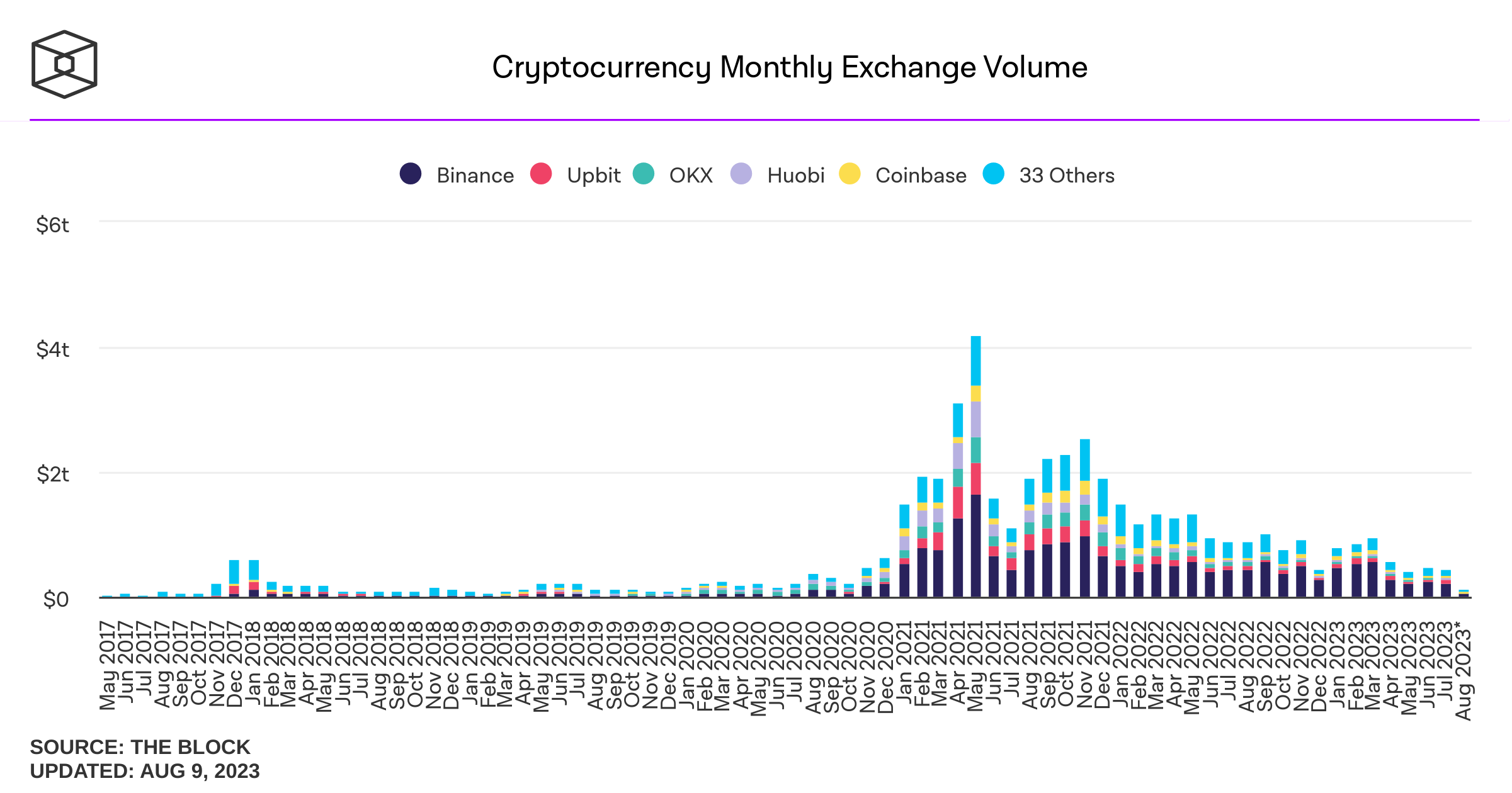

The gradual however regular incline this 12 months has come amid an additional fall in buying and selling quantity. Final 12 months, volumes on centralised exchanges fell 46%. This got here amid a vicious bear market, highlighted by a number of scandals, such because the FTX collapse, Terra’s loss of life spiral and quite a few bankruptcies.

