Key Takeaways

Final week noticed crypto suffered its worst 24 hours since FTX as over one billion {dollars} in derivatives had been liquidated on Thursday

By-product quantity outstrips the extraordinarily low spot quantity, with cascading liquidations having the potential to exacerbate value strikes

Volatility was sparked by sell-off within the bond market

Developments re-affirm how susceptible Bitcoin is within the short-term to the extremely uncommon macro local weather

Following an prolonged interval of relaxation within the crypto markets, the beast re-awakened final week. Crypto markets plummeted late Thursday and early Friday, led as at all times by Bitcoin. The world’s largest cryptocurrency shed 7% in what amounted to the most important one-day drop for the reason that spectacular collapse of FTX final November.

The yr 2023 has been characterised to date by the bizarre indisputable fact that crypto’s rise has been sluggish and regular. Except for a soar in March amid the regional financial institution disaster, Bitcoin has been perceptively devoid of the standard spikes and freefalls.

The Bitcoin value shows this clearly within the subsequent chart, in addition to Friday’s journey south.

Digging additional into final week’s value drop exhibits that, remarkably, Bitcoin fell 8% in simply ten minutes from 9:35 PM GMT on Thursday night. Taking a look at knowledge from Coinglass, this contributed to a surge of liquidations. All in all, over one billion {dollars} was liquidated in what amounted to the largest day of liquidations for the reason that FTX demise (anytime the phrase “since FTX” is utilized in crypto, it hardly ever spells excellent news).

The flood of liquidations highlights how a lot better the amount was in derivatives markets than spot, with the latter remaining extraordinarily skinny. Order books have been perceptibly shallow ever since Alameda evaporated amid the FTX debacle (liquidity was skinny even earlier than then).

What induced the unload?

The underlying explanation for the volatility was a sell-off within the bond market, with yields spiking to multi-year highs. Yields on long-term US authorities debt neared their highest degree since 2007, UK 10-year gilts rose to their highest yield since 2008, and Germany’s 10-year bund reached its highest yield since 2011.

Greater yields spell bother for danger belongings, as we’re nicely conscious by now, with Bitcoin despatched tumbling amid the tightening financial setting final yr. The latest transfer was borne out of buyers betting that top rates of interest will persist for longer than beforehand anticipated, or additional hikes might not be as unbelievable as beforehand anticipated.

The inverse relationship between Bitcoin and yields has been sturdy, demonstrated within the beneath chart. Therefore, Bitcoin’s drop is no surprise within the context of the developments within the bond market final week.

The sell-off reaffirms how susceptible Bitcoin is to a macro state of affairs that continues to perplex – excessive however falling inflation, whereas excessive rates of interest distinction with record-low unemployment and comparatively resilient financial knowledge.

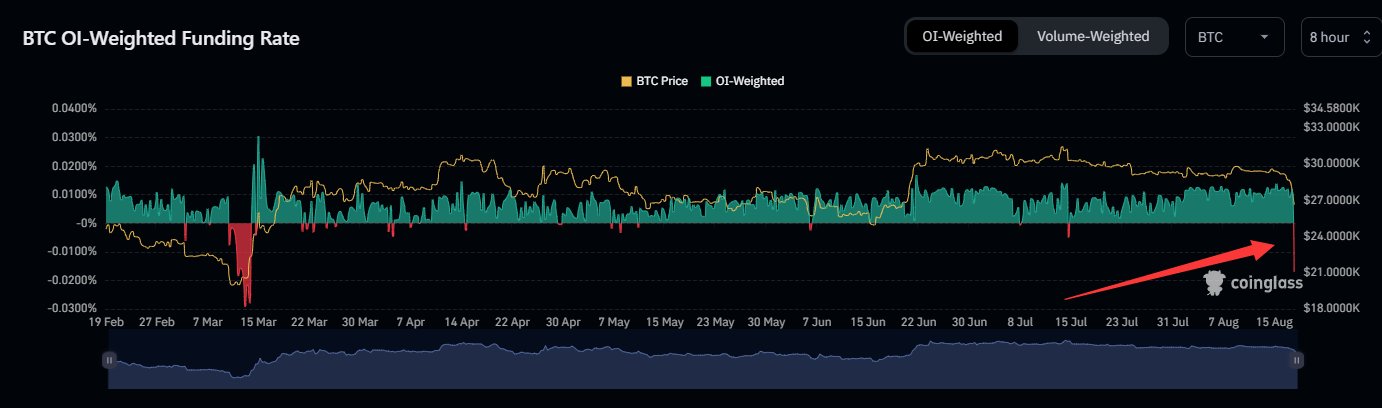

Getting again to the derivatives market, the shift was additional evident by funding charges, with the Bitcoin OI-weighted funding charge dipping beneath -0.01% for the primary time since March.

Lastly, destructive funding charges and freefaling open curiosity returned. It took some time, however volatility has returned.

What subsequent for crypto?

What this spells going ahead is up for debate. Some analysts affirm this can be a mere blip, a drop sparked by complacent overleverage following a interval of calm that felt like ceaselessly. A slight improve in hawkish sentiment going ahead gained’t in the end change a lot, they argue, for an economic system which appears more and more formidable about reaching a gentle touchdown.

Alternatively, some worry there might be a return to 2022-like situations. Whereas which will appear excessive, there’s each change there’s a recalibration away from the borderline-celebratory stance that rate of interest hikes had been full and the gentle touchdown was already assured.

If that had been the case, this might mark the tip of the bear market rally for crypto. Few belongings are as delicate to world liquidity as Bitcoin is, which means a reversion in the direction of the tightening seen final yr would undoubtedly spell purple candles on value charts.

This is able to be getting forward of oneself, nonetheless. The macro local weather stays largely unprecedented and really difficult to foretell. Even the Federal Reserve’s language betrays this, with some notable see-sawing in latest conferences.

Final Wednesday, assembly minutes mentioned that there are “vital upside dangers to inflation, which may require additional tightening of financial coverage”. Going again to the assembly in July, minutes say that the Fed believed inflation was falling and dangers “titled to the draw back”, with Jerome Powell asserting that “given the resilience of the economic system just lately, (the Fed is) now not forecasting a recession”.

Whereas these usually are not essentially conflicting – one can have inflation and tightening with out a recession, it’s simply fairly tough (however the place now we have been dwelling for the final eighteen months) – it does spotlight how unsure the entire local weather is.

Bitcoin is once more caught within the crossfire, a danger asset topic to the whims of the broader market because it grapples with this fast-changing setting.