The 12 months 2023 has seen the buying and selling droop proceed decrease, with out even the dramatic episodes of volatility resembling these aforementioned scandals. The Block’s information for July has buying and selling volumes now at ranges final seen in 2020:

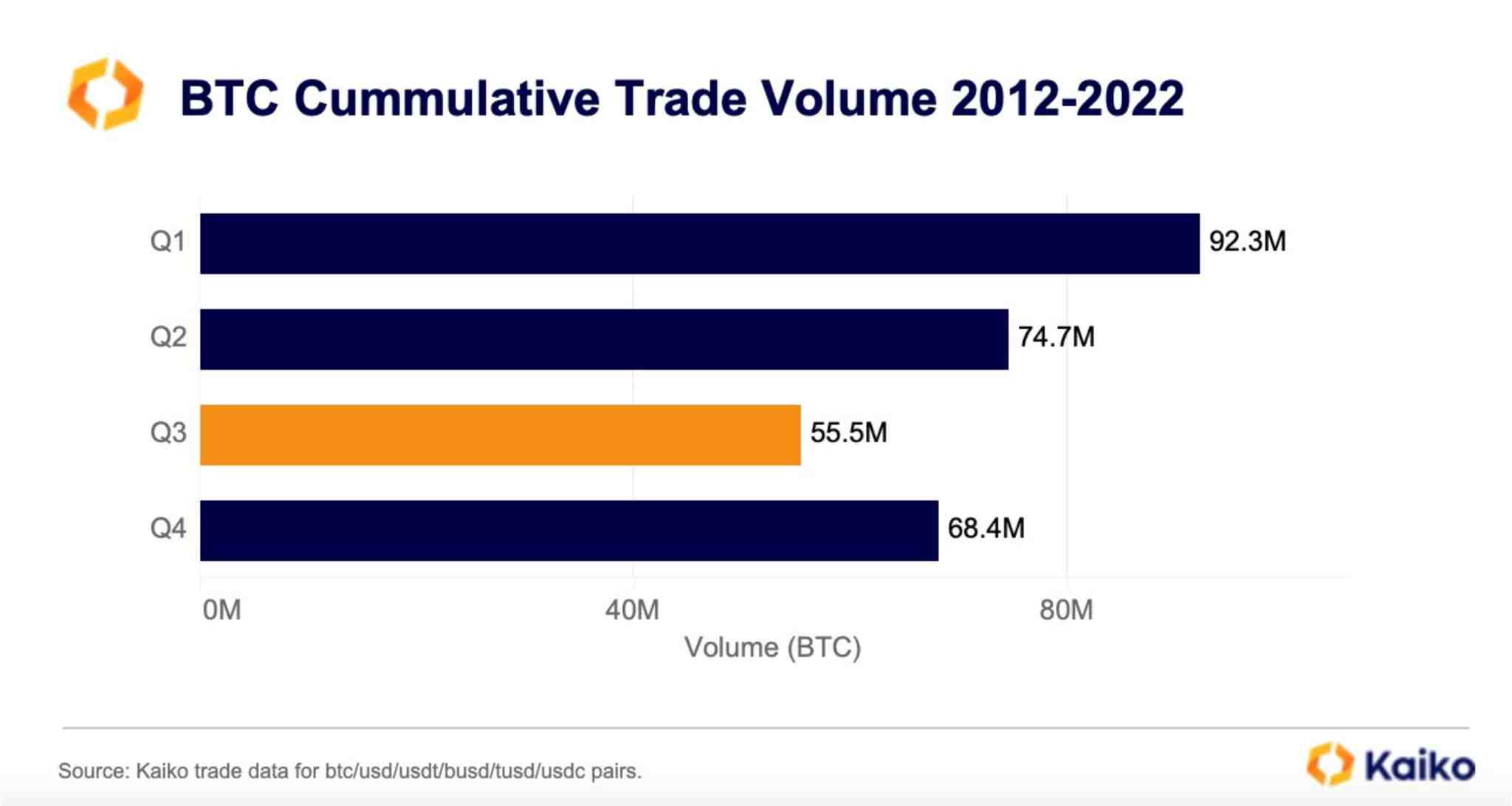

As we analysed right here not too long ago, that is partially a results of a typical summer time buying and selling lull, one thing which impacts asset lessons past crypto, too. The following chart from Kaiko reveals this, with Q3 regularly yielding the bottom quantity in Bitcoin’s brief historical past. Nonetheless, it’s prudent to notice that that is closely skewed in direction of the final couple of years, with Bitcoin surging into mainstream consciousness and its liquidity subsequently rocketing. Therefore, blaming this lull on seasonality alone feels misguided.

Bitcoin dominance is rising

Trying past Bitcoin, altcoins have additionally been quiet. There have been tales of the odd meme coin (Bald and Pepe, to call a pair) which have gained consideration, however compared to earlier years, the altcoin market has been devoid of the standard intrigue.

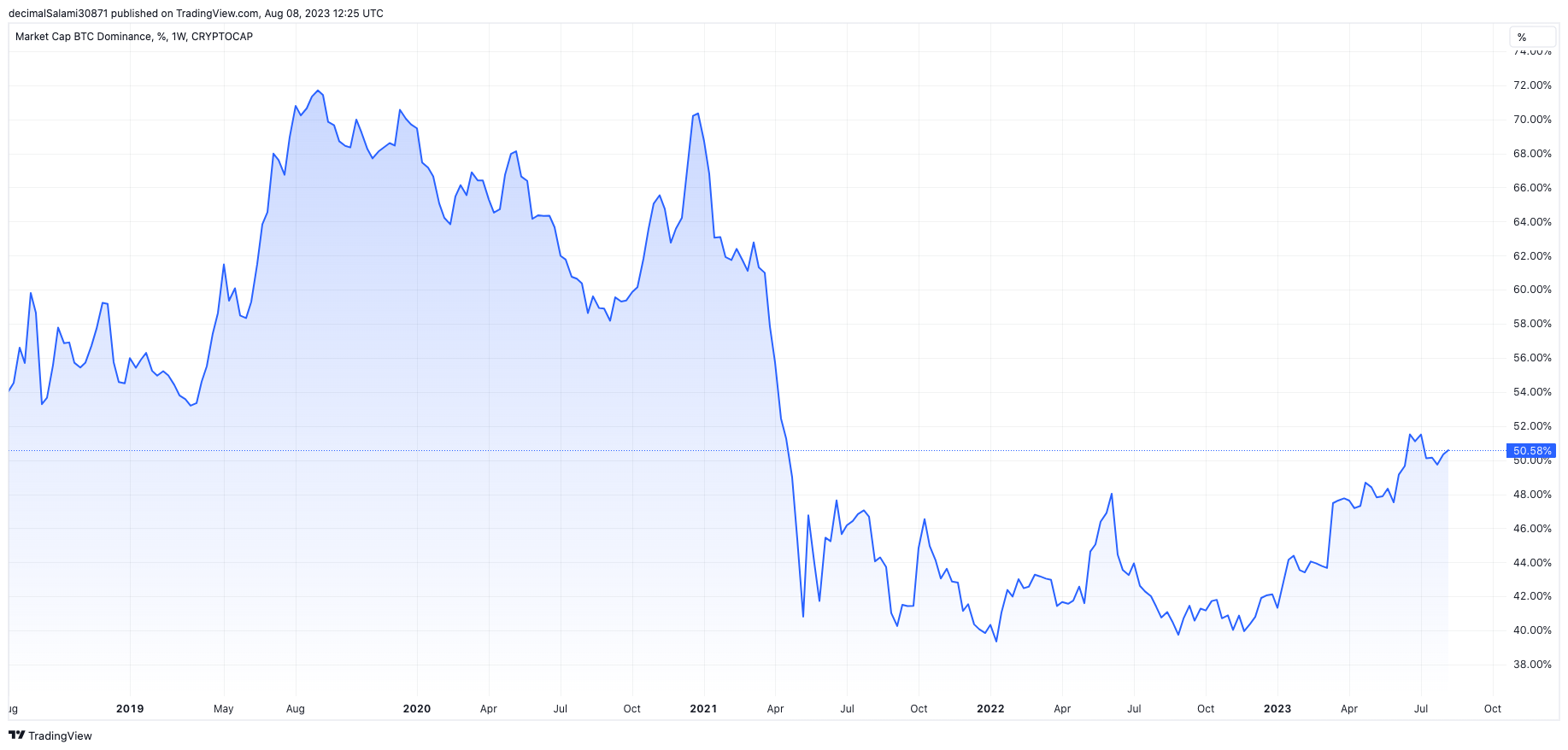

A technique of taking a look at that is the notable rise of Bitcoin dominance, which measures the ratio of the Bitcoin market cap to your entire cryptocurrency market cap. It has risen above 50%, up from round 40% at the beginning of the 12 months.

This rise in Bitcoin dominance is uncommon as a result of it has occurred throughout a interval of value growth throughout the trade. Beforehand, Bitcoin has tended to underperform alts in bull markets, with dominance subsequently falling.

This rise in Bitcoin dominance is uncommon as a result of it has occurred throughout a interval of value growth throughout the trade. Beforehand, Bitcoin has tended to underperform alts in bull markets, with dominance subsequently falling.

One think about each the rise in Bitcoin dominance and the low market participation throughout crypto is the influence of the regulatory crackdown within the US. The SEC outlined a number of cash as securities, together with Solana (SOL), Polygon (MATIC) and Cardano (ADA), and whereas Ripple secured an optimistic ruling in its personal case in opposition to the SEC, the local weather is undoubtedly extra unsure with regard to the place all these tokens slot in.

Bitcoin, alternatively, has largely been unnoticed of the securities wars, and has even seen a slew of spot ETF purposes lodged in current months. Lawmakers very a lot appear to be coping with Bitcoin as a separate style of asset (as many within the sector have lengthy carried out).

The regulatory crackdown on exchanges themselves has additionally been extreme, and has definitely contributed to falling volumes throughout the house, Bitcoin or in any other case. Each Coinbase and Binance have been sued in June, with Binance additionally the topic of a Division of Justice investigation, with some stories claiming costs could also be imminent.

Furthermore, we have to be cautious when assessing the obvious buying and selling volumes. One of many (many) accusations within the SEC case is that Binance manipulated commerce volumes, which means the true figures could possibly be even decrease.

Then there’s the difficulty of, even when actual, how a lot quantity is significant. Binance ceased zero-fee buying and selling for all Bitcoin pairs in March, and earlier than this, zero-fee buying and selling accounted for roughly 75% of volumes on the change. After the promotion ended, nevertheless, it promptly fell to 36%, with the bulk via the stablecoin which Binance continued to advertise zero-fee buying and selling on: TrueUSD. Previous to this growth, TrueUSD was seldom used with minimal liquidity.

Volatility

With the autumn in quantity, it follows that there’s additionally a fall in volatility. Merchants reside and die by volatility, and it’s intently correlated with quantity. The truth is, volatility is at present round three-year lows.

The consequences of the drain in market participation are being seen on volatility past Bitcoin, too. The beneath chart reveals that Ethereum volatility has not too long ago dipped to the extent of Bitcoin’s, and even beneath it. That contrasts with what we now have come to count on traditionally, with Ethereum sometimes buying and selling with greater volatility than its massive cousin.

The volatility is extra notable when contemplating that liquidity can also be so skinny. Order books are as shallow as they’ve been in a very long time. Liquidity took a selected fall in November when outstanding market maker Alameda collapsed amid the FTX scandal. Since then, not solely has its capital not been changed on order books, however extra US market makers have pulled out or scaled again operations within the wake of the regulatory local weather.

All issues thought of, the crypto markets are exhibiting remarkably low ranges of liquidity, buying and selling quantity and volatility. This comes by way of a mixture of things, from traders retreating on the danger curve to different bear market-related components. Regulation can also be a key issue, nevertheless, and undoubtedly suppressing market exercise whereas uncertainty is so excessive.

The turbulent value motion will return. However for now, crypto charts are usually not throwing up their trademark chaos.